Irish government runs €8.3bn budget surplus

It is the second year in a row the Republic of Ireland has been able to run a surplus

- Published

The Irish government ran a budget surplus of €8.3bn (£7.1bn) last year, equivalent to just under 3% of national income.

It took in tax and other revenues of €123.7bn (£106bn) and spent €115.4bn (£99bn), according to the Central Statistics Office.

It is the second year in a row the Republic of Ireland has been able to run a surplus.

This is mainly due to a windfall of revenues from corporation tax.

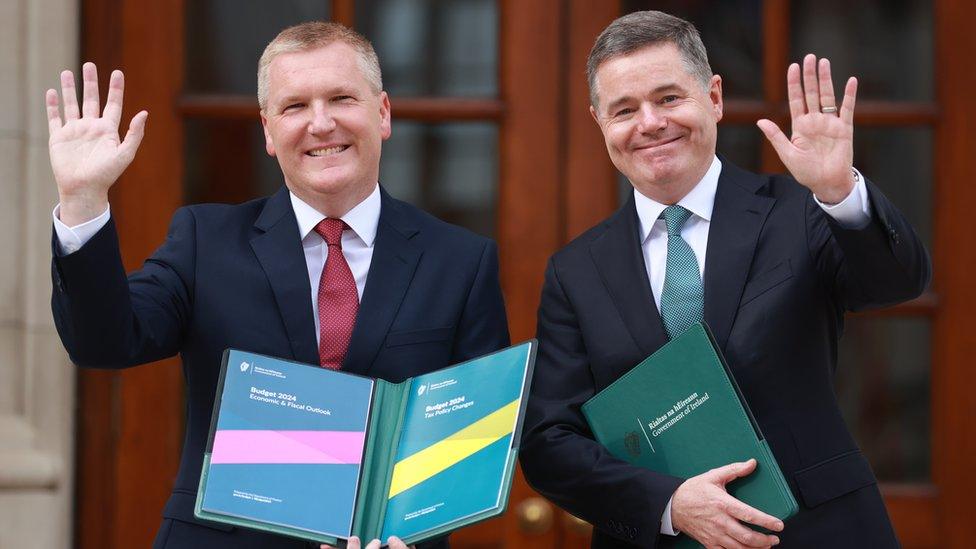

Finance Minister Michael McGrath said the surplus "gives us options that are not open to many peer countries in the developed world".

The government has begun the process of setting up a sovereign wealth fund using some of the tax windfall.

The aim is to establish a fund with assets of €100bn (£86bn) by the middle of the 2030s.

Multinational dependence

Partial reforms to global tax regulation have had the unintended consequence of large US companies paying tax on much of their global profits in Ireland.

This has seen corporation tax receipts in Ireland balloon from just over €4bn (£3.4bn) in 2014, to just under €24bn (£20.5bn) last year.

However, the expectation is that at least some of this revenue is transitory, so it cannot be relied upon to fund permanent spending increases or tax cuts.

Mr McGrath said: "While our headline position is strong, this can change quickly given the inherent volatility in our corporation tax receipts and the dependence we have on revenues from a small number of multinational companies."

Related topics

- Published10 October 2023

- Published27 March 2024