UK jobs market cools as vacancies fall

- Published

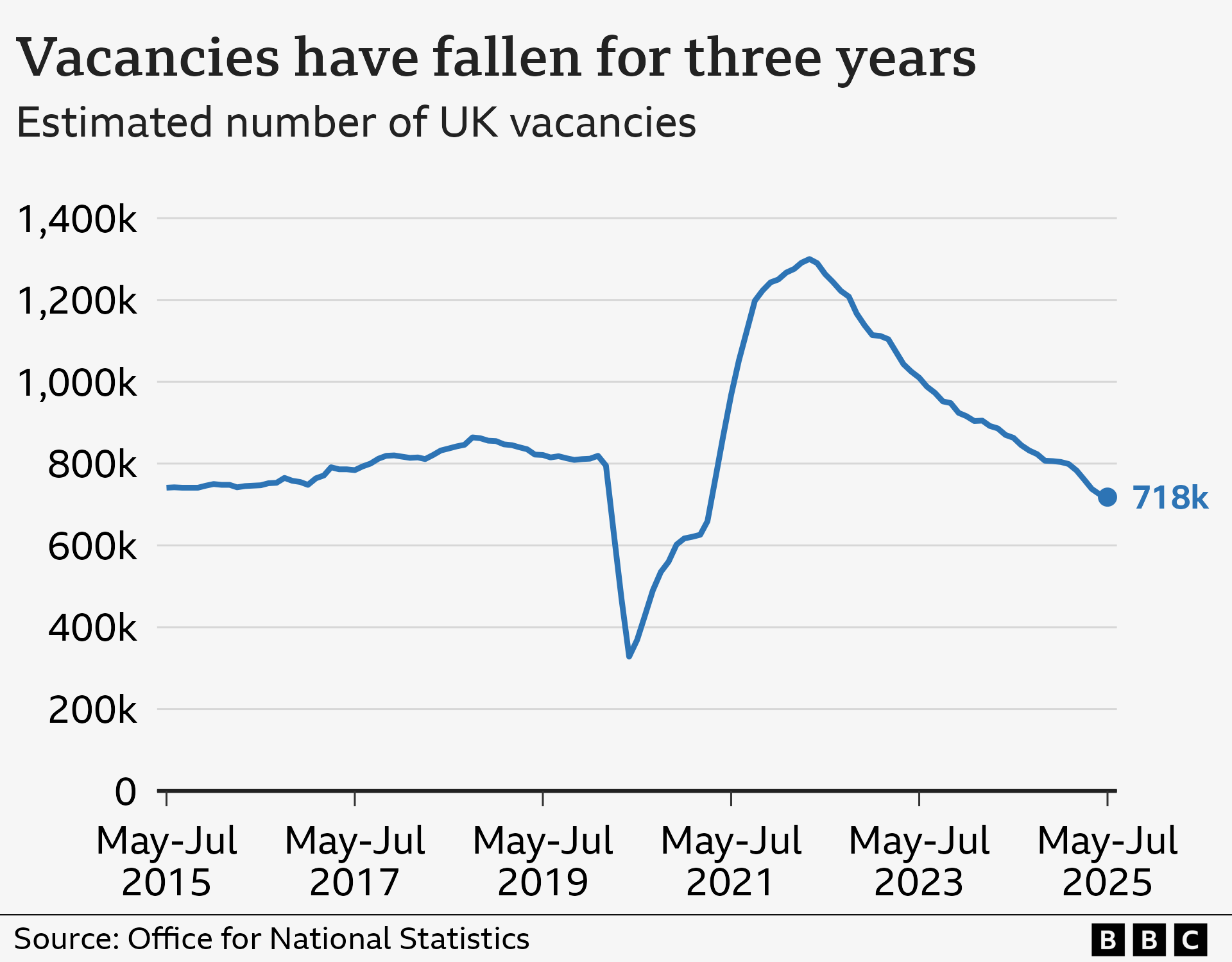

The UK jobs market has continued to cool as vacancies fell and the number of people on payrolls dropped, the latest official figures suggest.

