Falkirk sets largest council tax increase of 15.6%

Council tax pays for a range of local authority services

- Published

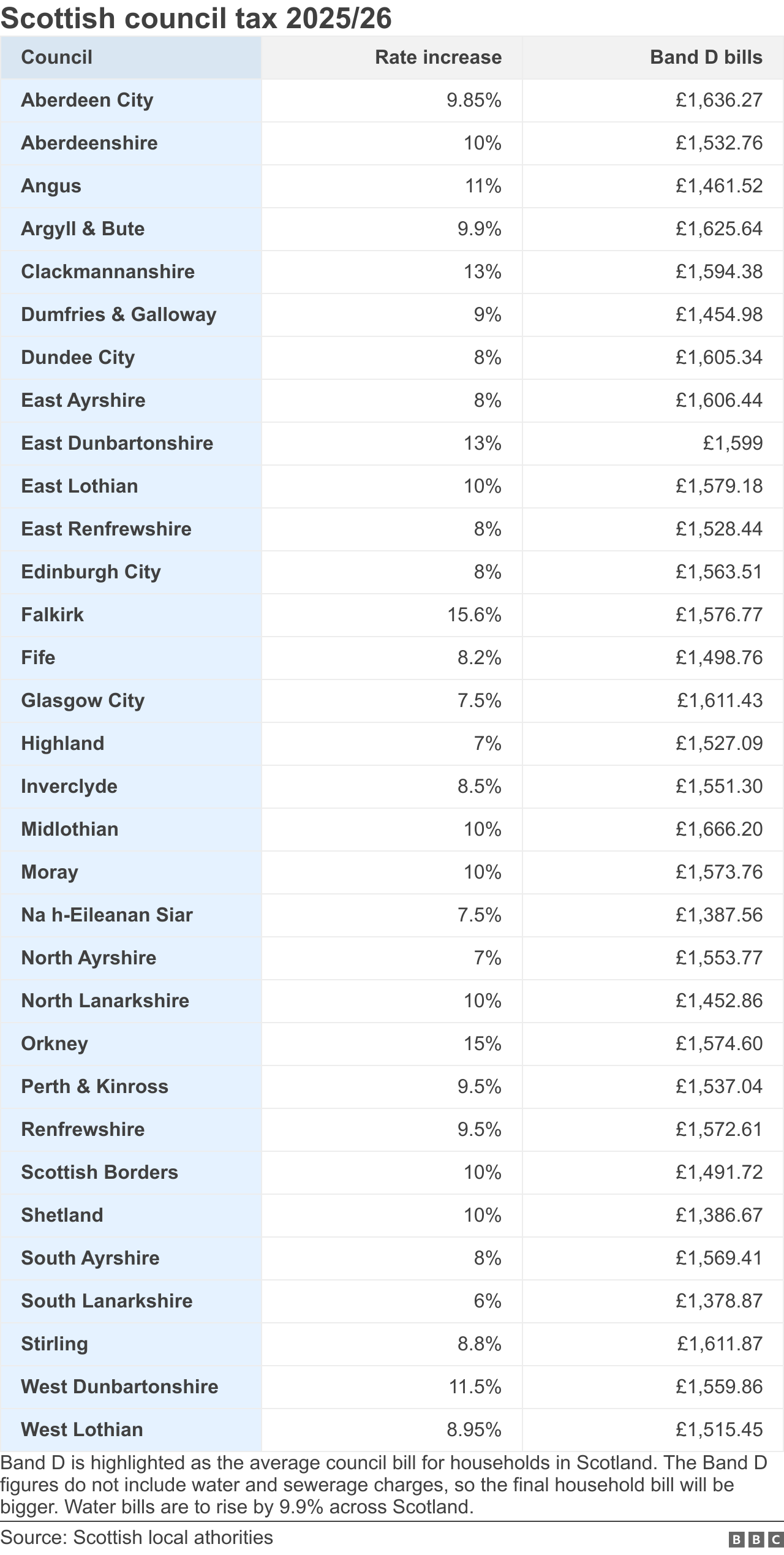

Falkirk Council has set Scotland's largest council tax increase after councillors agreed a 15.6% rise in a close vote.

