Northern Rock: Labour hits out at 'fire sale' price

- Published

- comments

The government has strongly defended the timing and value of the sale

Labour have criticised the government's sale of Northern Rock as a poor deal for taxpayers, saying it was sold off at a "fire sale" price.

The bank, which was nationalised in 2008 following its collapse during the global credit crunch, was sold on Thursday to Virgin Money for £747m.

But the government said the sale was the "best possible deal" for taxpayers.

The chancellor has revealed the bank had to be sold by 2013 under a deal signed by the former Labour government.

This had never been made public.

But shadow Treasury minister Chris Leslie said in Parliament: "If you felt constrained by a European Union requirement to sell by the end of 2013, why didn't the government simply try to change that?

"If you are now suggesting this is a bad deal for the taxpayer and you would rather have waited, why didn't you ask the European Commission for an extension?"

"With the British economy flat-lining for over a year, bank shares in decline and a deepening crisis in the eurozone, he could have made the case that circumstances had changed."

Financial Secretary Mark Hoban said that the sale offered the "best possible deal" for taxpayers.

"Given we were advised Northern Rock plc would have been likely to remain loss-making at least well into 2012, which would have depleted taxpayer resources still further, agreeing a sale now was even more imperative."

'Limited window'

Mr Leslie had sent a letter to Mr Osborne last week, raising concerns about the value and timing of the sale.

In his reply, Mr Osborne said that, under the deal negotiated by his predecessor Alistair Darling with the European Commission over state aid to banks, the government had to sell the majority of its stake by the end of 2013.

That deal with European authorities "left the new government with a limited window to get Northern Rock Plc back into the private sector," Mr Osborne said.

The government also said the sale's valuation of Northern Rock's "price-to-book value ratio" - that is, its assets minus its liabilities - is higher than peers Barclays, Lloyds TSB or the Royal Bank of Scotland.

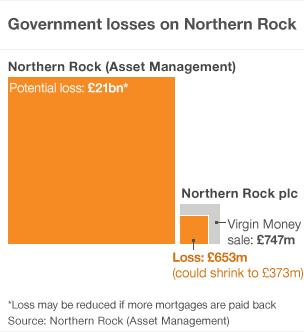

The previous Labour government in 2010 split the bank into two, Northern Rock plc, and Northern Rock (Asset Management), into which was placed its bad debt.

The so-called "bad bank" was saddled with the cost of being bailed out and still owes the Treasury £21bn.

The government has said it had no plans to sell Northern Rock (Asset Management).

The sale of Northern Rock plc is expected to be completed on 1 January 2012.

BBC business editor Robert Peston has said as taxpayers had injected £1.4bn into Northern Rock in 2010, the sale would see a loss of somewhere between £400m and £650m.

But there is the potential for the Treasury to receive a further £280m over the next few years.

- Published18 November 2011

- Published17 November 2011

- Published17 November 2011

- Published17 November 2011