Brazil: investing to win

- Published

- comments

Investors flooding to Brazil tend to comfort themselves with the thought that it invests more efficiently than China

It's not often you get to stand on the very spot where the next World Cup will begin - you can see me doing just that in my latest report from Brazil. Fingers crossed, the first game of the 2014 World Cup will kick off from the mountain of earth that is set to become the Corinthians' new stadium in Sao Paulo.

It sounds like a story we've heard many times before: country wins chance to host World Cup, then world spends years worrying whether said country will be ready in time. If I had to bet, I'd reckon Brazil would pull it off at the last minute, at vast expense, just like any other World Cup host you can remember.

But there is a larger prize to be won for Brazil, because some of the key issues they have to grapple with in hosting a successful World Cup - not to mention the Rio Olympics in 2016 - are the same ones that have been hurting the economy for years.

Other countries host the World Cup to get the population more into football. Safe to say, that's not an issue for Brazil. But they don't face another problem either: the risk of building a lot of infrastructure which they will never need again.

True, the capital, Brasilia, is getting another, brand new stadium for 2014, even though the civil servants and politicians who are forced to live there all support teams from home. The city doesn't have a really popular football team of its own.

Concentrating minds

But the Corinthians - one of the two most popular teams in the country - have needed their own stadium for decades. And with or without the World Cup, Brazil's in desperate need of new airport capacity and better roads.

If the World Cup concentrates minds to get them built in three years rather than ten, then so much the better. Andre Loes, of HSBC in Sao Paulo, reckons the country needs to invest an extra 3% of GDP a year in infrastructure over the next four years.

But it's not just infrastructure: investment, in general, has always tended to be too low in Brazil - especially compared with Asia. Total investment in Brazil comes to around 20% of GDP - half as much as China.

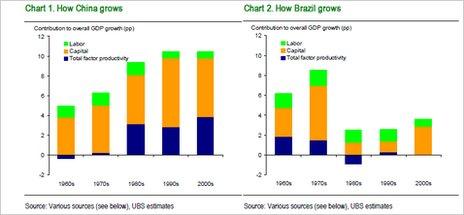

The investors flooding to Brazil have tended to comfort themselves with the thought that Brazil invests more efficiently than China - getting more bang for its smaller number of bucks. After all, how else can you explain how Brazil has grown so fast in the past decade or so, without much of a pick up in investment?

However, a fascinating report by Jonathan Anderson, at UBS, concludes that the truth is more troubling - at least if you're Brazil.

China has grown about 10% a year since 1980, while Brazil has grown by 3% a year (I told you they had a bad time in the 80s and early 90s).

Looking at that seven percentage point growth gap between them, he finds only four percentage points stem directly from China's higher investment rate. The rest is due to China making more efficient use of the capital and labour they've got - what economists refer to as growth in total factor productivity, or TFP.

Human capital

As these charts show, Brazil has struggled to use its capital and labour more productively ever since the 1970s. Even since 2000, the period when Brazil supposedly "came of age", the bulk of growth has come from increased investment, not higher productivity.

Incidentally, this isn't only about China - or Brazil. He produces very similar charts comparing the Asian emerging economies, as a group, to Latin America. The Asians have not simply invested more in recent decades than Latin America, they have also used their existing physical and human capital more efficiently.

The UBS research suggests that China has achieved the fastest growth in total factor productivity of any country in the world in the past 20 years. That's a remarkable finding, worth a blog in its own right. If true - total factor productivity numbers always come with a lot of health warnings attached - it would suggest that China's growth hasn't been as inefficient as its critics suggest.

Those who say China is heading for a fall like to compare it to the Soviet Union, which achieved rapid growth rates on the back of massive capital accumulation - largely in heavy industry - which turned out to be hugely inefficient. There are plenty of reasons to worry about the sustainability of China's growth, but the TFP estimates suggest that particular comparison might be misplaced.

And the lesson for Brazil? The lesson for Brazil is that it's not just the quantity of their investments that's holding them back. It's also the quality. With or without the World Cup, there's plenty of room for the country to raise its game.