Starmer refuses to rule out freeze on tax thresholds

- Published

Sir Keir Starmer has refused to rule out extending the freeze on tax thresholds, which has seen millions of people dragged into paying higher rates.

The freeze on National Insurance (NI) and income tax thresholds, introduced under the Conservatives, is currently due to end in April 2028.

But asked during Prime Minister's Questions whether the government still planned to lift the freeze, Sir Keir only said he was committed to Labour's election manifesto.

This included a pledge not to increase National Insurance, income tax or VAT - but no specific promise on thresholds.

U-turns on cutting disability benefits and winter fuel payments for pensioners have piled pressure on the government's spending plans, with economists saying tax rises are now likely in the autumn Budget.

Following major concessions on the government's flagship benefits plan, potential savings of around £5bn will now be delayed or lost entirely.

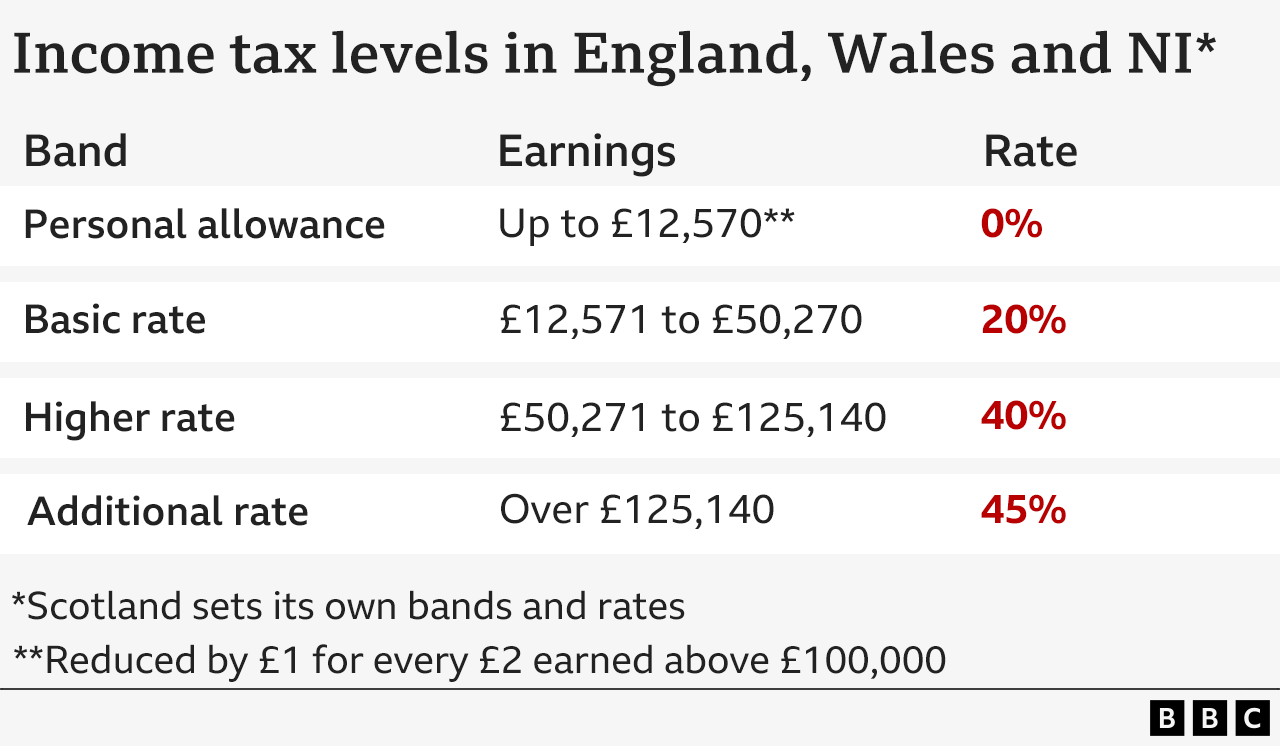

Tax thresholds - the income levels at which people start paying National Insurance or income tax, or have to pay higher rates - typically increased every year in line with inflation.

However, income tax thresholds have been frozen since 2021/22.

This means people risk being dragged into a higher tax band, or paying tax on their income for the first time, if they get a pay rise.

Extending the freeze until 2029/30 could raise an estimated £7bn a year.

In her Budget speech last autumn, Chancellor Rachel Reeves said extending the freeze "would hurt working people" and pledged to lift thresholds in line with inflation again from 2028/29.

However, asked by Conservative leader Kemi Badenoch if this was still government policy, Sir Keir did not rule out continuing the freeze.

"No prime minister or chancellor is going to write a Budget in advance. We are absolutely fixed on our fiscal rules. We remain committed to them," he told the Commons.

"We remain committed to our Budget, to our manifesto commitments."

The PM's answer contrasted to his previous response to Badenoch, when asked if he stood by Labour's promise not to increase income tax, National Insurance or VAT.

His reply to this was simply: "Yes."

The government's self-imposed fiscal rules include not borrowing to fund day-to-day spending and to get government debt falling as a share of national income by 2029/29.

The rules are designed to reassure financial markets but sticking to them limits the government's options and makes tax rises more likely.

Badenoch said a continued freeze would mean "millions of our poorest pensioners face being dragged into income tax for the first time ever", dubbing this a "retirement tax".

Watch: Tory leader focuses on tax at PMQs

Badenoch also accused Sir Keir of "flirting" with the idea of a wealth tax – something some Labour MPs on the left of the party have called for.

Supporters of the idea say a new 2% tax on assets worth more than £10m could raise £24bn per year.

However, critics argue such a move could see wealthy individuals leave the country.

Badenoch told the Commons: "Let's be honest about what that means, this is a tax on all of our constituents' savings, on their houses, on their pensions, it would be a tax on aspiration."

Asked if he would rule out a wealth tax, Sir Keir said Labour had stabilised the economy and "don't need lessons" from the Conservatives.

Pressed again on whether he would introduce a wealth tax by Green MP Adrian Ramsay, who suggested "those with the broadest shoulders should carry the largest burden", Sir Keir said: "We can't just tax our way to growth."

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It'll be delivered straight to your inbox every weekday.