Inverclyde's tax will rise 8.5% and Highland has set a 7% increase. East Dunbartonshire was the final council to reach agreement, announcing a rise of 13%.

It follows the announcement of some of the biggest council tax increases in about 20 years at the 32 local authorities across Scotland.

Orkney Islands Council agreed a 15% increase to council tax - which had been the largest increase in the country.

'Physically ill'

The 15.6% rise in Falkirk takes the annual bill for an average band D council tax to £1,576.77.

The budget of the council's SNP administration was defeated.

Instead the motion of Independent councillor Laura Murtagh was backed by the Labour group and other Independents.

Ms Murtagh said education services had to be saved from cuts.

Her budget rejected £1m of cuts to funded places in private nurseries, saying nurseries had not been consulted on this proposal.

She said: "I hate having to do this but it is the right thing to do.

"I do feel physically ill to the pit of my stomach where we are having to make these impossible decisions.

"We are going to take an awful lot of abuse over this budget and that isn't acceptable but it is the reality."

"We have a £33m budget gap and we have a duty to bridge that gap."

Council leader and SNP councillor Cecil Meiklejohn said her administration's proposed 13.7% would have brought Falkirk's council tax closer to the Scottish average.

One Falkirk man called the council tax increase "outrageous".

"That's unbelievable," said another resident. "Hopefully it'll go towards community stuff.

"Falkirk was a really, really good place with loads of stuff going on. But it's really quite sad now."

Another resident said: "It's quite bad, considering you have to wait a while for stuff to get done."

She said she hoped the money would go towards local services and repairing roads.

Rates across Scotland have been frozen or capped for much of the last two decades but this year authorities have turned to above-inflation rises to balance the books.

They need to pay for crucial local services from schools to social care, as well as bin collections, roads maintenance, libraries and planning departments.

Leaders gave a cautious welcome to the funding settlement from the Scottish government, calling it a "step in the right direction".

But they later warned that they face "difficult decisions" to cover a £100m funding gap arising from the UK-wide increase in employer National Insurance.

Aberdeen agrees council tax increase of 9.85%

- Published5 March

Biggest council tax rises in 20 years confirmed

- Published20 February

The 8.5% increase in Inverclyde will cost an extra £121.53 per year for the average Band D household.

Highland Council has voted to increase council tax by 7%. This means annual bills for an average band D property will be £1,527.09.

It said 2% of all council tax raised would be invested in schools and improving roads.

East Dunbartonshire Council said their 13% council tax increase includes 2.75% for the unfunded element of the employer's National Insurance rise, and 2.1% for the delivery of a new Balmuildy Primary School in Bishopbriggs.

Earlier this week Aberdeen City Council agreed a council tax rise of 9.85% and West Dunbartonshire 11.5%.

The Scottish government gave councils the power to put up the council tax by as much as they wanted this year. There was no attempt to implement a further council tax freeze or limit increases.

But it had hoped that large rises would not be necessary.

Instead every council has put up the charge by substantially more than inflation – some by five times the current rate.

The big question is how local voters will respond. Will they accept an increase if they see fewer cuts or positive improvements to services? Or will they feel councils could find more efficiencies and savings?

In some areas, critics have noted that the council tax rise came alongside an increase in councillors' salaries.

Local authorities would stress that the two issues are separate. But some councillors have admitted that it's still a bad look.

In Falkirk the rise is particularly noteworthy - it is 2% larger than the one the administration had proposed.

One question is whether this year's rises will reopen the long-running debate on whether the council tax should be replaced or substantially reformed.

A report commissioned by the Scottish government nearly 10 years ago set out various alternatives and looked at their pros and cons.

But finding a consensus on the right alternative option is hard.

Some also believe it is time for a widespread revaluation of homes to ensure they are still in the correct council tax band.

Inevitably though, some would face big hikes and this could prove controversial with the public.

Get in touch

How will increases in council tax affect your standard of living?