Pawnbrokers attracting new custom

- Published

James Constantinou says a range of unusual items are being offered by customers

James Constantinou and his staff hear all sorts of tales.

"Some find it a little bit shameful, but others come in and want to tell you their whole life story. A lot of people want to tell you about their predicament," he says.

"It is almost like they need to tell someone. You do hear a lot of stories - divorces, redundancies, a lot of heartbreak tales."

But Mr Constantinou is not a counsellor, police officer or a priest. He is a pawnbroker. Or, more exactly, a high-end pawnbroker.

While he says business is booming, financial advisers point out that people's belongings are at risk of sale if they fail to pay back the loan.

Designer goods

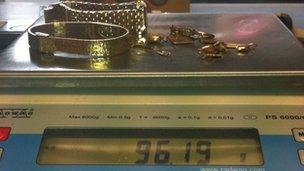

If you think of pawnbrokers, you probably imagine people getting cash for gold or watches. Mr Constantinou does that, but says he has noticed a gap in the market, and has decided to focus on more expensive items too.

He is based in leafy and affluent Weybridge, in Surrey. Clients from all across the country courier their valuables to his shop, Prestige Pawnbrokers.

Pawnbrokers charge interest on the loan secured on the the items offered

He will pawn anything of value, from fine wines and art to rare books and antiques.

The shop opened just as the recession was kicking in, and he says it is getting busier all the time.

"More and more people are coming through the door, they have been to the banks, and have been turned down for an overdraft or loan," he says.

"So, they are looking round their homes, and they are finding out they have actually got items they can use as collateral."

He is not the only one to benefit from this, with new pawnbroker shops opening up.

The National Pawnbrokers Association says business increased by 15% in 2011, and thinks that half of that is down to middle-income customers, and small businesses.

The way it works is simple. The customer brings along something to pawn, and usually walks away with a loan worth around 70% of its market value.

They have at least six months to pay it back, and interest rates tend to be between 5% and 10%.

Quick cash

At Christmas, Lorraine Giacomelli's bathroom flooded. It was ruined, and the damage had spread to her downstairs neighbour's home.

Lorraine Giacomelli says a friend suggested she went to a pawnbroker

"I was really, really upset and just did not know where I was going to get the money from. I did not have a clue how I was going to get this thing sorted out," she says.

A friend suggested she went to a pawnbroker. She says she was not convinced at first.

"I did not think I had anything worth pawning to be honest. I thought it would be jewellery and stuff," she says.

"But I had my shoes and my handbags, and got £4,000 on the same day."

And so, the pawnbroker is keeping her shoes and handbags in secure storage. She has got until August to pay back her loan, with interest of £196 a month.

But, if she does not find the cash, then she will lose her items.

At that stage, the pawnbroker can sell them. If he makes more than the original loan and interest, she will get to keep the difference.

"It is in our interest that the client gets the item back. It is a common misconception that the pawnbroker wants to sell the item," says Mr Constantinou.

Instead, he says he tries to extend the term of the loan.

"We are in the business of making money out of the interest, so if we have to sell an item, it is not in our interest at all. We lose a client. "

'Risk'

David Braithwaite, from Citrus Financial Management, says there are certain advantages to using a pawnbroker.

"It is probably cheaper than something like a payday loan," he says.

"But the big advantage of a pawnbroker is that you do not have to go through normal credit checks, like you would if you were applying for a bank loan or credit card.

"So it can be viewed as a simpler, no questions asked way of getting money. And you get it very quickly as well."

But he points out that it is basically a secured loan.

"It is almost like a mortgage. So, rather than having it secured on your house, you are having your loan secured on your item.

"You need to have an item that is worth securing a loan on. If you do not pay back your loan, your item is at risk. They will take that back off you."