Are taxes going up or down?

- Published

Tax is a big issue in this election, with parties criticising each others plans and records.

The Conservatives say taxes are coming down and have pointed to cuts to National Insurance.

But Labour and other parties have been talking about high levels of tax under the government.

The answer as to whether they are going up or down depends on which tax changes you are looking at and over what period.

Taxes, NHS waiting lists and small boats - BBC Verify tests key claims

- Published5 June 2024

Conservative claim that Labour would cost families £2,000 fact-checked

- Published7 June 2024

National Insurance cuts

Rishi Sunak regularly talks about there being a £900 tax cut for a typical worker.

Mr Sunak is talking about the impact of Chancellor Jeremy Hunt's two cuts in National Insurance (NI) of 2p in the pound each, the second of which came into force in early April.

The average wage for a full-time employee is about £35,000, and that person will indeed pay about £900 less in NI this year as a result of the changes.

But that worker will also be paying tax on more of their salary because of previous government decisions. The independent Institute for Fiscal Studies think tank (IFS) estimates that overall they will actually be £340 better off.

The promised extra 2p off NI promised in the Conservative manifesto by 2027 would take the cut from £900 to £1350.

Threshold freezes

One of the reasons why people are benefiting by less overall is freezes on tax thresholds.

These are the points at which you start paying tax and start paying higher rates of tax.

In particular, the level of income at which people start paying NI and income tax has been frozen in the UK - since July 2022 for NI and since April 2021 for income tax.

This means more people pay tax and more people pay higher rates of tax than would have happened if these tax thresholds had gone up in line with rising prices.

Take somebody working full time on the minimum wage.

The minimum wage has gone up by about 10%, but the point at which people start paying tax has not. That means that somebody working 35 hours a week on the minimum wage is having to pay tax on almost £8,300 of their earnings. Last year, it would have been on £6,400.

If you combine the impact of the threshold freezes and the NI cuts, the IFS estimates that for every, external £1 given back to workers (including the self-employed) this year through NI cuts, £1.30 will have been taken away due to thresholds being frozen between 2021 and 2024.

