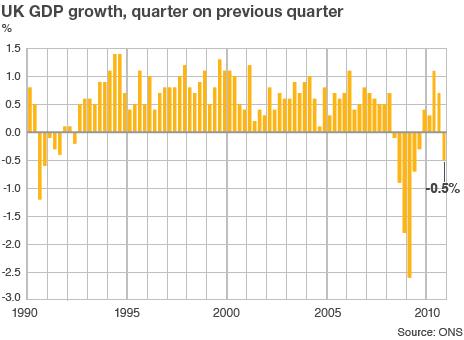

UK economy suffers 0.5% contraction

- Published

The UK's economy suffered a shock contraction of 0.5% in the last three months of 2010, figures have shown.

The severe weather hit activity in the quarter, but the Office for National Statistics (ONS) said even if the weather impact had been excluded, activity would have been "flattish".

The Chancellor, George Osborne, said the numbers were disappointing.

But he added the government would not be "blown off course" from its austerity programme.

The figures are set to raise concerns over prospects for the economy, with large public spending cuts expected to come in this year.

The BBC's economics editor Stephanie Flanders said people were right to worry about where the UK's growth would come from in 2011, especially as higher-than-expected inflation had dealt a further blow to household budgets.

Osborne: "We will not be blown off course by the bad weather"

The contraction follows four straight quarters of growth.

The release is a first estimate for the quarter from the ONS and is subject to revision. The statistics body will publish two further updates at monthly intervals.

'Horrendous'

The contraction took economists by surprise, as forecasts had been for growth of between 0.2% and 0.6%.

The construction industry was a large contributor to the fall, with activity decreasing by 3.3% in the quarter.

"This is a horrendous figure. An absolute disaster for the economy. We knew that retail sales were heavily affected and that services output would be weak, but the collapse in construction was a major contributor to the downside surprise," said Hetal Mehta from Daiwa Capital.

"While today's GDP figures are backward looking, they are nevertheless crucial to understanding the resilience of the economy to shocks. It seems that the economy is incredibly vulnerable. And with the fiscal tightening yet to fully bite, we will have to brace ourselves for a bumpy ride."

The sector that saw the most growth was manufacturing, which expanded by 1.4%.

"Manufacturing remains the one bright spot on the landscape clouded with uncertainty but there are widespread challenges at home and abroad that could still dent growth this year," said Jeegar Kakkad from the manufacturers' organisation, the EEF.

'No question'

The chancellor blamed the severe weather for the weak figures, but said he had no intention of changing his programme of cuts to public spending.

"These are obviously disappointing numbers, but the ONS has made it very clear that the fall in GDP was driven by the terrible weather in December," Mr Osborne said.

"There is no question of changing a fiscal plan that has established international credibility on the back of one very cold month. That would plunge Britain back into a financial crisis. We will not be blown off course by bad weather."

But shadow chancellor Ed Balls said the figures were a matter of "great concern" and due largely to the speed and scope of the coaltion government's deficit reduction programme.

"The fact is the recovery has completely stalled in the last three months of last year. This is an economy which was growing in the middle of the year, which has now ground to a halt," he said.

"We have inflation going up, unemployment rising, now the economy not growing. And all those boasts from George Osborne and David Cameron that they'd secured the recovery - it seems as though the opposite has happened."

Bank of England Governor Mervyn King also appeared to contradict Mr Osborne's analysis in a speech on Tuesday, external.

"Even abstracting from the effects of snow, growth at home slowed in the second half of last year," he said, adding that spending faced further "headwinds" this year, including government spending cuts.

Rates dilemma

Sterling fell sharply following the announcement from the ONS, dropping more than a cent against the dollar to $1.5770.

The weak figures also highlight the dilemma facing the Bank of England, which needs to tackle above-target inflation but is reluctant to raise interest rates when the UK's economic recovery is still uncertain.

"The MPC [Monetary Policy Committee] must abandon any early interest rate rise until the recovery is more secure," said David Kern, chief economist at the British Chambers of Commerce.

"On its part, the government must ensure obstacles that hamper businesses in their efforts to create jobs, invest and export must be removed."

Meanwhile, separate figures from the ONS showed that public sector borrowing came in at £16.8bn in December, down from £21bn a year earlier, and some way off the record £23.3bn reached in November.

The figures exclude the impact of financial interventions by the government, which reduce overall borrowing because of profit contributions from the part-nationalised banks.

The British Chambers of Commerce said the latest borrowing figures indicated an improvement but said the UK's deficit was still "unacceptably high".