Santander's free business banking is no longer forever

- Published

The 1935 Rolls Royce has lasted longer than the promise of free banking

About 230,000 small businesses that bank with Santander have been told that their accounts, supposedly free for ever, will now cost £7.50 a month.

The bank has been sending letters to the customers giving advance warning of the change, which will come into effect later this year.

Santander says the old accounts are "no longer viable".

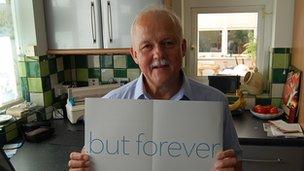

Barry Daniels, who runs a wedding car business from the village of Curdridge near Southampton, is not happy at all.

"I was shocked and horrified - I thought the free banking was for ever, as promised," he says.

'Horrendous situation'

Mr Daniels' business involves hiring out cars to wedding couples - either a 1935 Rolls Royce he restored himself, or a more modern Daimler.

The firm, Chartwell Wedding Cars, turns over about £10,000 a year.

Mr Daniels switched his business account from NatWest to the Abbey eight years ago, specifically to take advantage of the free banking offer.

"They were offering free banking forever," he points out.

"They didn't charge for cheques, they gave free envelopes to send off cheques, so everything you get is free."

The new charges will not be trivial, in his view.

"We are running along quite nicely as we are; £7.50 a month is £90 a year, which we could do without," Mr Daniels says.

"But I feel that once they have got us onto that, and they have got us off the free banking they could charge for cheques and everything, so we could end up in a horrendous situation where we pay a lot of money every month," he explains.

'Not viable'

The accounts in question are largely ones that Santander has inherited from banks it has taken over in the past - the Abbey and the Alliance & Leicester.

Santander argues that the impending account changes mean the customers will receive an improved service in exchange for the new monthly fees.

For instance, there will be more business managers to talk to in local Santander branches.

A higher rate of interest, 0.25%, will be paid on balances held in the business current accounts.

And all business customers will be able to operate their accounts in Post Office branches. Previously, this benefited only Alliance & Leicester business customers.

"Our business customers have told us they require more," a bank spokeswoman says.

"The majority of our customers will see that this account is highly competitive and gives them the all-round service they demand so that they can concentrate on growing their businesses.

"It is not viable to offer them more, for free," she explains.

Santander continues to offer a free banking account to new start-ups, but usually only for 12 months.

What next?

The word "forever" is emblazoned in big blue letters on the brochure Mr Daniels was given by the Abbey back in 2004.

When is a promise not a promise?

So the recent Santander letter telling him that his account is being changed with the application of a new monthly fee is in clear contradiction to its original marketing promise.

What can he do about it?

Both the Financial Ombudsman Service (FOS) and the Financial Services Authority (FSA) have advised him to complain to Santander in the first instance, and seek an answer within the required eight weeks.

Meanwhile, the Federation of Small Businesses (FSB) says it is investigating whether bank may be in breach of contract.

"Santander launched this 'free business banking for life' to a big fanfare and as a skilled marketing stunt," says Pierre Williams of the FSB.

"The announcement they have withdrawn these accounts will come as a severe disappointment to the businesses that joined the bank on the strength of this promise."

Unfair?

The terms and conditions of Mr Daniels' account make it clear that they can be varied by the bank with proper warning.

The bank says it is doing just that and will, in due course, issue all its customers with the required 60 days notice of the changes.

Anyone who does not like it will have to close their account and take their business elsewhere.

In Mr Daniels' view he is not being subjected to a variation on his account, but in effect a compulsory transfer to a new one.

Is that fair?

Chris Warner, a lawyer at the consumers' association Which? warned that small businesses do not have the same legal protection as individuals against being taken by surprise by the small print in contracts.

"Businesses are not protected as consumers are against unfair terms in contracts," he explained.

Marc Gander, of the Consumer Action Group, says anyone in Mr Daniels' position should think about going to the County Court to obtain a judgement that Santander has breached its obligation to treat customers fairly, under the <link> <caption>Banking Conduct of Business (BCOB)</caption> <url href="http://www.fsahandbook.info/FSA/html/handbook/BCOBS" platform="highweb"/> </link> regulations.

"These regulations set a statutory duty on banks to act fairly," Mr Gander says.

"They are hugely powerful but no-one seems interested in using them."