China promises support for euro and euro bonds

- Published

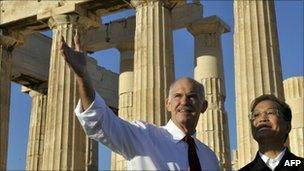

Wen Jiabao spoke to his Greek counterpart George Papandreou

Chinese Premier Wen Jiabao says his country will continue to support both the euro and European government bonds.

"I have made clear that China supports a stable euro," he said.

He also promised not to cut China's investment in European bonds, despite the recent crisis which has weakened the value of many such bonds.

Mr Wen is visiting Greece, the worst-hit of the 27-nation European Union. He has promised to buy Greek government bonds the next time they go on sale.

China has said it needs to diversify its foreign currency holdings and has bought Spanish government bonds.

Later in the week, the Chinese leader will attend an EU-China summit, where the subject of the yuan is almost certain to come up.

Artificially low

China is accused of keeping its currency artificially low against other world currencies, particularly the dollar- which makes Chinese goods cheaper on world markets, and non-Chinese goods more expensive within the country.

That argument is hottest in the US, where the House of Representatives has backed legislation that in theory paves the way for trade sanctions on China.

Mr Wen urged the EU to recognise China as a market economy, something that would make it less vulnerable to anti-dumping charges under World Trade Organization rules.

He added that despite its growth China remained an emerging economy: "Per capita GDP is just one eighth of Greece's and the percentage of population below the poverty line is three times that of Greece. China continues to be an emerging country."

China's economic growth slowed to an annual rate of 10.3% in the second quarter of the year, from 11.9% in the first quarter.

The government is targeting growth of 8% for the year as a whole.

- Published1 October 2010

- Published30 September 2010

- Published30 September 2010

- Published24 August 2010