Currency war's key battlegrounds

- Published

Dominique Strauss-Kahn said co-operation between countries had weakened since the financial crisis

It has been called a "currency war", by the International Monetary Fund's managing director and the Brazilian finance minister among others.

IMF chief Dominique Strauss-Kahn told the BBC last month that there were signs that countries were trying to use their currencies "as a weapon".

For his part, Brazil's Guido Mantega said competitive devaluations by advanced countries amounted to a new trade war.

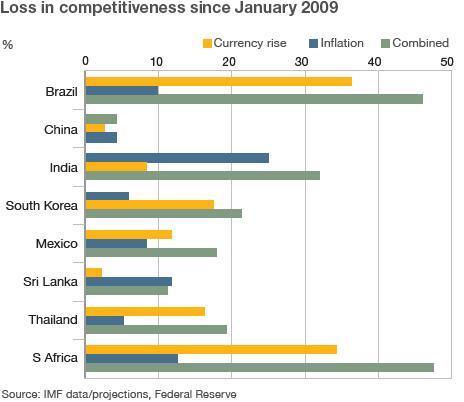

"We're in the midst of an international currency war," he told a meeting of industrial leaders in September. "This threatens us because it takes away our competitiveness."

But what does it all mean?

There are several main elements, two of them fairly new, but the first is a long-standing one.

China versus the US

It is China's policy of managing its currency and limiting its movement against the US dollar.

It has been through several phases and during the financial crisis, China went back to keeping the yuan from rising.

China is trying to hold the yuan's value down

Since just before the Toronto G20 summit in June, it has eased the controls and allowed the currency to move up against the dollar, but by less than 2.5% (as of now). And because the dollar has fallen, the yuan has dropped against many other currencies as well.

Why the Chinese reluctance to allow the yuan to rise much? A fear of job losses among export industries that would be made less competitive.

The rise against the dollar has not been enough to satisfy the US, where there is a long standing complaint that China manipulates its currency to gain an unfair advantage. The cry is: "It costs American jobs."

US economic policy

Many in the US complain about China, but are their hands entirely clean? Some in the rest of the world say not.

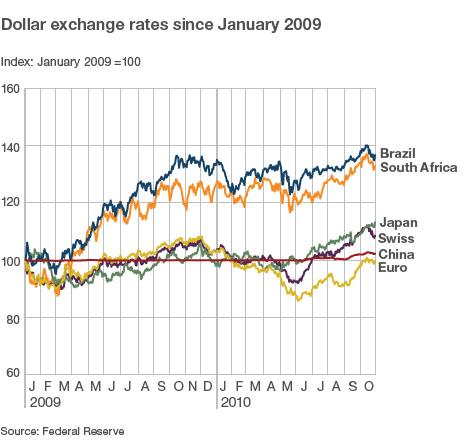

The dollar has fallen sharply in recent months, because interest rates are low, so investors have been seeking higher returns in emerging economies.

They need to buy the currency of the country concerned to make those investments. That tends to push its value up, while the dollar, which they are selling, tends to fall.

And the effect is aggravated by the Federal Reserve's other policy, known as quantitative easing. The Fed buys financial assets and the money it pays with has to be invested somewhere.

The weak dollar has an advantage for the US - it's that competitiveness issue again. It should help American exporters.

The US has a large trade deficit, so more exports could help fix that. Some even argue that the Fed's policies are actually intended to weaken the dollar and help the US economy recover by exporting more.

Emerging economies

The Fed's policies have led to a wave of money-seeking opportunities in the emerging economies. That tends to push their currencies up, undermining their competitiveness.

There is also the risk of bubbles in financial and property markets. And capital inflows can go into reverse - as they did in the Asian crisis in the 1990s.

So the third element in the currency "war" is the resistance of emerging economies, and some developed ones too.

Brazil and Thailand have used tax measures to slow the inflows. Japan, South Korea and others have intervened in the currency markets, buying foreign currency in an attempt to interrupt the rise of their own.

There is a view that they will just have to live with it. The upward pressure on the currencies of many emerging economies reflects the fact they are more growing strongly than the US.

It is difficult for them to manage, but the underlying reason is that they are doing relatively well.

Economic imbalances

The currency war is closely linked with another theme that has been troubling many economists for several years, that of global economic imbalances.

In international terms, it is trade that is unbalanced. Actually, the thing that is most often the focus is the "current account balance", which means trade in goods and services plus some financial items, including remittances that migrant workers send home.

Usually, though, trade is responsible for most of the current account imbalance.

Some countries have large trade surpluses, notably China, Germany, Saudi Arabia and Russia. The big deficit country is the United States.

Some countries at the eye of the European storm have hefty deficits too - Greece, Portugal and Spain. Britain also has a deficit, although as a share of national income, it is not all that large.

The other side of international imbalances is high savings at home with a surplus country such as China, and relatively low savings in a deficit country such as the US.

Household savings have risen in the US, the UK and other deficit countries, because consumers are borrowing less in the wake of the financial crisis.

But international imbalances also reflect how much governments borrow and in many deficit countries that has risen, partly offsetting the increase in private savings.

Why does all this matter? Those countries where saving has risen desperately want to export more. They want to sell more abroad to make up for consumers at home drawing in their horns.

That is true of the US, Britain and many others. They could do that more easily if consumers in China and the other surplus countries were willing to buy more imported goods.

A rise in China's currency would not be a cure-all, but it would probably help.

- Published8 October 2010

- Published28 September 2010

- Published23 October 2010

- Published7 October 2010

- Published11 October 2010