India gets smartphone boost from low-cost devices

- Published

So far, only 10% of India's mobile users have smartphones

Animesh Roy has just purchased his first smartphone. The 26-year-old, who works in a hospitality company in the Indian city of Calcutta, was looking for a device with a lot of applications.

But he had one key condition - it had to be cheap.

So he didn't pick the Apple iPhone or the Samsung Galaxy, the two most popular models globally, but a Bolt A35, made in India by a local company, Micromax.

Mr Roy, who earns 13,000 rupees ($240; £155) a month, shelled out $77 for his acquisition.

"I was looking for a phone that would give me value for money," he told the BBC.

"I can't afford an expensive phone, but this one is good-looking and offers me all the applications that a Samsung or an iPhone would offer, at a much lesser price."

Mr Roy is one of many Indians switching to smartphones for the first time and opening new avenues of growth for manufacturers.

Currently only 10% of mobile consumers in India use smartphones, but that is expected to change in the next few years.

Last year, about 19 million smartphones were sold in India. But sales are forecast to exceed 100 million over the next three years.

According to the IDC research company, India will become the third largest smartphone market by 2017 after China and the US.

"It's an unprecedented situation right now in the smartphone segment and the boom is here to stay," says Rahul Sharma, co-founder of Micromax.

"This is primarily been driven by the replacement market. People are replacing their feature phones with smartphones."

Local players

Micromax is gaining market share in the Indian mobile phone market

Samsung is the leader in the Indian smartphone market, with more than 40% last year.

But domestic handset manufacturers, such as Micromax and Karbonn, are catching up fast by offering consumers smartphones below $100.

The two firms offer Android-based smartphones at below $75. On the other hand, the lowest-priced Apple and Samsung smartphones in India are $490 and $113 respectively.

And their pricing policy seems to be working. According to data from IDC, Micromax was the second biggest smartphone vendor in India in the first quarter this year.

Karbonn was fifth, even though it started selling smartphones only a year ago. Sony was third and Nokia fourth.

According to figures from Consumer Media Research, based in Gurgaon, near Delhi, Micromax increased shipments to 633,000 smartphones in the first quarter this year, compared with 9,990 in the same period in 2012.

Karbonn shipments grew to 304,000 from zero a year ago.

It is hardly surprising, given that affordability is central in driving consumer demand in India.

Micromax is aiming to become the market leader in smartphones by next year.

"We will double our smartphone portfolio in the $100-$200 range over the next three months," says Mr Sharma. "We are going to attack the market in a diversified way over the next year."

Unlocking potential

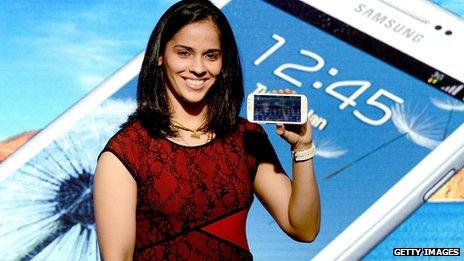

Samsung sells more smartphones in India than anyone else, but its competitors are pressing it hard

Another key factor in India that has slowed the growth of companies such as Apple is that, unlike their Western counterparts, Indian carriers do not subsidise handsets.

One big reason is that 95% of mobile phone users in India have prepaid accounts without fixed contracts.

This means that customers would have to pay nearly $800 for the latest iPhone 5.

However, in an attempt to increase market share, Apple has changed its strategy. Last year, it introduced instalment payment plans that made iPhones more affordable, brought in a new distribution model and upped its marketing efforts.

It also slashed the prices of previous iPhone models. Initial reports suggest that the plan has worked.

According to Canalys, a Singapore-based market researcher, iPhone shipments to India have risen threefold in the past six months.

Apple has been offering Indians a special deal on the iPhone 4

The company, seeing the success of its earlier schemes, introduced another attractive offer last month, allowing a consumer to buy an iPhone 4 for $350 in exchange for any old smartphone.

The offer is further backed by an easy monthly instalment scheme that allows interest-free payment over 12 months.

The MobileStore, an Indian chain owned by the Essar conglomerate that claims it sells 17% of all iPhones in India, says the scheme has been a mega-success.

Himanshu Chakrawarti, its chief executive, says its iPhone sales jumped fourfold after the scheme started.

"When you talk about phones, India, like any other country in the world, considers iPhone to be right up there," says Mr Chakrawarti.

"And the strategy adopted by Apple to use iPhone 4 as a volume driver is working wonders."

There is little doubt that India's smartphone market will boom in the coming years, but affordability will be key in deciding which companies can cash in.

So far, Indian manufacturers have had the upper hand. But global companies have indicated they are willing to tailor their pricing strategies to counter that.

With the two sides vying for market share, the Indian consumer is a likely winner.

- Published7 May 2013

- Published6 May 2013

- Published26 April 2013

- Published30 November 2012