House prices stagnate as mortgage rates increase

- Published

Halifax said the average UK house price, external had risen by 0.1% in April, with a typical home now valued at £288,949.

Prices last month were up 1.1% from the same point last year, following a 0.4% annual rise seen in March.

Amanda Bryden, head of mortgages at Halifax, said the housing market was "finding its feet in an era of higher interest rates".

"While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of relative stability," she added, with activity and demand improving.

“However, we can’t overlook the fact that affordability constraints are still a significant challenge, for both new buyers and those rolling off fixed-term deals," Ms Brydon said.

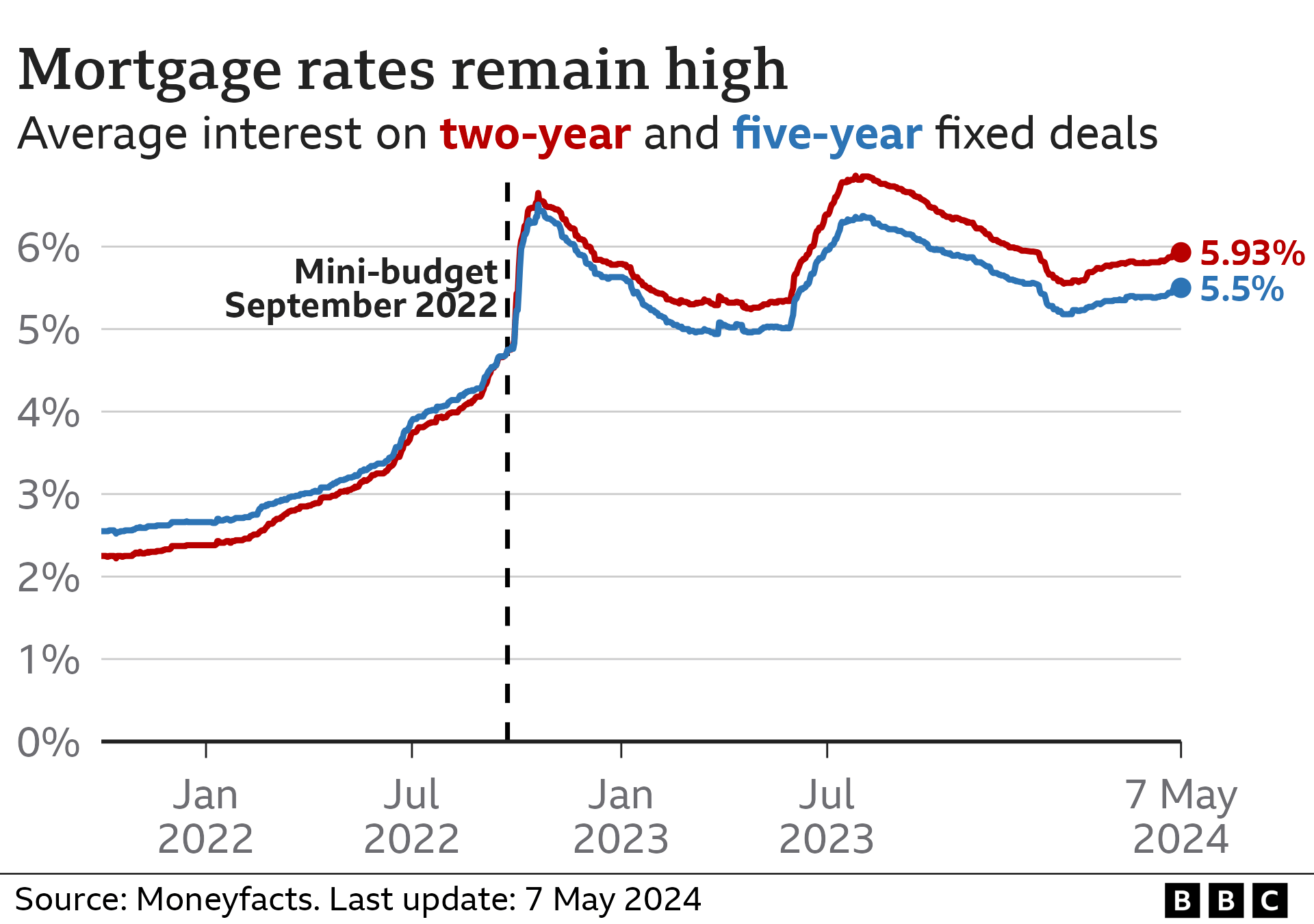

"Mortgage rates have edged up again in recent weeks, primarily as a result of expectations around future Bank of England base rate changes, with markets now pricing in a slower pace of cuts."

First-time buyers and homeowners looking to remortgage are still facing a "significant challenge" when it comes to finding affordable deals, the Halifax has said.

The lender said house prices have been largely flat so far this year, and only saw a small increase in April.

Mortgage rates have been rising in recent weeks, mainly due to expectations that the Bank of England will make fewer interest rate cuts this year.

However, a forecast from estate agent Savills suggests that house prices will rise by more than a fifth by the end of 2028.

Savills said it had upgraded its forecast for the next few years on expectations of a stronger performance from the UK economy together with steady cuts to interest rates.

The Bank's latest decision on interest rates will be announced on Thursday, with most analysts predicting they will be left unchanged at 5.25%.

At the start of the year, many analysts had expected the Bank to make several cuts to its key interest rate in 2024, with the first predicted to take place in June.

But with inflation - the rate at which prices rise - not falling as fast as expected, forecasts of when the Bank will cut have been pushed back.

This change in expectations has had a knock-on effect on the mortgage market, pushing rates back up.

Why mortgage rates are going up, not down

- Published5 May 2024

House prices fall as lenders raise mortgage rates

- Published1 May 2024

'Wonky' market

