Libor: What is it and why does it matter?

- Published

Libor, the London inter-bank lending rate, is considered to be one of the most important interest rates in finance, upon which trillions of financial contracts rest. Here, the BBC explains some of the key facts.

1. What is Libor?

A global benchmark interest rate used to set a range of financial deals worth an estimated:

$450,000,000,000,000

The value of deals determined by Libor was revised down from $800 trillion to $450 trillion following new figures in the Wheatley report on 28 September 2012.

2. Why is it so important?

As well as helping to decide the price of other transactions, it is also used as a measure of trust in the financial system and reflects the confidence banks have in each other's financial health.

-

Mortgages

-

Loans

-

Inter-bank lending

-

Indicator of trust

-

Reflects health of banks

3. How is it set?

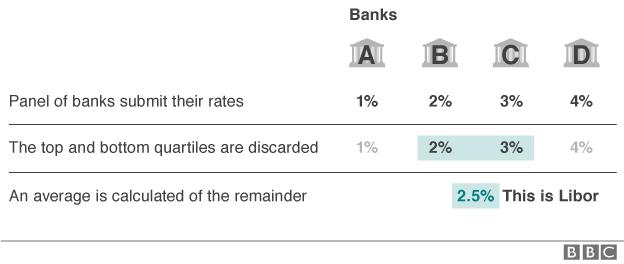

Banks don't just lend money to one another whenever they like. There is a system. Every day a group of leading banks submits the interest rates at which they are willing to lend to other finance houses. They suggest rates in 10 currencies covering 15 different lengths of loan, ranging from overnight to 12 months.

The most important rate is the three-month dollar Libor. The rates submitted are what the banks estimate they would pay other banks to borrow dollars for three months if they borrowed money on the day the rate is being set. Then an average is calculated. This is a simple example of how it works.

4. How have the allegations of manipulation arisen?

Since the rates submitted are estimates, not actual transactions, it has been suggested that banks could have submitted false figures. It is alleged that traders at several banks conspired to influence the final average rate that results, the official Libor rate, by agreeing amongst themselves to submit rates that were either higher or lower than their actual estimates.

During the past three years Barclays Bank, JP Morgan, Swiss bank UBS, Royal Bank of Scotland and Deutsche Bank have all been fined by financial regulators for this practice, which is seen as market manipulation and corrosive to trust in the financial markets.

In August 2015, former city trader Tom Hayes was convicted of conspiracy to defraud for manipulating Libor. He was jailed for 14 years a sentence that had since been cut to 11 years.

5. Could Libor be manipulated now?

After the allegations came to light the government commissioned a major review of Libor and how it was set. Oversight of Libor was passed from the British Bankers' Association to the Intercontinental Exchange - ICE. Rates are now based on actual transactions for which records are kept. Another key change is that there are now specific criminal sanctions for manipulation of benchmark interest rates.