Cyprus crisis: What are capital controls and why does it need them?

- Published

Most of us assume the money in our bank account is always available to us

"Neither a borrower, nor a lender be."

That was the recommendation given by the rather creepy Polonius to his son Laertes, who was about to head off to the temptations of Paris in the play Hamlet.

Sage advice as it may appear, the truth is that each and every one of us is a lender - often without even realising it - and our economy would not function nearly so well if that were not the case.

That's because your bank account is a loan, from you to your bank.

You may think of it as money - akin to cash, one cash-machine trip away from banknotes - but it is nonetheless a loan.

And, as most of us are well aware by now, the bank takes this borrowed money and re-lends it to businesses and homebuyers.

Inherent flaw

But while you have the right to withdraw your money from the bank at a moment's notice, the bank, of course, does not have the right to demand that mortgage borrowers and companies repay the loans it has made at the drop of a hat.

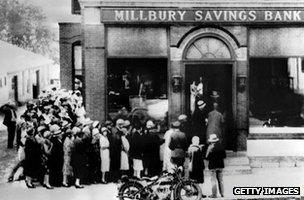

And this makes all banks vulnerable to a sudden collapse. Because if everyone turned up one day and tried to empty their bank account - in other words, asks for their loans to be repaid - the money would not be there to repay them.

It is an inherent vulnerability.

Even a solvent bank - one that has made sensible loans and investments that will eventually be repaid in full - does not have the cash readily available to pay out even a fraction of its deposits.

All banks are inherently vulnerable

Fortunately, people don't normally do that. Indeed, a bank's very business is predicated on the fact that only a fairly predictable minority of its many depositors ask to withdraw their money from one day to the next.

But occasionally, people do queue up outside the bank - or empty their accounts electronically - if they suddenly become afraid that the money in their bank account is no longer safe. It is what is known as a bank run.

If the bank is solvent - which, during a crisis, can be near-impossible to judge - then in most countries, the central bank will throw it a lifeline - an emergency loan that will provide the requisite cash until the depositor panic subsides. That way the cash machines of a healthy bank are guaranteed never to run empty.

Precisely such fears over Cyprus' banks have already led them to borrow some 9bn euros of so-called Emergency Liquidity Assistance from their central bank, to replace money withdrawn by more savvy depositors in recent months.

Hot potato

But what if the bank is not solvent? What, for instance, if it has lent a bunch of money to the Greek government that will never be repaid in full?

In that case - as the European Central Bank made clear last week - the bank could no longer rely on largesse from the central bank to keep its doors open. The central bank has no interest in making a loss on its emergency lending, or in propping up banks that have no future.

And that is where capital controls come in.

A capital control is when the government tells you that you are no longer allowed to move your money around freely.

Normal service will be resumed within "a matter of weeks"

In this sense, Cyprus has already had capital controls in place for over a week. Because, for over a week, the government has declared special "bank holidays", during which the country's banks have been shuttered, and there have been strict limits on how much people can withdraw each day from cash machines.

The island's two biggest banks - Laiki Bank and Bank of Cyprus - had made such big losses on the loans they made, that they probably no longer had enough money to repay all their depositors - not now, not ever.

And somebody would ultimately have to bear those losses.

And, once the Cypriot government made clear that the "somebody" was going to be the banks' depositors, then bank runs seemed all but inevitable.

Consider a hypothetical Russian oligarch. He owns various shell companies in Cyprus in order to take advantage of a treaty between Cyprus and Russia that enables him to pay zero tax on the profits made by his various Russian businesses.

Why would he choose to stash his tens of millions in loose change in Laiki Bank if it becomes apparent that about 40% of that money was about to be effectively confiscated in order to cover the bank's losses?

Of course he, and everyone else, would try to withdraw his money immediately - something that would hasten and worsen the bank's collapse, and which must therefore be blocked by the Cypriot government.

Suitcase ban?

There are many types of capital control, and they don't just have to be applied at the bank's doors and cash machines.

