Raspberry Pi shares soar on stock market debut

Raspberry Pi's credit-card sized computers have been sold in more than 70 countries

- Published

Shares in computer firm Raspberry Pi soared as much as 40% after they began trading on the London Stock Exchange.

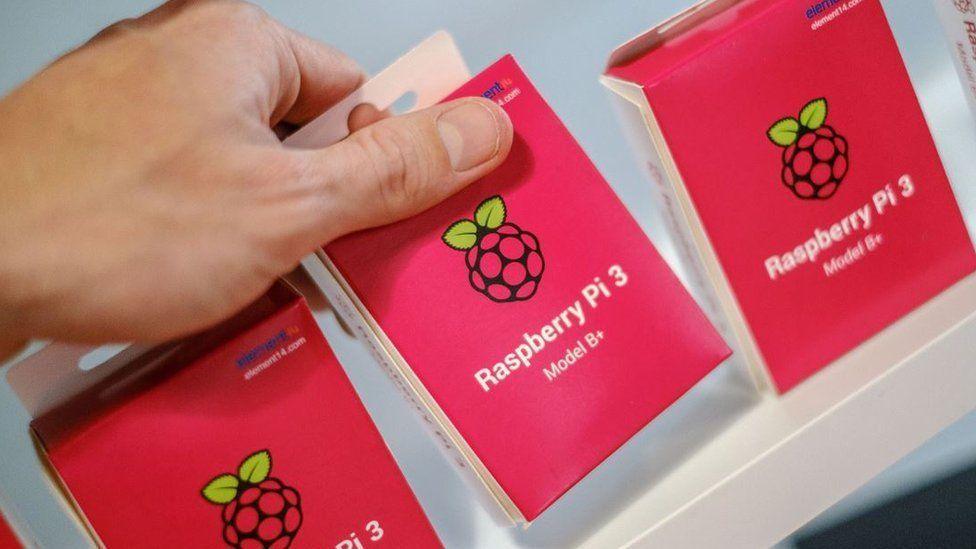

The Cambridge-based business is known for creating affordable credit card-sized computers designed to boost coding skills among children.

Shares hit 392p in early trading on Tuesday, above the initial public offering (IPO) price of 280p.

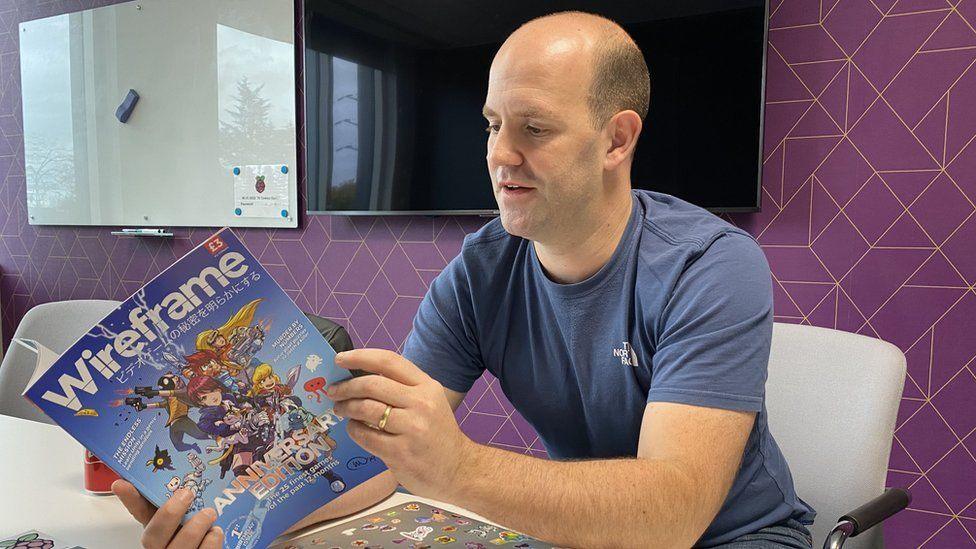

Raspberry Pi chief executive Eben Upton said: "The reaction that we have received is a reflection of the world-class team that we have assembled."

He said it was also because of "the strength of the loyal community with whom we have grown."

Mr Upton founded the business in 2008 and the first product was released in 2012.

It has since sold more than 60 million of its single-board computers alone.

Computer scientist Eben Upton founded Cambridge-based Raspberry Pi in 2008

IPO terms suggested a valuation of £541.6m ($688.8m), the company said in a stock market update. Raspberry Pi said the listing would raise £166m ($211m).

Shares began trading in "conditional dealing" for institutional investors and those on the London Stock Exchange. Full open trade is due to begin on Friday.

'There is life in the London stock market'

Kathleen Brooks, research director at brokers XTB said: "This is a sign that there is life in the London stock market, and companies can derive value from listing in London.

"It is also a decent payday for the company's founders and directors."

Raspberry Pi said it would use cash from the equity raised for engineering projects, improving its supply chain, and other general corporate purposes.

The company opened a store in Cambridge in 2017

Raspberry Pi's products have been sold across more than 70 countries worldwide.

It is a subsidiary of the Raspberry Pi Foundation - a UK charity founded when the company was set up in 2008, with the goal of promoting interest in computer science among young people.

Follow Cambridgeshire news on Facebook, external, Instagram, external and X, external. Got a story? Email eastofenglandnews@bbc.co.uk, external or WhatsApp us on 0800 169 1830

Related topics

- Published26 December 2022

- Published16 May 2024