Rent 'unaffordable' for low-income families in third of UK

- Published

- comments

A third of Britain is effectively off-limits to lower-income working families because private rents are unaffordable, a new report claims.

The report comes from the Resolution Foundation, external, which campaigns on behalf of low to middle-income families.

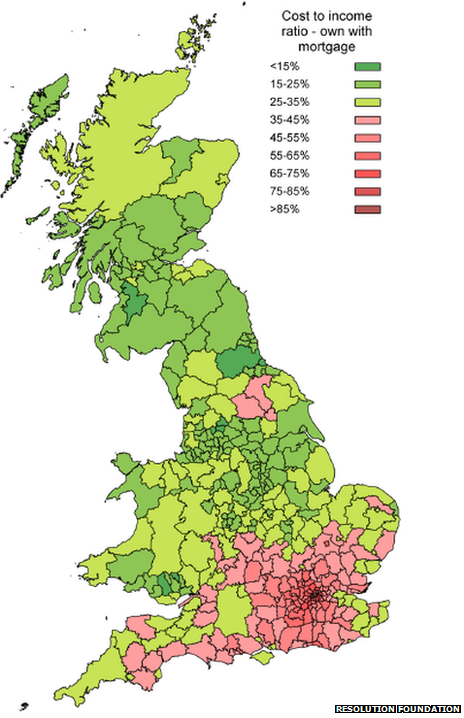

It says most of southern England is now beyond the reach of less affluent households.

The housing minister said the report was "factually flawed" and failed to take housing benefit into account.

With social housing usually unavailable and home ownership unaffordable for many first-time buyers, renting privately is often the only option for households on lower incomes.

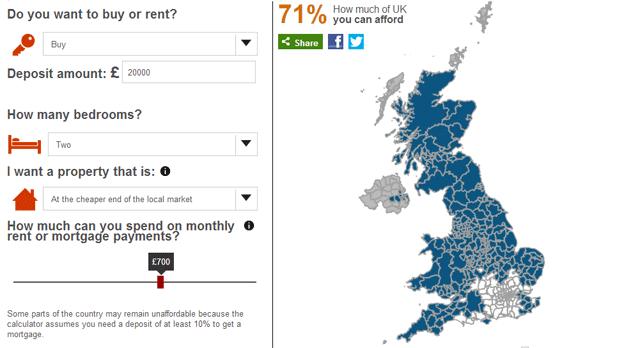

A BBC housing calculator also identifies how renting a modest two-bedroom home for less than £700 a month is almost impossible in London and much of the South East. Modest is defined as having a rent below 75% of similar properties in the area.

The Home Truths report, external identifies local authorities that are "affordable" for a couple with a child requiring a two-bedroom property on a household income of £22,000 a year. Affordable is defined as a rent that is no more than 35% of net household income.

On that basis, 125 of 376 local authorities in Britain (33%) are unaffordable for less-affluent working families.

"The private rented sector is now, in large parts of the country, the most expensive form of housing," says Vidhya Alakeson, of the Resolution Foundation.

"It is also the only option for most low to middle-income households, many of whom are faced with the unenviable choice of forgoing other essentials in order to pay for housing or living in overcrowded conditions to reduce their housing costs."

Housing Minister Mark Prisk described the report as "alarmist" as it "suggests rents are soaring when in fact they have fallen in real terms".

"And it fails to recognise that housing benefit provides a safety net which ensures that up to a third of private properties in most areas are affordable to low income families," he said.

The BBC housing calculator also allows users to see where they can afford to buy a house. A deposit of £10,000 is only enough to buy a two-bedroom home in 41% of local authorities, because a deposit of at least 10% is needed to get a mortgage.

With a deposit of £20,000, almost 30% of the country remains unaffordable, including all of Greater London and much of the South East.

Blue = affordable | white = not affordable | grey = no data

Even with a £50,000 deposit, central London and areas to the south and west of the capital remain unaffordable. Analysts suggest recent rises in UK house prices have been driven by increases in London and the South East.

Londoners say they're spending over half their salaries on rent

"Home ownership is out of reach for the vast majority of low to middle income families because few have the savings needed for a deposit," says Ms Alakeson. "While the crisis in London is well documented, there are affordability black spots in almost all regions of the country."

The government recently announced a Help to Buy scheme, offering loans for people moving into new-build homes worth up to £600,000. Another government scheme to assist those buying new-builds and existing homes is due to come into force next January. And shared ownership schemes provided through housing associations are also available to some first-time buyers.

The housing minister said the government had put a range of measures in place to create "a bigger and better private-rented sector", including the £1bn Build to Rent fund and £10bn in loan guarantees to build new homes specifically for private rent.

"And for those looking to buy, the numbers of towns which are affordable for first-time buyers is at its highest since 2002, thanks to schemes like Help to Buy which enable people to buy newly-built homes with a fraction of the deposit they would normally require," he added.

However, there are concerns that without a significant increase in housing supply, additional demand generated by such schemes will push up house prices, exacerbating the problem of affordability.

The latest figures show that in the year to last March, just over 108,000 new homes were completed in England. But this is less than half the number needed to meet demand.

Homelessness is on the rise with more than 55,000 households in temporary accommodation in England - 10% higher than a year before. More than 1.8m households are currently on the waiting list for social housing - a 60% increase in the last 10 years.

The Mayor of London, Boris Johnson, has described the shortage of affordable housing as "the gravest crisis the city faces".

In his plan for the capital, 2020 Vision, published last month, Mr Johnson writes that high house prices have had "brutal consequences for many Londoners".

"Fewer and fewer take out mortgages in the way that their parents did, because they simply cannot afford the deposit," he says. "Rents are now punishingly high, and pre-empt an ever growing proportion of your disposable income."

There are concerns that London is pricing out the key workers it needs to function.

Responding to the Resolution Foundation report, the chief executive of the housing charity Shelter, Campbell Robb, said families were paying so much for housing that "they're forced to choose between putting food on the table, turning on the heating or paying their rent".

"Shared ownership schemes are one of the best ways to offer low-income families an affordable place to live. We need to see more schemes that are affordable for low-income families and that give them the stability and security that our current rental market sadly doesn't provide."