Q&A: Standard Chartered Iran allegations

- Published

The New York office of the bank clears about $190bn per day for its international clients

The UK-based bank, Standard Chartered, has now paid a total of $674m (£419m) to US regulators and authorities for illegally hiding transactions with Iran and other countries under US sanctions.

The New York State Department of Financial Services (DFS), one of the regulators that issued the fines, said the the bank laundered as much as $250bn (£161bn) for nearly a decade.

So who is Standard Chartered and what did they do wrong?

Who is Standard Chartered?

The Chartered Bank was founded by Royal Charter and opened in Bombay, Calcutta and Shanghai in 1858, before expanding to Hong Kong.

The bank as we know it was formed in 1969 through the merger of Standard Bank of British South Africa and the Chartered Bank of India, Australia and China

Despite its historic Asian ties, Standard Chartered is headquartered in London and is regulated by the UK Financial Services Authority.

The bank made a pre-tax profit of $6.8bn in 2011, two-thirds of which come from Asia.

The bank has been operating in New York since 1976. The New York office clears about $190bn per day for its international clients.

What is the bank accused of?

Essentially, the New York State DFS says Standard Chartered spent the best part of 10 years, from 2001 to 2010, hiding billions of Iranian financial deals.

The dollar transactions originated and terminated in European banks in the UK and the Middle East, and were cleared through its New York branch, the complaint said.

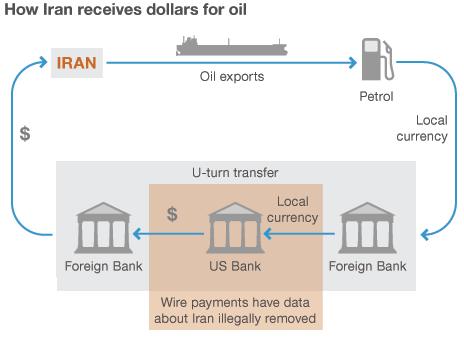

Under the sanctions regime, until 2008, banks in the US in some circumstances were allowed so-called U-turns with Iranian financial institutions.

U-turn transactions are money moved for Iranian clients among non-Iranian foreign banks such as in Britain and the Middle East and cleared through the US, but which neither started nor ended in Iran.

To ascertain whether these transactions are permitted or not under the current U-turn laws, US clearing banks use the wire-transfer messages they get from banks involved.

If the banks do not have enough information, they are supposed to freeze the assets.

"By 2008 it was clear that this system of wire-transfer checks had been abused," the regulator says, and U-turns with Iran were banned.

Standard Chartered is said to have made millions in fees for those 60,000 secret transactions for "Iranian financial institutions".

SWIFT is the international payments scheme. When ordinary people have to make money transfers across borders, they often need a SWIFT or BIC number of their bank.

The bank is accused of falsifying SWIFT wire payment directions by stripping the message of unwanted data that showed the clients were Iranian, replacing it with false entries.

What does Standard Chartered say?

Standard Chartered firmly rejected US claims that it "schemed" with Iran to conduct secret transactions worth $250bn (£160bn) when it was first accused earlier this year.

In a statement in August it said that the order issued by the New York State DFS does not present a full and accurate picture of the facts.

"The analysis, that the group shared with all the US agencies, demonstrates that throughout the period the group acted to comply, and overwhelmingly did comply, with US sanctions and the regulations relating to U-turn payments," it said.

"As we have disclosed to the authorities, well over 99.9% of the transactions relating to Iran complied with the U-turn regulations. The total value of transactions which did not follow the U-turn was under $14m."

In a statement following the fines, the bank said the US Treasury Department's Office of Foreign Assets Control (OFAC) found that only $133m worth of transactions were found to be in violation of sanctions laws between 2001 and 2007, and that the bank had now carried out a "comprehensive review and upgrade" of its compliance systems and procedures since then.

Who issued the fines?

Fines have been paid to the US Federal Reserve, the New York State DFS and OFAC. the Department of Justice also seized assets from the bank worth $227m.

The New York State DFS is a relatively new organisation - formed in October 2011 to reform the regulation of financial services in New York. It supervises 4,400 institutions, with assets of about $6.2tn.

The Federal Reserve is the US central bank, responsible for monetary policy but also for supervising and regulating banking institutions.

OFAC is an office in the US Treasury department, responsible for enforcing economic and trade sanctions against foreign countries it regards as a threat to US interests.

What is the sanctions regime against Iran?

Iran has been subject to US economic sanctions since 1979, when the shah was overthrown and Islamic militants took 52 Americans hostage inside the US embassy in Tehran.

The laws were toughened by executive orders signed by Presidents Ronald Reagan in 1987 and Bill Clinton in 1995.

In particular, Mr Clinton consolidated his two orders into Executive Order 13059 in 1997 by "confirming that virtually all trade and investment activities with Iran by US persons, wherever located, are prohibited".

This has been tightened further since - for example, the right to import carpets of Iranian origin disappeared in 2010.

The current regime operates under the US Treasury Department's Office of Foreign Assets Control (OFAC), external.

Under criminal law, violations of the Iranian Transactions Regulations may result in a fine up to $1m and/or jail for up to 20 years.

OFAC also regulates trade with other isolated countries, such as North Korea.

The New York State Department of Financial Services said it had uncovered evidence of similar schemes to conduct business with other countries under OFAC sanctions - Libya, Burma and Sudan.

How widespread are sanctions violations?

Earlier this year HSBC was accused by the US Senate of failing to prevent money laundering from countries around the world, including Mexico and Iran.

According to the Senate report, the US unit of HSBC carried out 28,000 undisclosed sensitive transactions between 2001 and 2007, an internal audit commissioned by the bank found. The vast majority of those transactions - worth $19.7bn - involved Iran.

Two affiliates, HSBC Europe and HSBC Middle East repeatedly altered transaction information to take out any reference to Iran, the report said.

This may have been to prevent red flags in the system triggering an individual review of an accepted transaction, slowing it down, the committee said.

But the report said that more work would need to be done to establish in which of these thousands of cases, if any, US law had been broken.

- Published24 July 2012

- Published2 August 2012

- Published6 August 2012

- Published11 December 2012