Council fraudster's £1m still not refunded to taxpayers

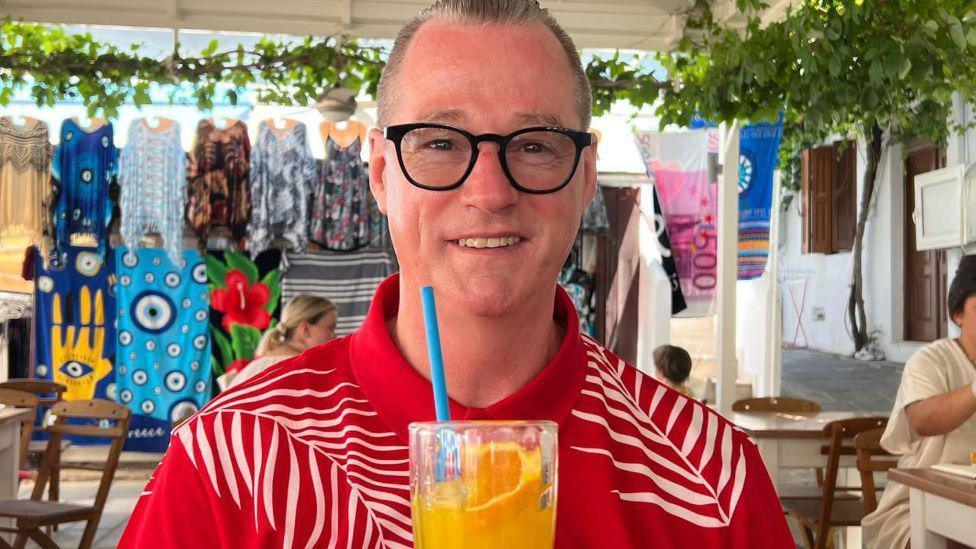

Michael Paterson was jailed last year

- Published

Aberdeen City Council is still to contact or refund taxpayers after an employee was able to embezzle more than £1m over a period of 17 years, the public spending watchdog has said.

Michael Paterson exploited his position as a council tax and recovery team leader to keep taking the money between 2006 and 2023 until suspicions were finally raised.

Paterson - who admitted the crime - was jailed for four years last year.

An Accounts Commission report has now said council controls which were in place were not adhered to and lacked scrutiny, external.

It also warned that all of Scotland's local authorities must learn from the weaknesses that allowed the fraud to go undetected for so long.

Aberdeen City Council said it would examine the findings.

Paterson, who is now 60, had started working for the local authority back in 1988, and rose through the ranks to become council tax and recovery team leader.

He had unsupervised authority to issue council tax refunds of up to £3,000, and could also alter payee account details without authorisation or verification, which he did to transfer money to himself.

Paterson realised that he could benefit in situations where a householder had left a property and had not reclaimed for overpayment of their council tax.

He had started the embezzlement as he was worried about debts.

However he would instead spend the money on foreign holidays, eating out, and technology - particularly Apple goods - as well as maintenance of his home.

The Accounts Commission said Aberdeen City Council had to speed up improvements

The scam worked until a colleague noticed that a refund of more than £2,000 had been made on a computer system using Paterson's username.

She confronted him as she thought that the account was not due a refund.

He told her he had been conducting tests and had accidentally put the refund through the live system instead of the test system.

She reported her concerns to bosses who launched a probe into Paterson's activities - and the scale of his crime emerged.

Police were called in, and he said: "I know I've done wrong. I regret what I've done".

He had processed 655 payments to himself.

The final total taken was £1,087,444.47, but Paterson - whose salary was £35,000 a year - was still in debt at the time of his arrest.

First offender Paterson admitted the crime

The Accounts Commission described it as concerning that the perpetrator's actions were able to go unnoticed for so long.

The organisation said the council acted quickly to make improvements, but needed to increase momentum.

The report said the council expects to recover the loss through a combination of cash from the pension of Paterson and a claim on the council's insurance.

"Since February 2024, there has been ongoing work to identify all accounts affected by the embezzlement," the report explained.

"So far, around 1,400 accounts have been identified from the estimated 5,700 accounts affected.

"At this stage, no attempt has been made to contact taxpayers and no refunds have been made," the report added.

Fundamental lessons for others were said to include segregation of duties, and monitoring.

Andrew Burns of the Accounts Commission said it was a "cautionary tale"

"This is a cautionary tale," Andrew Burns, deputy chairman of the Accounts Commission said.

"All councils in Scotland need to learn from this prolonged and significant fraud.

"It isn't enough to have controls to counter fraud; checks need to be followed, weaknesses identified, and routine testing of systems carried out.

"This case shows the risks when internal controls aren't followed."

Mr Burns praised the member of staff who confronted Paterson.

He added: "It shows the value and importance of whistleblowing policies and procedures.

"These are critical to ensure staff across the public sector have the confidence to quickly escalate concerns if they suspect fraud."

Aberdeen City Council said in a statement: "Aberdeen City Council will carefully examine the findings of the Accounts Commission.

"A report will be brought to the council for consideration, including the Accounts Commission's recommended actions and the council's proposed response to the recommended actions."

Related topics

- Published5 July 2024

- Published7 June 2024