Autumn Statement: UK borrowing forecasts raised

- Published

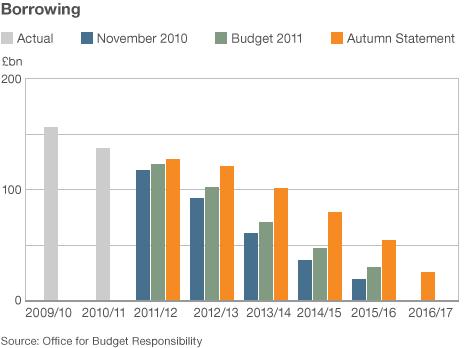

Forecasts for UK government borrowing have been increased, the chancellor has announced in his Autumn Statement.

He said borrowing would be £5bn more this year than originally forecast, £19bn higher next year and £30bn higher in 2013-14.

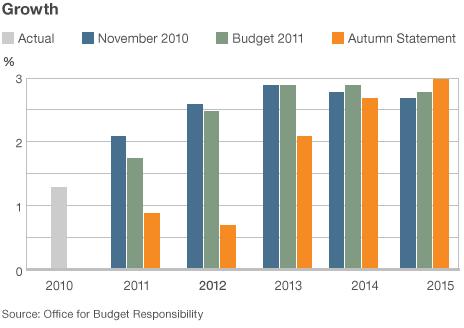

The increases are a result of the reduction in the expected level of growth in the economy.

The Office for Budget Responsibility, external now expects growth of 0.9% this year, down from the 1.7% predicted in March.

The prediction for next year has fallen to 0.7% from 2.5% predicted in March.

George Osborne: "Our debt challenge is even greater than we thought."

The borrowing forecasts predict that the government will borrow £111bn more in the next five years than had been expected in March.

George Osborne stressed that the current forecasts did not predict a recession, but added that the OBR was assuming, "that the euro area finds a way through the current crisis and that policymakers eventually find a solution that delivers sovereign debt sustainability".

"If they do not then the OBR warn that there could be a much worse outcome for Britain," he added.

"We hope this can be averted, but if the rest of Europe heads into recession it may prove hard to avoid one here in the UK."

The OBR cited as its reasons for the weakening forecasts the eurozone debt crisis, growing inflation in food and fuel prices, and also an increase in the amount of the deficit that it believes to be structural.

The deficit is the amount that the government spends more than it is raising through taxes. A structural deficit is a longer term one that remains even if the economy recovers.

"Our debt challenge is even greater than we thought because the boom was even bigger, the bust even deeper and the effects will last even longer," the chancellor said.

But while growth forecasts have been cut sharply until 2013, in 2014 the forecast has been cut from 2.9% to 2.7%, and in 2015 the growth forecast has been raised from 2.8% to 3.0%.

"We take slight issue with some of the forecasts he's published for GDP particularly in the back years," said Adam Chester at Lloyds Corporate Markets.

They are "very rosy projections in 2015-16", he added.

In its report, released after the chancellor had completed his statement, the OBR said that the policy measures outlined in the Autumn Statement would give the government a 60% chance of meeting its deficit-reduction target, compared with a 50% chance if nothing had been done.

The government now aims to eliminate the structural deficit by 2016-17, a year later than its previous target.

John Hawksworth, chief economist at PricewaterhouseCoopers said: "It will be a very close call whether the chancellor will meet his key fiscal target of eliminating the structural deficit by 2016-17 and this clearly restricted his room for manoeuvre in the Autumn Statement.

"The new policy measures announced... will involve the period of tough spending constraint being extended for two further years. This is a case of 'prudence postponed'."

Shadow chancellor Ed Balls said the OBR forecasts showed "growth flatlining this year, next year and the year after; unemployment rising; well over £100bn more borrowing than the chancellor planned a year ago; more borrowing than the plan the chancellor inherited at the last general election".

"Cutting too far and too fast has backfired," he said.

BBC economics editor Stephanie Flanders highlighted the OBR's prediction that for 2014-15: "The structural deficit - the bit that won't go away with economic growth (supposedly) - has gone from 1% of GDP to 2.8%.

"In other words, the structural deficit forecast for that year has almost trebled as a share of the economy, in just eight months."