Tax error letters start to arrive

- Published

John Whiting from the Chartered Institute of Taxation gives advice on paying back the taxman

UK tax authorities are braced for a deluge of inquiries after sending out fresh tax calculations.

The first 45,000 of nearly six million taxpayers have been sent letters telling them that they have paid the wrong amount of tax.

Tax experts say they should consider challenging demands for extra payments.

HM Revenue & Customs is simultaneously trying to recover £2bn that was underpaid in the past two tax years, and to repay £1.8bn that was overpaid.

The rest of the new tax calculations will be sent out by Christmas.

The previous mistakes have been revealed by the introduction of a new computer system.

This has reconciled separate HMRC databases for tax and national insurance payments, and has highlighted where tax had previously been overcharged or undercharged.

Hardship

Repayments to 4.3 million people will be worth on average £420 each and will be made via changes to their tax codes for the next tax year, 2011-12.

Extra tax charges will average £1,380 and most of these will also be recovered via changes to next year's tax codes.

Where the tax charge is more than £2,000 the taxpayer will, in theory, be asked to pay a lump sum.

But a Revenue spokesman said those could be staggered in cases of hardship.

HMRC will use its experience of the first 45,000 letters - form P800 and its guidance notes - to see just how many recipients write to it, phone or visit its inquiry centres.

Check the facts

Tax experts say that anyone who appears to owe extra tax should first check the facts on their letter to make sure the updated record of employment and income is accurate.

"Look back through your coding notices and compare them to your payslips to ensure your employer has applied the correct coding," said Tony Bernstein, tax partner at accountants HW Fisher.

"Study the PAYE codes, particularly the last one, and check that all the figures in the code reflect your circumstances.

"If there has been a mistake somewhere, then get in touch with your tax office and make them aware of this," he added.

Appeal

If someone wants to challenge the new calculation, they can simply phone HMRC to ask for a recalculation.

In some limited circumstances, it may be possible to ask the authorities to write off the extra money being demanded.

A procedure called the extra statutory concession allows HMRC to write off tax, if it was provided with all the relevant information but failed to use it within 12 months of the end of the tax year in which the information was received.

"In those cases where HMRC had all the information needed and the taxpayer could reasonably have thought they were being accurately taxed, [but] an underpayment has still arisen, it can be written off," said an HMRC spokesman.

"In fairness to all taxpayers, this is not a blanket exemption and very much depends on the specific circumstances of each case."

The Low Incomes Tax Reform Group said: "If you disagree with HMRC's decision on that, you can refer the matter to the Adjudicator, but you cannot appeal.

"However, it is important to know that the concession exists, something about which HMRC are notoriously reticent," it said.

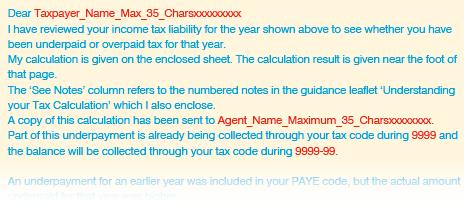

Dummy of letter - form P800 - from HM Revenue & Customs which will be sent to nearly six million taxpayers

- Published7 September 2010

- Published4 September 2010

- Published23 July 2010

- Published21 July 2010