Tax take

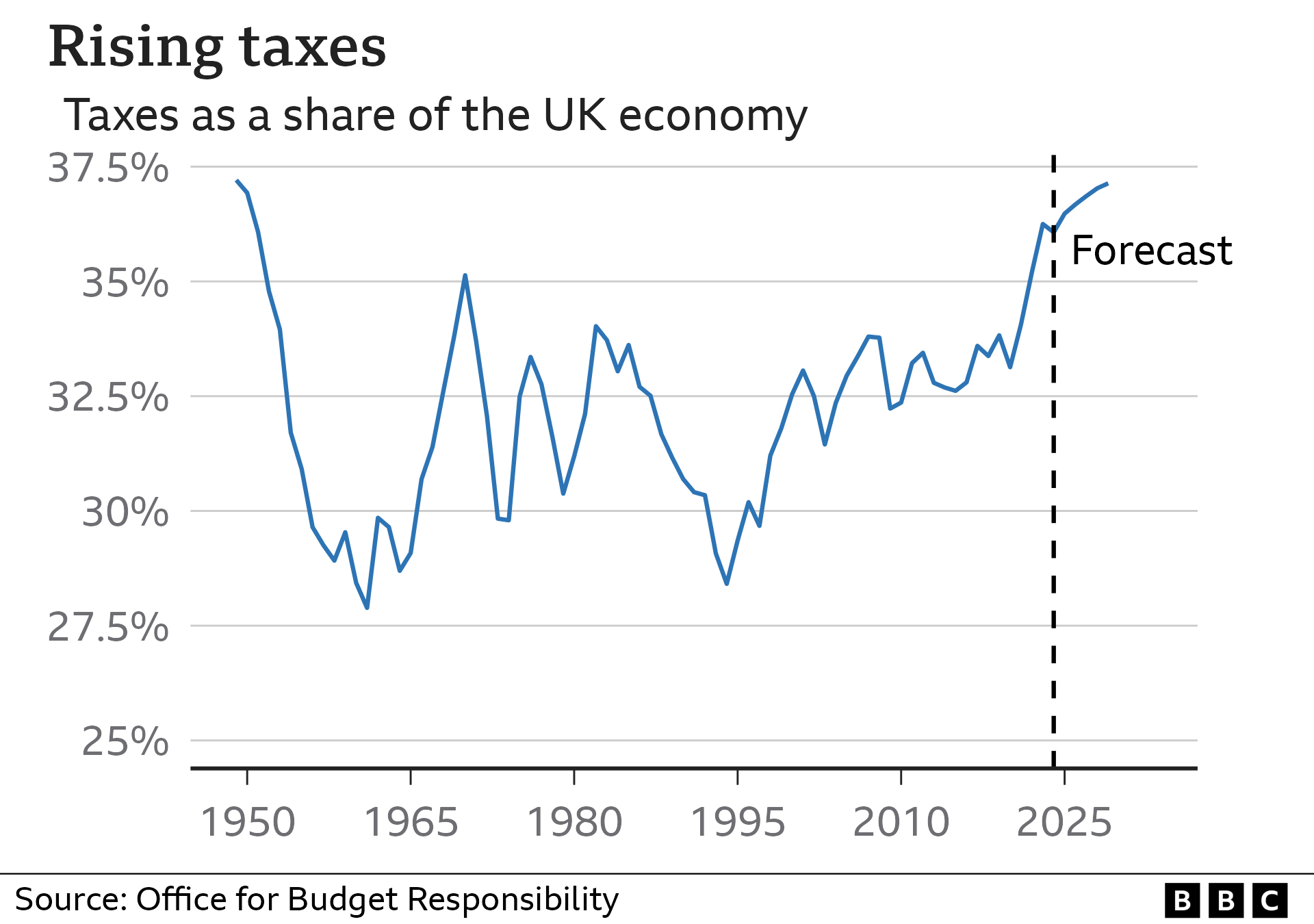

Shadow chancellor Rachel Reeves told BBC News on 19 March: "The tax burden is the highest for 70 years."

She is talking about the amount of money raised in taxes as a proportion of the size of the economy, measured by gross domestic product.

This year it is expected to be historically high, although lower than it was last year. In the next five years, it is expected to reach that 70-year high.

Chancellor Jeremy Hunt says that higher taxes have been necessary to deal with the pandemic and the government's response to the energy crisis, but that he would like to bring taxes down "when it is affordable and responsible".

Having pledged to make a series of tax cuts in his manifesto, the prime minister was asked on 11 June whether the overall tax take would fall by the end of the next Parliament.

He didn’t answer that question directly, instead saying: “the tax burden will be about one percentage point lower in every single year compared to the forecast that you saw at the Spring Budget”.

That forecast came from the Office for Budget Responsibility, which predicted that the overall amount of tax raised would go up by 1.1% of the value of the economy over the next five years.

So it could be a close-run thing whether taxes would rise or fall under the Conservatives.

