UK inflation rate rises to 4.4% in February

- Published

Watch: Darren Morgan from the ONS says fuel prices have helped to push inflation higher

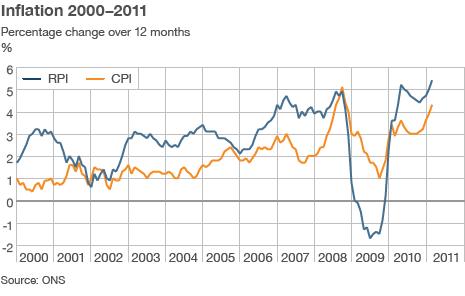

The UK Consumer Prices Index (CPI) annual rate of inflation has risen to 4.4%, up from 4% in January.

This was driven by higher food, fuel and clothing costs and was the highest level for more than two years.

Retail Prices Index (RPI) inflation - which includes mortgage interest payments - rose to 5.5% from 5.1% in January, the highest rate for 20 years.

The CPI measure has now been one percentage point or more above the 2% target for 15 months.

The overall increase in CPI to 4.4% was more than had been forecast by economists.

The CPI figure is the highest since October 2008, and will put pressure on the Bank of England to lift interest rates to curb accelerating inflation.

The expectation of higher interest rates pushed the pound to its highest level against the dollar in more than a year.

It rose 0.5% to $1.639. Against the euro it rose 0.6% to 1.154 euros.

Contributing factors

According to the Office of National Statistics, external, the largest inflationary pressures came from clothing and footwear costs, which rose by 3.6% following the January sales.

Overall transport costs rose by 0.8% between January and February - pushed up by a 1.4% increase in pump prices, following rises in the price of crude oil.

Other contributing factors included rising domestic heating costs, an increase in financial services costs as well as the higher cost of books and toys.

However, alcohol prices fell by 1.1% - a record monthly fall. Spirits fell by 5.8%.

Inflation target

"Inflation has jumped to its highest since October 2008, putting the Bank of England under even greater pressure to demonstrate its commitment to hitting its inflation target by hiking interest rates," said analyst Hetal Mehta of Daiwa Capital Markets.

"And this pressure will no doubt intensify as higher commodity prices feed through in the coming months, taking inflation to around 5%.

But she suggested that a rise in interest rates should bring the rate of inflation under control.

"Provided that interest rates start to increase by 25 basis points [0.25%] per quarter from August, in line with our expectations, then we believe inflation will average 2% next year," she added.

For its part, the British Chambers of Commerce (BCC) urged the Bank of England to remain cautious.

"The MPC must be careful before it takes action that may threaten the fragile recovery, particularly in the face of a tough austerity plan," said David Kern, BCC chief economist.

"It is likely that the MPC will look to restore its credibility and so we can expect interest rates to be raised in the next few months.

"However, we urge the Committee to move cautiously, and avoid premature measures that may cause an economic setback." he added.

Public borrowing

Meanwhile, the ONS also announced that public sector borrowing last month was £11.8bn, a record for the month of February.

The official figure was nearly double the £6.9bn forecast by economists.

The increase in public sector spending may mean that Chancellor George Osborne has less room for extra spending when he delivers the Budget on Wednesday.

"Today's batch of public finance and inflation numbers remind us that the unusual combination of low growth and above target inflation are bad news for the chancellor," said the BBC's economics editor, Stephanie Flanders.