US economy shrinks as firms import more ahead of tariffs

- Published

The US economy shrank in the first three months of the year as government spending fell and imports surged due to firms racing to get goods into the country ahead of tariffs.

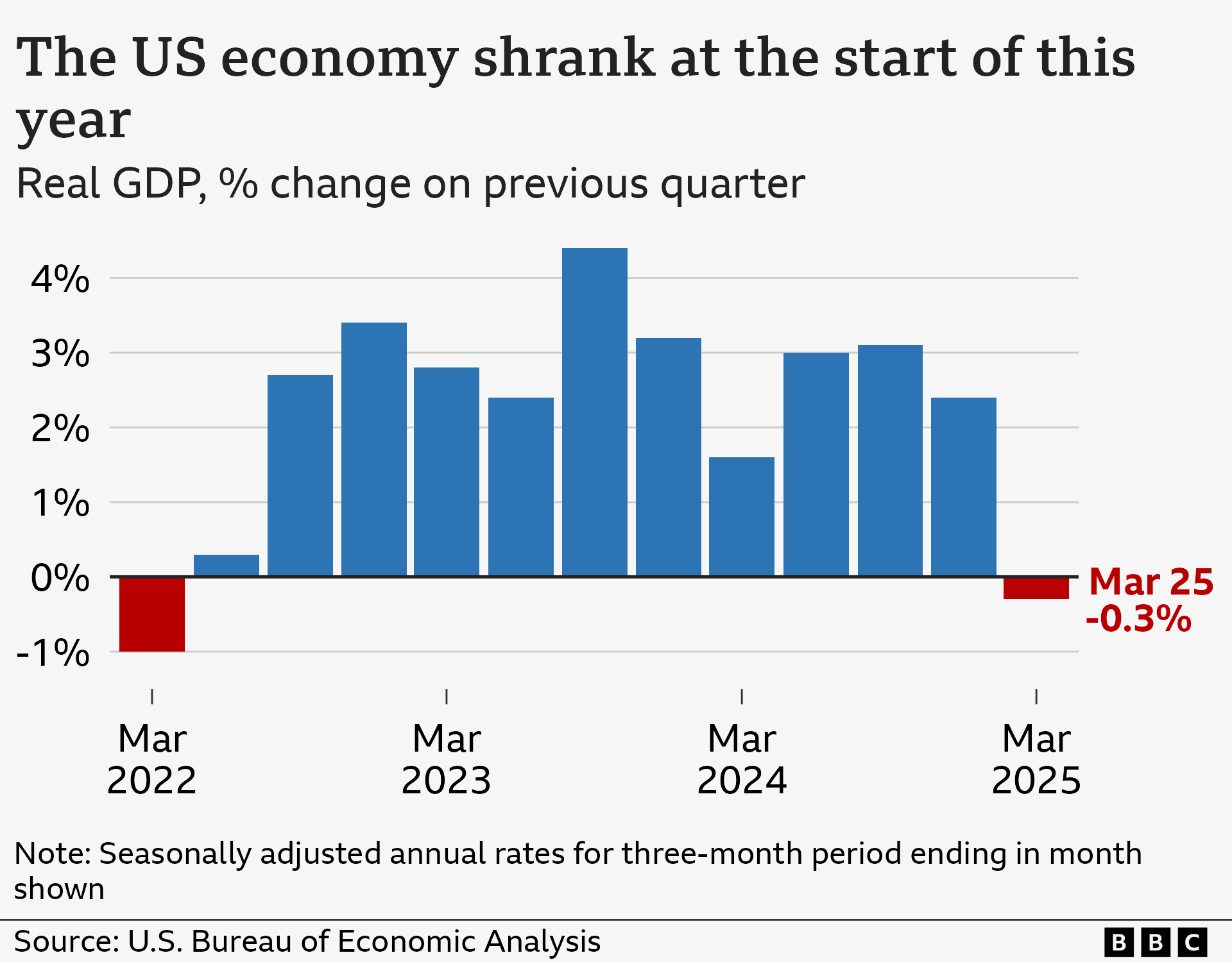

The economy contracted at an annual rate of 0.3%, a sharp downturn after growth of 2.4% in the previous quarter, the Commerce Department said.

The figures marked the first quarterly decline in three years, and came as the introduction of import taxes by President Donald Trump has scrambled global trade and created major uncertainty.

But analysts said it would take more time to understand the impact of the tariff changes.

While imports count against growth in calculations of gross domestic product (GDP), the surge is expected to be reversed in the months ahead. Those swings do not necessarily indicate an economy performing poorly.

The report also showed consumer spending - the primary driver of the US economy - expanded 1.8%, though at a slower pace than in 2024.

At a television appearance with cabinet members, Trump blamed his predecessor, Joe Biden, for the economic weakening, maintaining that his policies would drive investment in the US and an economic boom.

"This is Biden," he said, while appearing to dismiss bubbling fears of price increases, supply shocks and shortages of items such as toys, as trade between the US and China falls sharply.

"Well, maybe the children will have to have two dolls instead of 30 dolls, you know? And maybe the two dolls will cost a couple of bucks more than they would normally."

In a statement, the White House said the GDP figures were a "backward-looking indicator".

"The underlying numbers tell the real story of the strong momentum President Trump is delivering," press secretary Karoline Leavitt said.

Watch: Is the US heading into a recession? Three warning signs to watch

Since re-entering the White House in January, Trump has taken the business world by storm, announcing a series of new trade tariffs that he says will raise money for the government and help boost US manufacturing.

While he has watered down some of the policies in face of domestic outcry, analysts say the measures still leave the US with the highest overall effective average tariff rate in more than 100 years.

This report tracked activity through the end of March, a period before Trump announced his most far-reaching "Liberation Day" tariffs on China and other countries around the world, which sparked a dramatic sell-off in the stock market and turmoil in currency and debt markets.

It showed imports skyrocketed by more than 40% in the first three months of the year, while consumer spending grew 1.8%, down from 4% at the end of 2024.

Analysts cautioned that those figures could be distorted by people pulling forward their purchases in anticipation of tariffs.

The report also showed an unexpected jump in business investment, while final sales to private domestic purchasers - a closely watched indicator of overall demand - grew a solid 3%, little changed from the previous quarter.

"Overall, not as bad as feared," said Paul Ashworth, chief North America economist at Capital Economics.

Tariffs are a tax on imports, which economists have warned will lead to higher prices.

Some firms, such as toolmaker Stanley Black & Decker on Wednesday, have already announced plans to raise prices in response to the measures.

If shoppers baulk at higher prices and demand falls as expected, it could dampen growth further.

As corporate America enters a busy period of public updates for investors, many companies, including carmakers such as Stellantis and Mercedes, have said they cannot provide guidance about sales expectations for the months ahead, citing the uncertainty.

Leading stock indexes in the US, which had recovered from steep losses as Trump rolled back on some of his plans, opened lower after the figures were published but ended the day roughly flat.

But economists at Wells Fargo said it was difficult to draw firm conclusions from the latest data, noting that the drag on growth from trade was the biggest since the 1940s.

"The US economy is at a greater risk of recession today than it was even a month ago, but this contraction in GDP is not the start of one," they said.

Additional reporting by Bernd Debusmann Jr at the White House