Pensions auto-enrolment attracts cautious welcome

- Published

- comments

Kerry Lightfoot, an employee of Morrisons in Redcar: "It will be peace of mind that there will be something there at retirement"

A huge reform in pension provision for millions of low and middle earners has been given a cautious welcome by trade unions, employers and charities.

Staff at the UK's biggest firms have started to be automatically enrolled in a workplace pension, which both they and their employers will pay into.

The TUC said it was the beginning of a "pensions new deal".

But others warned that it could lead to people still not saving enough for their retirement.

It is designed to supplement the current state pension and to stem the drastic decline in workers' pension provision.

"Too many employers have walked away from their responsibilities, and now just one in three private sector workers are in a pension, threatening many with a miserable retirement," said general secretary Brendan Barber.

"Of course it can and should be made better, but we now have what should be a stable framework," he said.

Pensions Minister Steve Webb said the new system, considered the biggest change to saving for retirement for over a century, should work because it was so simple.

"You don't have all the hassle and complexity of choosing a pension. The firm chooses it for you, they put money in, you put money in, and then the only hassle is if you want to opt out," Mr Webb added.

How it works

Staff will either join their existing employer's scheme, or one of the new group schemes that employers can adopt, such as the National Employment Savings Trust (Nest).

The process of recruitment started with the biggest employers on 1 October 2012 and will then be staggered over the next few years until 2018. The smallest employers begin auto-enrolment for their staff in January 2015.

At the same time, contribution levels will rise slowly, to avoid giving either staff or their firms an unwelcome financial jolt while the economy is still in recession.

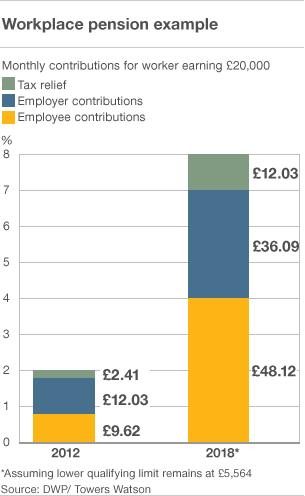

Contributions will start with staff paying in a minimum of just 0.8% of their pensionable earnings.

On top of that employers will have to pay in 1% of their employees' pensionable earnings, with tax relief contributing another 0.2%.

These contribution levels will eventually rise to 4% from the employee, 3% from their employer and 1% in tax relief, giving a total of 8%.

The contributions will be invested and then when the employee retires, currently at 55 at the earliest, they will have to buy an annual pension, or annuity, with their accumulated pot.

The employers' organisation, the CBI, praised the design of the scheme.

"The change is rightly being phased over many years, to ensure it remains affordable for businesses in these tough times," said director general John Cridland.

How much pension?

Critics, however, have suggested that this grand plan could lead to many people generating very small pensions.

That may be because they will pay in only small sums during their working lifetimes, or because the investments will be at the mercy of financial markets, which may provide poor returns.

When the full 8% contribution rate is in effect, someone earning £20,000 a year would see £1,154.88 in combined contributions being added to their pot each year.

If they were aged 22, and then saved for 40 years before retiring at the age of 62, these contributions would eventually total £46,160.

If, over those 40 years, there was an average 3% a year return on the funds in which the contributions were invested, then the retiree would end up with a pot of £88,488.

According to the Money Advice Service, external, at the current historically low annuity rates this would provide a man in good health with an inflation linked annual pension of as much as £2,714 a year, or £226 a month.

Michelle Mitchell of Age UK said the government now needed to press ahead with plans for an underlying flat-rate state pension.

"We believe this would prevent people worrying about jeopardising means tested benefits if they are auto-enrolled and would give a clearer idea of how much money a person can expect when they retire," she said.

"We want to see the current contribution and transfer restrictions on Nest, the government savings scheme, lifted, so people can accumulate their savings in one place and eventually convert them into a good value annuity."

Opting out

Workers will have the option to opt out of the pension savings scheme, and will be given details of how to do this before they start to see their contributions being diverted from their pay packet.

"Some people might think about quitting their new pension, but we urge them to stick with it and get saving for their old age," said Joanne Segars, chief executive of the National Association of Pension Funds (NAPF).

"Leaving the pension would mean losing tax breaks and employer contributions which are, in effect, free money."

The Department for Work and Pensions said that, by the end of the year, about 600,000 more people in the UK would be saving into a workplace pension and by May 2014 about 4.3 million people would be signed up.

The eventual aim is to increase that figure to between six and nine million people by the end of the 2018, by when automatic enrolment will cover all employers.

Pension provision in the private sector has been in drastic decline in the past two decades, with fewer than three million private sector workers now paying into a company pension scheme.

In some cases employers simply do not provide any pension scheme for their staff at all.

In other cases staff do not join existing schemes, typically because they are low paid and fear they cannot afford to contribute, or because they work in industries such as catering where there is a high turnover of staff who stay in jobs for only short periods of time.

The concept of automatically recruiting staff to pension schemes - but with the possibility of staff then opting out - was first suggested by Lord Turner's Pension Commission in 2005.