The human cost of Lloyds’ takeover of HBOS

- Published

- comments

The job cuts are part of the banking group's strategic review

Never have so many jobs been shed by a single bank in British history. It's possible no UK company of any sort has ever reduced job numbers by so much.

Because when Lloyds reduces staff numbers by the further 15,000 announced today - scheduled to happen before the end of 2014 - it will have reduced employee numbers by 45,000, compared to where they were at the end of 2008.

Some will see those job losses as the biggest cost of the government's decision at the end of 2008 to allow Lloyds to acquire HBOS, to prevent HBOS collapsing and being fully nationalised.

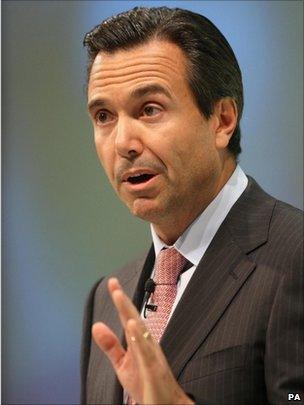

That said, Lloyds' new chief executive, Antonio Horta-Osorio, would argue that the latest 15,000 job reductions are not the elimination of duplicated functions but represent streamlining and simplification that any sensible bank would do.

The latest job reductions - some of which will happen through redundancies, though Lloyds hopes to take out as many jobs as possible by natural attrition and redeployment - will mainly affect those employed in middle management and back offices.

There's also worrying news for Lloyds' suppliers, since - as part of the new chief executive's plan to take £1.5bn of annual costs out of the bank - it is reducing the number of businesses that provide goods and services to it from 17,000 to less than 10,000.

The aim, which would be good news for all of us as taxpayers and owners of 41% of Lloyds, is to return Lloyds to profitability on a sustainable basis.

'Big incentive'

And there is a bit of actual good news for taxpayers today in that the amount Lloyds in effect borrows from taxpayers has fallen by £60bn in the last six months.

What this means is that Lloyds has repaid everything it owes to the Bank of England under the Special Liquidity Scheme, which was created by the Bank of England during the great crash of 2007-8 to prevent banks like Lloyds from collapsing after assorted securities markets shut down, depriving banks of vital finance.

Under Mr Horta-Osorio's new strategy, Lloyds will become a much more UK-focussed bank - whose recovery will to a large extent be dependent on the UK's economic recovery.

Which means that Lloyds will have a big incentive to contribute to that recovery by providing adequate access to credit to small businesses and households that need it.

Lloyds is withdrawing from more than half of the 30 countries overseas where it currently operates. And it will attempt to reinvigorate the Halifax brand, to compete with the Lloyds brand.

In spite of plenty of speculation to the contrary, Mr Horta-Osorio has decided to keep Scottish Widows, Lloyds insurance business.

In fact a central element in his plans to rehabilitate Lloyds is an aim to sell a wider range of products and services to the banks' many millions of customers, with the hope of generating substantial growth in income from retail finance other than just borrowing and lending.

Update 0855 BST: I have had a chat with Antonio Horta-Osorio, and the most striking thing he said was how he is reinforcing the links between the fortunes of Lloyds and the fortunes of the UK economy.

Lloyds is by a margin the biggest retail bank in the UK, and - under the new strategy - is to become even more relatively focused on the UK (although it is being forced to sell 600 branches, under its Verde project, by the European competition authorities).

Mr Horta-Osorio says he wants to create a more unified banking group

"I strongly believe you need strong banks to foster a strong economy" he told me. "And a strong economy is also vital to healthy banks."

So he is in effect asking us to trust him that Lloyds will do the right thing by British households and small businesses, because to do otherwise would be to irrationally damage his bank.

There is evidence that money is following his mouth, in that Lloyds has increased net lending to small businesses this year by 2%, against a market that has shrunk 3%. And Lloyds, unlike other banks, is ahead of targets for lending to businesses set under the big banks' Project Merlin agreement with the Treasury.

Now, as I've already pointed out, today's news is unsettling for Lloyds' suppliers, which are being culled, and for employees (Lloyds currently employs 112,000 - and by the time the existing and new job reduction programmes are finished, the numbers employed will have dropped to less than 90,000).

But investors, which include all of us as taxpayers, seem to like what they've heard of the bank's new strategy, even though Mr Horta-Osorio has slightly reduced Lloyds' target for the return it will earn on equity capital by the end of 2014 (to between 12.5% and 14.5%, compared with Lloyds' cost of capital of around 11.5%).

Lloyds' share price is up more than 7% this morning, after its recent lousy run, though it is still well below the price we as taxpayers paid for our 41% stake.

Structurally, Lloyds is centralising many management functions, so that audit, risk, human resources and finance will now all be done at the centre, rather than devolved to separate operating units.

Mr Horta-Osorio told me he wanted to dismantle silos within Lloyds, to create a more unified group.

And in respect of generating additional income, the thrust will be to sell a wider range of products and services to retail and business customers.

One statistic which he regards as redolent of past failure by Lloyds is that of the group's 30m customers (yes, it has 30m customers), only two million purchase insurance from Lloyds.

He believes some 17 million of its customers are "eligible" to purchase insurance, so Lloyds will do all it can to persuade them to do so.

Here's one interesting question. Will they be more or less likely to buy insurance from Lloyds as a consequence of its record in mis-selling PPI credit insurance?

Here's the point: Lloyds was the biggest mis-seller of PPI; but Mr Horta-Osorio, as new chief executive, broke ranks with the other banks to be the first to apologise for the mis-selling and to offer an expedited, comprehensive settlement of PPI claims.

Update 1211 BST: A former hack who is even older than me, says this: "The only two businesses I can think of which probably shed more than Lloyds in such a short timescale were British Steel Corporation after the 1979 strike and British Coal after the miners' strike."