Lowest tax rates

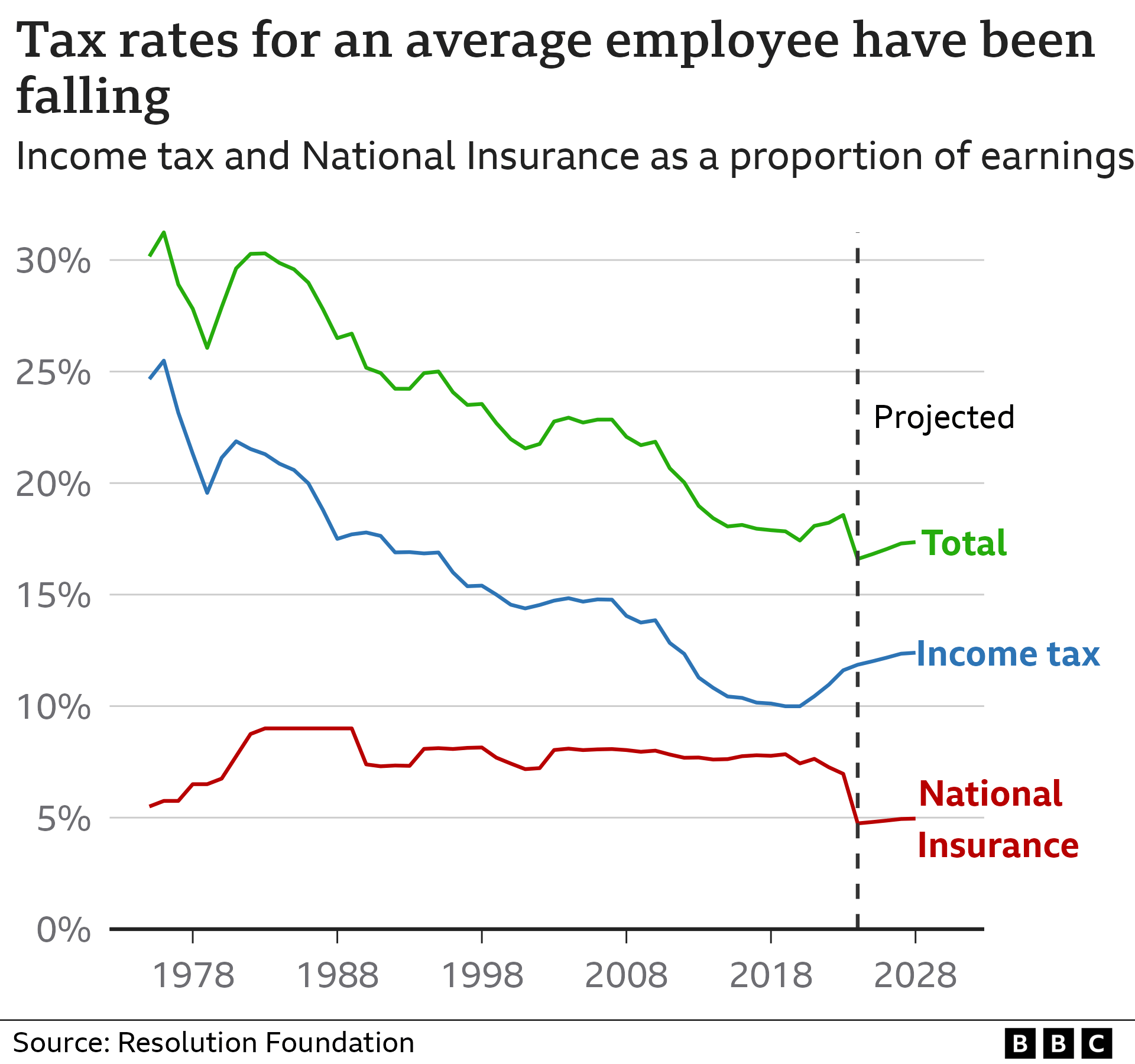

The prime minister told BBC News on 20 March: "If you look at the average tax rate paid by an average worker today, it's at the lowest rate that it's been in almost 50 years."

This is correct. The Resolution Foundation pointed out after the Budget that the 4p cut in National Insurance means the typical employee from April 2024 will be "facing a lower effective tax rate than at any time since at least 1975".

However, those rates are predicted to rise in the coming years as a result of the frozen thresholds.

The Resolution Foundation calculated how much difference would be made by the Conservative manifesto pledges and found that the rates would still be rising in the coming years but a slower rate.

Paul Johnson from the IFS wrote a piece, external in the Times explaining how it can be that the average worker is paying a low rate of direct tax (that's income tax and National Insurance) when the overall amount of tax raised is approaching record levels.

He said part of that is down to money raised through indirect tax (such as the sales tax VAT), which has been boosted by recent high inflation.

But he also said that high earners had seen big increases in their taxes. The top 1% of earners pay 29% of income tax now compared with 25% in 2010.

And while the state pension has gone up by 8.5%, the frozen thresholds have been a problem for some pensioners.

If they have high enough incomes from pensions, investments or are still working, they have lost out from frozen thresholds (although they've been promised higher thresholds in future by the Conservatives) but not benefited from the cuts to NI, because they do not pay NI.

How do UK taxes compare with other countries?