Job openings fell by 5.8% to 718,000 between May to July across nearly all industries, according to the Office for National Statistics (ONS).

It said there was evidence that some firms may not be recruiting new workers or replacing people who have left.

However, the slowdown was not as sharp as some economists had anticipated.

Average wage growth remained at 5%, the unemployment rate was unmoved at 4.7% and an estimated drop in people on payrolls - down 8,000 between June and July - signalled a "very gradual cooling", according to former Bank of England policymaker Andrew Sentence.

He pointed out that there are more than 30 million people on employer payrolls in the UK.

The ONS has said payroll numbers should be treated with caution and it is taking additional steps to address concerns about the quality of the data.

Nevertheless, Ashley Webb, UK economist for Capital Economics, said the "modest fall" in payroll data "suggests that the fallout in the jobs market from the rise in business taxes and the minimum wage" is calming down.

In April, the National Living Wage rose from £11.44 to £12.21.

At the same time, National Insurance Contribution by employers rose from 13.5% to 15% while the salary threshold triggering payment by firm was lowered from £9,100 a year to £5,000.

Job vacancies were at their lowest level since the three months to April 2021, when the UK was dealing with the effects of the Covid pandemic.

Outside the pandemic, the last time that vacancies were lower was in the three months to January 2015.

Liz McKeown, director of economic statistics at the ONS, said: "The number of employees on payroll has now fallen in 10 of the last 12 months, with these falls concentrated in hospitality and retail.

"Job vacancies, likewise, have continued to fall, also driven by fewer opportunities in these industries."

However, although the number of job openings fell, it did not feed through to a rise in the unemployment rate, Mr Webb said.

He added that firms giving notice of redundancies was "relatively subdued" in July.

Chancellor Rachel Reeves said there was "some really positive news" in the data.

However, she said there was "more to do" to reduce the unemployment rate, which remained at a four-year-high between April and June.

"Everybody who can work should be in work," she said. "As a government, we're committed to helping more people back to work."

But Helen Whately, shadow work and pensions secretary, said the unemployment rate was the "sad but predictable outcome of Labour's war on business - which has seen taxes hiked to record highs and employers strangled in reams of red tape".

Speaking on Monday after two other reports highlighted falling vacancies, Louise Maclean, business development director of Scottish hospitality firm Signature Group, said added employment costs since April had made being profitable "just so hard".

"We are having to be so careful with every hour of employment we give to make sure we improve efficiencies, serve customers faster, serve them better, to deliver profitability in every hour of trade," she told Radio 4's Today programme.

The business would previously have focused on hiring 17 or 18-year-olds, Ms Maclean said, but "unfortunately, the younger people are less attractive without experience" at the moment.

"Slightly older people that have got experience, that can hit the ground running - they know what the customers want, are more attractive," she added.

Education minister Baroness Jacqui Smith told the Today programme that National Insurance paid by employers had helped stabilise the UK economy.

She said there were "some important signs that the decisions we took to fix the foundations of the economy are now enabling us to move forward," pointing to the Bank of England's decision to cut interest rates last week.

Who are the millions of Britons not working?

- Published26 March

Interest rates cut to lowest level in more than two years

- Published7 August

Monica George Michail, associate economist at the National Institute of Economic and Social Research, said the fall in jobs vacancies would be likely to contribute to slowing wage growth.

This is one the economic indicators the Bank of England looks at when making decisions on altering interest rates as it can fuel or cool the rate of inflation.

The Bank's inflation target is 2% but the pace of price rises have grown in recent months, due to higher food and energy costs.

Ms Michail predicted that the Bank would cut interest rates one more time this year, forecasting that borrowing costs will fall from 4% to 3.75% in November.

Get in touch

Are you looking for work or is your business making staffing cuts?

Sign up for our Politics Essential newsletter to keep up with the inner workings of Westminster and beyond.