Facebook's Instagram deal: Can one app be worth $1bn?

- Published

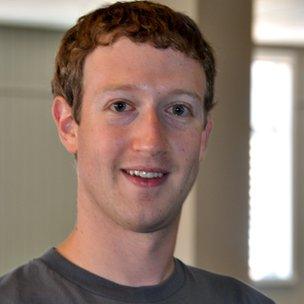

Mark Zuckerberg promises to keep Instagram going

One billion US dollars is a tidy sum of money.

It would buy you some 2,100 Rolls Royce Phantoms. Or 200 million mosquito nets to fight malaria. Or the whole of the New York Times company (with $50m change to spare). If you are Microsoft, it buys you some 800 AOL patents to fight the next patent war.

Facebook boss Mark Zuckerberg chose to spend $1bn on Instagram, a small web start-up just under two years old, with 13 full-time staff who work on a single smartphone app.

The business model

Yes, Instagram is very popular. The app's fancy "filters" give your photos a lovely vintage feeling, a bit like the faded Polaroids tucked away in the drawers of your parents' living room. They port mediocre photos into an alternate universe where they look kind of good; an online service allows users to share their pictures with friends.

The drawback, of course, is Instagram's business model. The company has no revenue to speak of. Maybe its business model was to be bought by another tech firm with too much money in the bank.

So is this the return of silly money to Silicon Valley? Is it a case of panic buying, with valuations pushed up in a bidding war with Google or another competitor?

Facebook is certainly not spending $1bn on an app.

Rather, it is buying three things: a potential rival with a rapidly growing user base; a weapon to fight other even bigger threats in the social networking space; and most importantly a better hook into the world of mobile computing.

One user = $28

Instagram's growth is impressive indeed. The app has some 30 million iPhone users. A week ago it launched on Google's Android operating system and chalked up five million downloads in just six days.

Still, it suggests that Facebook values an Instagram user at about $28.

Cheap, you might say, given the fact that Facebook has a much-touted valuation of $100bn - or $118 per user (Facebook's listing on the Nasdaq stockmarket is imminent).

Well, at least Facebook has revenue and is making a nice profit.

Facebook's problem, though, is the fact that its days of rapid expansion are over, and that many see Facebook as something that's done on an old-style desktop computer.

This is where Instagram comes in. The app's strength - mobile devices - is Facebook's biggest weakness. The social network simply has not got the same traction on smartphones as it has on desktop computers. This is an Achilles heel. The number of phones with web access is already outnumbering computers, and sales of tablet computers could soon outpace those of traditional PCs.

Another YouTube deal?

Don't forget that pictures were at the heart of Facebook's success; the easy sharing of pictures made it stand out against early rivals. Today, the social network is the world's largest photo-sharing website.

Combine Instagram's mobile appeal with some careful Facebook integration (without annoying existing users too much), and Mark Zuckerberg could have made a very nifty move. It could be as clever as Google buying YouTube for $1.65bn in 2006, before it was totally obvious how important web video would become.

Buying Instagram could also help Facebook to fend off new rivals like social photo-sharing website Pinterest, which is arguably the world's fastest growing social network yet (albeit still smaller than Instagram, with currently about 20 million users).

Facebook will have to tread carefully, though. Instagram users are a passionate bunch, and already they worry that their app will go the way of many other clever online services that were swallowed by tech giants like Google and Yahoo: quickly sidelined, forgotten and closed down.

Mark Zuckerberg promises to be different, and says he is "committed to building and growing Instagram independently".

The winners

The biggest winners of the Facebook deal are, of course, the people directly involved with Instagram.

Founder and chief executive Kevin Systrom has reportedly netted $400m; his co-founder Mike Krieger is about $100m richer - all for just under two years' worth of work.

Reports suggest that $100m will be shared out among the other 11 members of staff, some of whom joined the company just a few weeks ago.

And then there are the investors, a roll call of Silicon Valley greats (including Facebook's first chief technical officer).

Kudos, by the way, to the three venture capital firms that reportedly invested $50m in Instagram, valuing the company at just $500m. In less than a week they've doubled their money.

Did I hear anybody say "technology bubble"?

- Published10 April 2012

- Published10 April 2012

- Published14 March 2011

- Published9 April 2012

- Published23 March 2012

- Published2 February 2012

- Published1 February 2012

- Published4 December 2011