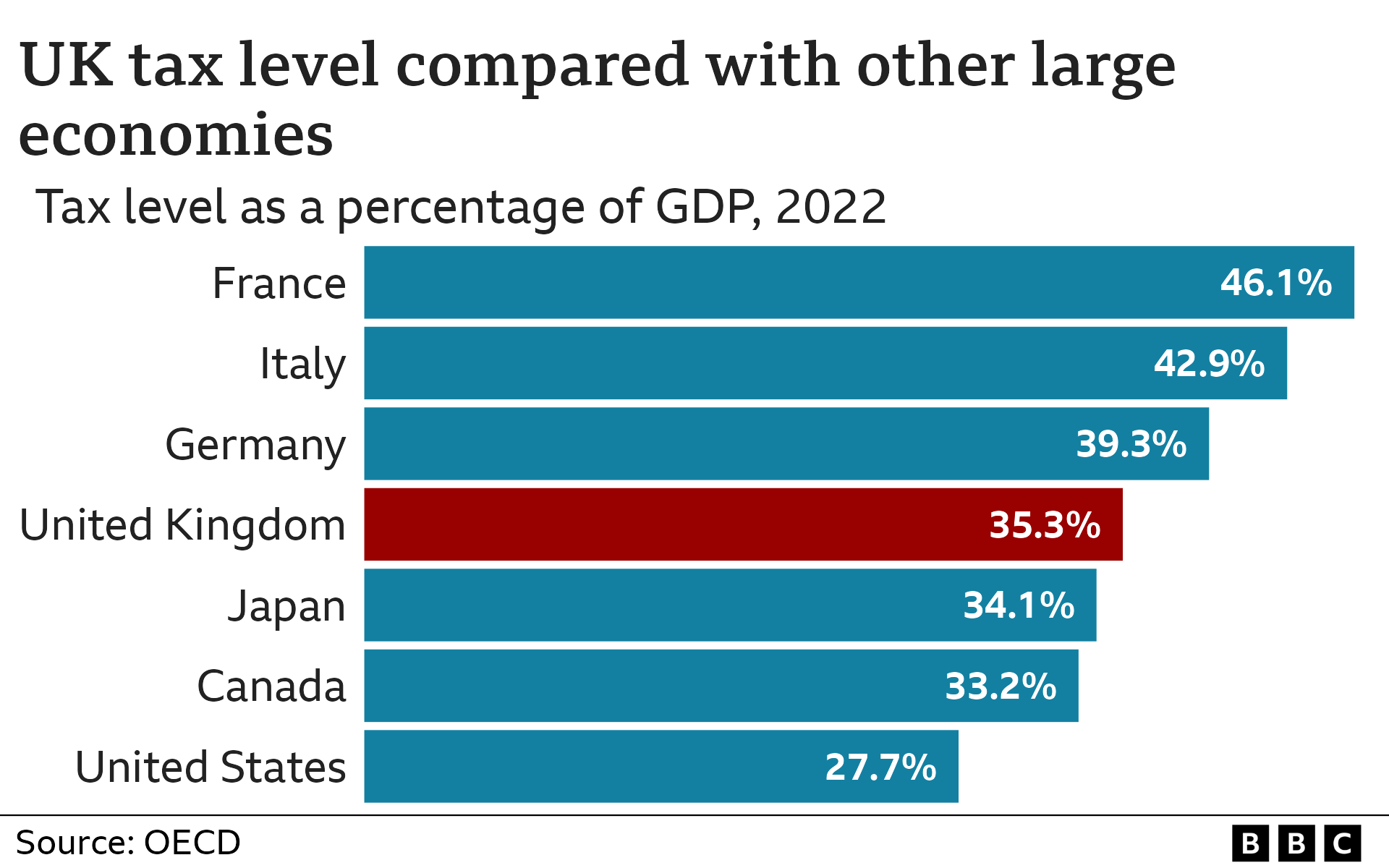

You can look at the amount of tax raised as a proportion of the size of the economy, or GDP.

In 2022 - the most recent year for which international comparisons can be made - that figure was 35.3%.

That puts the UK right in the middle of the G7 group of big economies.

France, Italy and Germany tax more; Canada, Japan and the US tax less.