Santander U-turn on free business accounts

- Published

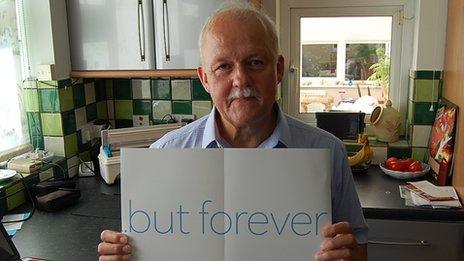

Barry Daniels displays the original "free forever" promise

Santander has staged an about-turn and will no longer withdraw its "free banking forever" account from 230,000 small business customers.

The original decision, first revealed in late July, upset some customers who thought the bank was reneging on an unbreakable promise to them.

They would have had to pay either £7.50 or £12.50 a month for a business bank account that was previously free.

Santander had previously said it was within its right to change the account.

But less than two months after first announcing the change, it has reversed its policy.

"After listening to feedback from our existing customers, a small number of whom do not feel their businesses would benefit from these changes, we will be retaining the fee-free option for existing customers," a spokesman said.

'Wonderful news'

A letter will be sent next week to the customers telling them of the change.

One factor that may have weighed on the bank's mind is that every one of the affected customers could have taken their complaint to the Financial Ombudsman Service (FOS).

This would have cost the bank £500 each time in FOS administration fees and could, theoretically, have landed it with a bill of £115m if every customer had taken this route.

Barry Daniels, a Santander account holder from Hampshire who runs a wedding car service, said he was very pleased by the latest development.

"That's absolutely wonderful; that's quite a success, they have done the honourable thing," he told the BBC.

Mr Daniels had planned to complain to the FOS and so had Dinny Reed, who runs a honey farm near the village of Kingsley in Hampshire.

"It's wonderful, fantastic, news and a real triumph for the little guy against the big banks," she said.

"It shows it is worth protesting."

Wrong in law?

Santander could have been in for a very uncomfortable contest over the legitimacy of its suggested change.

Dinny Reed says complaining was worthwhile

Not only did the marketing brochures state that the accounts would be "free forever" in big letters, some had even spelled out the limited circumstances in which that promise might be altered.

"We guarantee that unless there are any changes to the law or banking regulations, or any new taxes relating to bank charges, you will benefit from free day-to-day business banking forever," one brochure seen by the BBC said.

Some disgruntled customers had been thinking of taking the bank to the small claims court to sue for the return of any charge that was eventually imposed.

One such customer was John Pettman, a commercial landlord from Whitstable in Kent and also a semi-retired lawyer, who is still annoyed.

"They were trying to con me, it was yet another example of the inappropriate actions of large banks," he said.

"In my opinion, on a point of law, the "free banking forever" was an entrenched term and condition that can't be altered by the other term and condition that says they can vary it.

"I trust they now accept that they were not only wrong in law, but also wrong on the question of morality," he added.

Mis-sold policies?

If a court had rejected this legal argument, Mr Pettman had been prepared to take his case to the Financial Services Authority (FSA).

John Pettman had been preparing to go to court

He argued that the bank must have mis-sold the accounts if its marketing promise, displayed in big letters on its brochures, could be subsequently over-ruled by the small print.

David Price, who runs a property management business in Folkestone in Kent, had also planned to pursue this line of argument.

He has four of Santander's free business accounts, as well as personal ones, and was prepared to take all his money and move it elsewhere if the bank had gone ahead with its plan to levy charges.

"I feel these charges were not justified, it was not within their terms and conditions, it was an external guarantee," he argued.

"If they had reneged on this guarantee, I think they would have been guilty of mis-selling.

"I am pleased they have honoured their initial promise and trust it will be permanent," he added

Better service

The bank's explanation for trying to levy charges on its free accounts was that its own market research had shown that its customers with such accounts - largely inherited from the Abbey and Alliance & Leicester - had in fact wanted to pay, but for an upgraded account with more facilities.

David Price is still offended by Santander's behaviour

The new accounts with charges are the ones that have been on offer to new customers since November 2011, after the free ones were withdrawn for new customers.

Santander is adamant that the new accounts are very good value for money.

"Our free offer allowed no access to branches or additional support for business customers," the bank said.

"Feedback - both from existing customers and non-customers - increasingly told us they wanted more access to local business support; more transparency; more competitive and fixed costs; more interest on their current account and easy access to funding for their businesses.

"We will, of course, be happy to upgrade any customer who would like to make the most of the additional benefits offered by the fixed-fee account," the bank added.

- Published29 July 2012

- Published23 July 2012

- Published24 May 2012