Most controls allow people limited access to their bank account, in order to let them meet their day-to-day needs and maintain a minimum level of activity in the economy.

In the case of Cyprus, the detail of just how much access people will be given is still frustratingly absent.

The BBC's Paul Mason: "Every figure in this document has the word 'euro' and two x's"

The controls will remain in place so long as there remains a popular belief that money in one bank account is more at risk than money in another bank, or in another country, or just stashed under the mattress. Such popular beliefs are what sustain bank runs.

It appears that special controls will remain at the two most Cypriot troubled banks, at least until the exact losses for their depositors have been calculated and imposed.

Cyprus may well also introduce international capital controls, to head off a collapse of the entire Cypriot banking system.

In other words, people may not be allowed to transfer their money out of a Cypriot bank account into, say, a German bank account, in which case they may also have to bar people from ferrying bulging suitcase-loads of euro banknotes on flights to Athens.

All such moves fly in the face of the founding treaties of the European Union and the eurozone, which declare that money should be free to flow throughout the entire single currency area.

Indeed, one of the main reasons for European monetary union was to enable such free flows of money.

But the measures are supposedly temporary only, lasting only "a matter of weeks".

The assumption is that once the dust has settled, the panic will end, and the controls can be lifted again.

Terrible precedent

That's the theory. Unfortunately, human psychology does not necessarily work that way.

Bank holidays take on a whole new meaning

People tend to look back to the recent past as much as forwards to what they can rationally expect in the future.

Why, as a foreign investor, would you choose to keep your money in any Cypriot bank, bearing in mind the following three recent events:

Initially, the Cypriot government was proposing to impose losses (via a one-off tax) on all deposits in all banks, not just on deposits bigger than 100,000 euros in the two insolvent banks

Even if you escaped taking direct losses, your money has been locked up in your bank for the past week, and faces being locked up in Cyprus for many weeks, if not months, more

Those depositors who have been stung are among the biggest and most internationally mobile depositors in the country's banking system, and could well move their money to another country where they felt their business was more highly valued, if they are allowed.

All of these things may set a terrible precedent - not just for Cyprus, but for the rest of the eurozone too.

For example, what might happen if Greece asks for yet more leniency and bailout cash from the rest of the eurozone in the coming months?

Would you feel confident leaving your money in a Greek bank account, knowing that capital controls and losses for depositors had been part of the deal for Cyprus?

The precedent of Cyprus surely heightens the risk of future bank runs elsewhere in the eurozone, especially considering the mixed messages from the European authorities, external.

What's more, in Cyprus itself it remains far from clear that there will not be further losses to be meted out to depositors out in the coming years, providing ample incentive for them to move their money elsewhere as soon as they get the chance.

As the BBC's business editor Robert Peston recently pointed out, the problems at its banks, the probable death of its large offshore banking industry, not to mention a good dose of government austerity, all mean Cyprus may face a nasty recession.

And recession usually means more losses for the banks and more debt problems for the government further down the line. Just ask Greece.

Litmus test

Having said all this, capital controls are not always a terrible idea. So long as they are imposed to stop an irrational and damaging panic, they can actually be quite helpful.

Malaysia, for example, imposed capital controls during the 1997 Asian crisis, at a time when international investors were pulling their money out of many East Asian countries, causing their currencies to collapse.

The country was roundly criticised by international policymakers, financiers and economists at the time, and was told that the measures were counter-productive, because of the terrible precedent they would set.

But, in retrospect, they seemed to do a lot of good. The Malaysian banks avoided collapse, the economy rebounded quickly, and international investors eventually regained full access to their local bank accounts intact.

So the litmus test for Cyprus may be what happens over the coming months. If the economy stabilises, and the finances of the Cypriot banks and government start to look manageable again, confidence should return and the capital controls may be safely removed.

But so long as the outlook for Cyprus remains bleak, the fear will remain of more losses in the future. In that case it may prove impossible to convince wealthy non-Cypriots to keep their money in Nicosia and Limassol, given the choice.

And the capital controls will surely have to remain in place.