Private school gives VAT lobbying tips to parents

The head of Princethorpe College has urged parents to voice concerns about Labour's plan to add tax to private school fees

- Published

The principal of a private school foundation in Rugby has urged parents to lobby parliamentary candidates over Labour’s plan to add tax to private school fees.

Ed Hester emailed parents to say Princethorpe Foundation was "scenario planning" for Labour's VAT policy.

In the email, seen by the BBC, he said there was "a small window to potentially influence the debate" and "sow seeds of doubt", asking parents "to add your voice to ours", and shared tips about points to raise with candidates.

A spokesperson for the Princethorpe Foundation told the BBC it stood by what was written in the letter.

"It’s unsettling times for children in independent schools and we're doing our best to support our families," the spokesperson said.

The price of sending a child to a fee-paying school does not currently include VAT, which has a standard rate of 20%.

Labour wants to change that and use the tax raised to train thousands more teachers for state schools, if the party forms the next government.

The Princethrope Foundation runs three independent fee-charging schools and a nursery.

One of them, Princethorpe College, has about 900 students aged 11-18 and said its termly tuition fee for the 2024-2025 academic year would be £5,623.

But on its website, external, the school said it might have to share with parents "the burden of any VAT imposed".

In his email to parents, Mr Hester wrote: "There is now a small window to potentially influence the debate, sow seeds of doubt and affect the timing and scale of any implementation.

"By working together, we hope we can encourage a pulling back by the policy makers from the most destructive scenarios."

He shared examples of points parents could raise with candidates, including "the sacrifices you have made to afford this education".

He said parents may wish to mention "the special reasons" they chose the school, or their "worries about what will happen to local state schools if the tax comes in".

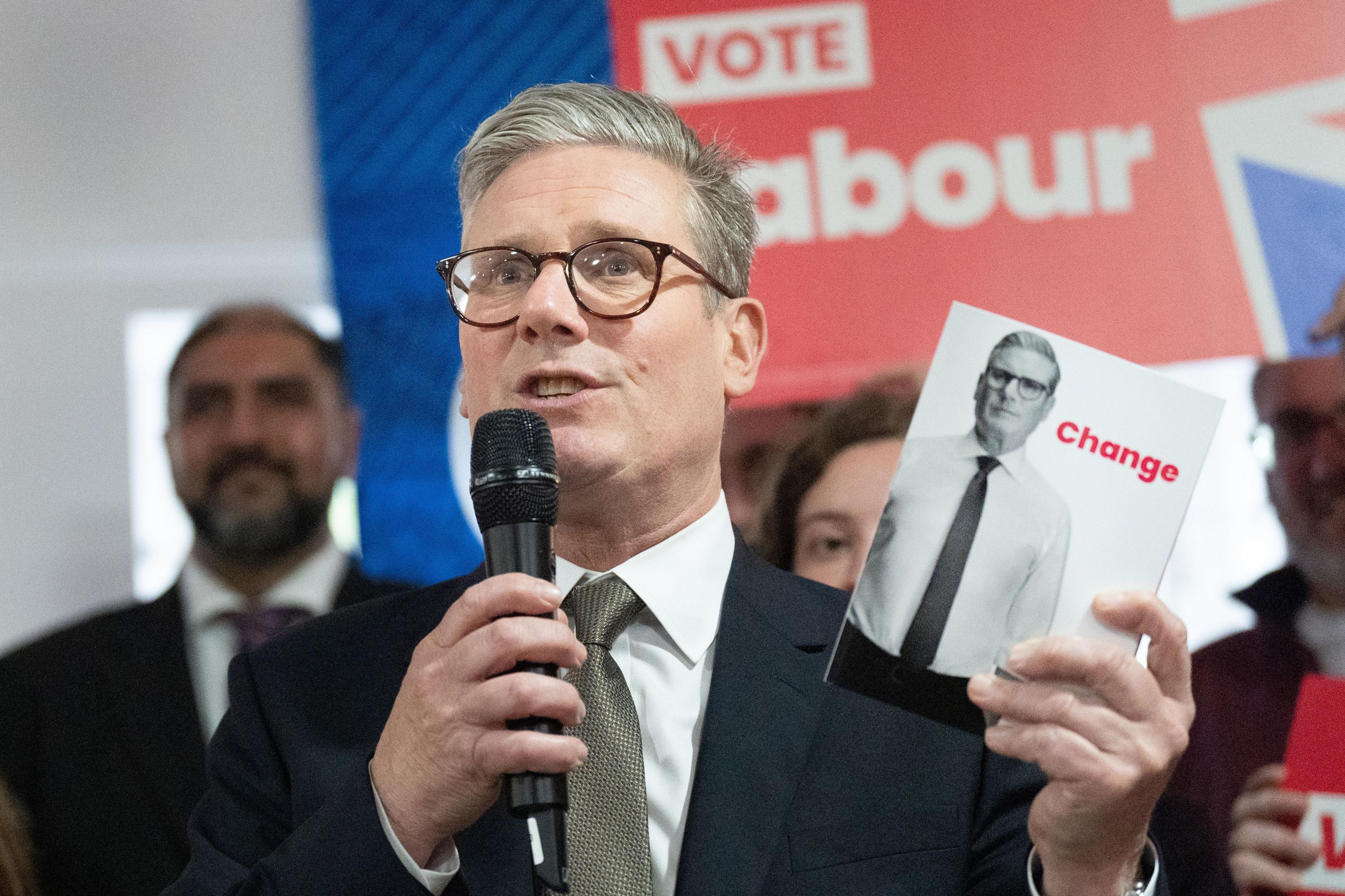

Labour leader Sir Keir Starmer has called the VAT policy a "tough decision"

Private school fees are not currently subject to VAT because of a legal exemption for organisations providing education.

About half of England's private schools are also registered charities, so receive an 80% reduction on business rates.

There are about 2,500 private schools in the UK, educating about 7% of all pupils, including about 570,000 in England.

Labour’s manifesto, external pledges to end private schools' VAT exemption and business rate relief. It does not say it will remove their charitable status.

The Institute for Fiscal Studies (IFS) think tank calculates, external that Labour's policy would raise about £1.6bn per year.

That could allow a 2% increase in state school spending in England.

Conservative Prime Minister Rishi Sunak has said he opposes Labour's plan, calling it part of a "class war" to "punish" aspirational parents.

Liberal Democrat leader Sir Ed Davey said he had "never thought in principle that VAT should be applied to education".

Reform UK said it would give private schools tax relief of 20% and put no VAT on fees, to "incentivise" parents to choose independent schools.

And the Green Party has promised to remove the charitable status of private schools.

Follow BBC Coventry & Warwickshire on Facebook, external, X, external and Instagram, external. Send your story ideas to: newsonline.westmidlands@bbc.co.uk, external