Halifax's house price data is based on its own mortgage lending, which does not include buyers who purchase homes with cash, or buy-to-let deals. Cash buyers account for about a third of housing sales.

The lender said Northern Ireland saw the biggest rise among the nations and regions, with prices up 3.4% from a year earlier.

Within England, the North West recorded the biggest rise, up 3.3%, while price falls were mainly in the south of England, the Halifax said.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said while house prices appeared to have stabilised, "look a little closer at the annual figures and the market is wonky – with the north/south divide seeing prices climb in the north and drop steadily in the south".

She added this was due to mortgage rates remaining "stubbornly high" and creeping upwards.

The average two-year fixed rate mortgage is currently at 5.93%, up from around 5.8% at the end of March.

"It’s not a dramatic move, but it’s in the wrong direction, and it’s coming at a time when homeowners expected mortgage rates to be dropping."

With homes in the south of England tending to be pricier, higher mortgage costs have had a bigger impact in the region.

"As a result, demand is down, and property prices are level or falling," said Ms Coles.

Halifax said that it still expected property prices to "rise modestly" in 2024, if interest rates are cut later this year.

Savills is predicting, external house prices will grow by 2.5% this year, an upgrade from the 3% fall it was forecasting in November last year.

By the end of 2028, the estate agent expects values to have risen by 21.6% on average, up from its previous outlook of 17.9%.

The new forecast would mean the average house price rising by £61,500 between 2023 and 2028 to £346,500.

"Improving economic performance, combined with steady cuts to the base rate, will open up greater capacity for growth from 2025," said Lucian Cook, head of residential research at Savills.

Savills used data from Oxford Economics and Nationwide, and its forecasts apply to average prices in the second-hand market only, so do not include new-build properties.

Ways to make your mortgage more affordable

Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

Move to an interest-only mortgage. It can keep your monthly payments affordable although you won't be paying off the debt accrued when purchasing your house.

Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Get in touch

Are you affected by issues covered in this story?