Personal insolvencies at new high in England and Wales

- Published

Bev Budsworth, The Debt Advisor: "The private sector needs to help charities"

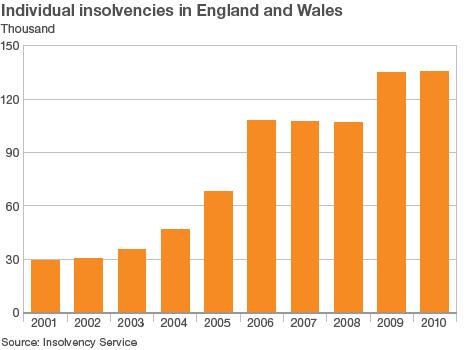

A record number of people were declared insolvent in England and Wales in 2010 although the number of new cases fell in the last three months of the year.

There were 135,089 people declared insolvent last year, the Insolvency Service said, up 0.7% on 2009 and the highest since records began in 1960.

However, there was a 13.6% drop in the last quarter of the year compared with the same period in 2009.

There was also a 23% fall in the number of companies going bust in 2010.

Debt problems

The record number of personal insolvencies for the whole of 2010, which was double the number in 2005, came despite a drop in the final quarter of the year when 30,729 individuals were declared insolvent.

Experts suggested this fall at the end of the year was the result of fewer people being able to attend court proceedings owing to the weather, a more sympathetic attitude from lenders, and people putting off insolvency until the new year.

Insolvencies throughout 2010 were driven by a 6.5% rise in Individual Voluntary Arrangements (IVAs) - which allow an official deal to be struck between the debtor and creditors - to 50,716.

There were also 25,179 Debt Relief Orders - a relatively new style of insolvency for relatively low debts.

However, the number of people taking the more traditional bankruptcy route fell by 20.7% compared with 2009 to 59,194.

Compared with the last recession in the early 1990s, the latest figures show a very different picture.

The number of individual insolvencies has shot up in the past decade, and now far outstrip the numbers seen in 1992 and 1993 of about 37,000 each year, although it is easier now to be declared bankrupt.

Experts said this was because the amount of credit built up by individuals - especially on credit cards - mushroomed in the last decade. IVAs were also in their infancy in 1992-93.

Advice

The latest figures come in the same week as it was revealed that some specialist debt advisers have stopped taking new cases.

For the past five years, the £25m-a-year Financial Inclusion Fund has been paying for about 500 specialists in England and Wales to give free advice.

But the cash is due to run out in March and the government has said it will not renew the fund.

Some experts suggest people's debt problems are likely to continue.

Some families' finances have been hit by rising prices

"The number of people in formal insolvency procedures fell in the last quarter of 2010. However, personal insolvency continues to run at a record high," said a spokesman for the Association of Business Recovery Professionals.

"Worryingly, these figures do not include the number of people using informal insolvency solutions such as debt management plans, of which there are estimated to be around 700,000.

"Unfortunately, for those that are struggling with debt the worst may not be over. Inflation, the rise in the cost of fuel and the increase in VAT means that the cost of living has risen at a time when most of us are experiencing pay freezes, pay cuts and, in some cases, unemployment."

Pat Boyden, partner and personal insolvency expert at PricewaterhouseCoopers, said: "Evidence suggests that people are struggling more with their day-to-day financial pressures such as utility bills rather than their levels of existing debt."

Chris Nutting, director of personal insolvency at accountants KPMG, said he expected the figures to lead to tighter lending conditions and higher costs for new credit as creditors counted their losses.

Businesses

The number of companies going bust in England and Wales fell sharply in 2010 as the economy recovered from recession.

There were 4,905 receiverships, administrations or company voluntary arrangements last year.

That was 23% fewer than in 2009, which was a record year for company insolvencies.

The number of firms that were liquidated - the end point of the insolvency process - also fell, by 16% to 16,045.

In January, figures from the Scottish body Accountant in Bankruptcy revealed that 1,098 companies in Scotland were declared insolvent during the year - a record number.

In Northern Ireland, there were 85 company liquidations in the last three months of the 2010, up from 79 during the previous three months, and 74 during the last quarter of 2009.