Pound jumps after MPC minutes show 9-0 vote to hold QE

- Published

The pound has jumped after the Bank of England released minutes from its July meeting of the monetary policy committee (MPC).

Policy makers voted 9-0 in favour of keeping the stimulus programme at its current level, the minutes show.

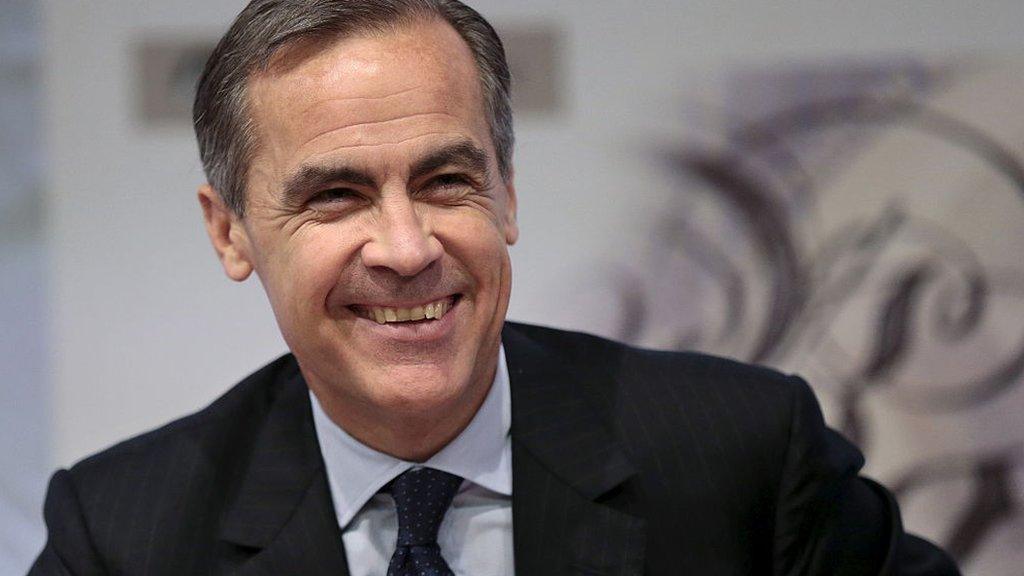

The July meeting was the first to be chaired by new governor Mark Carney.

Two members of the monetary policy committee (MPC) had voted to expand the quantitative easing programme at the previous meeting in June.

However, some members said the case for more stimulus was "warranted".

Paul Fisher and David Miles had backed an extra £25bn of asset purchases in recent months, along with former governor Sir Mervyn King.

But according to the minutes, external, the members who would have voted for more stimulus were prepared to wait while the committee explored other options over the next month.

Quantitative easing is a bond buying programme designed to boost the economy.

The last increase to the programme came in July 2012 when the MPC announced the purchase of £50bn worth of assets, which brought the total purchases to £375bn.

The pound jumped against the dollar following the release of the minutes as investors took the view that more monetary easing was less likely, and at one stage hit $1.5247 before dropping back slightly.

The pound was also boosted by better-than-expected UK jobs figures, with unemployment down 57,000 to 2.51 million in the three months to May.

Forward guidance

Ilya Spivak, currency strategist at DailyFX, said: "The 9-0 represents a stark difference from the 6-3 polls at recent Bank of England meetings and suggests new Governor Mark Carney was able to unite the committee behind the idea of delivering stimulus via Fed-style forward guidance rather than outright intervention into the markets.

"The markets appear to be signalling their disappointment with stimulus by rhetoric versus direct pressure on rates," he said.

It is thought that Mr Carney favours forward guidance to boost confidence. The idea is that business and consumers will be more likely to borrow if they know that interest rates are going to remain low.

Vicky Redwood, chief UK economist at Capital Economics, said in a note: "Some members still think more stimulus is required and just wanted to wait for August's inflation report, when a range of policy options would be discussed.

"Nonetheless, it perhaps looks as though a more formal form of forward guidance is as much as we will get next month."

The MPC said there were signs that the economy is strengthening but the performance depends on consumer activity.

"Growth in the second half of the year would depend in large part on the behaviour of the household sector," the minutes said.

But it noted that income growth was "weak" and that could hold back spending.

- Published17 July 2013

- Published12 February 2014

- Published31 October 2016

- Published1 July 2013