Mark Carney: The 'film star' Bank of England governor

- Published

Mark Carney has "star quality and knows how to use it," says Scott Reid

Bank of England governor Mark Carney has said he will be staying on an extra year after his initial term comes to an end in 2018, to help oversee the UK's Brexit negotiations with the European Union.

Mr Carney's decision came after increasing speculation about his future as the head of the Bank of England.

Governors are traditionally appointed for an eight-year term, but when Mr Carney took the job in 2013 he initially signed up for five years, with an option for a further three. He has now said he will stay until June 2019.

In his letter to Chancellor Philip Hammond, Mr Carney said his move should help "contribute to securing an orderly transition to the UK's new relationship with Europe".

During the referendum, Mr Carney had come under pressure from some Brexit campaigners for his remarks that voting to leave the EU would push the UK into a recession - seen by some as outside the governor's non-political remit.

The governor defended his intervention, saying the Bank's role was to "identify risks, not to cross your fingers and hope risks would go away".

Mr Carney has overseen the introduction of the Bank's first polymer banknotes

Nevertheless, this sparked calls for him to resign.

Mr Carney "never seems to want to recognise the result of the referendum and get on with it," said one MP, Jacob Rees-Mogg, recently.

Governor's role

Since his arrival three years ago, Mr Carney has presided over measures designed to boost the UK economy in the aftermath of the global economic crisis.

There have been bouts of quantitative easing - pumping money directly into the financial system.

He introduced a policy of "forward guidance" at the Bank, also aimed at raising confidence; though just six months after its implementation in 2013 this needed a rethink.

The Bank had originally said it would not consider raising interest rates until the unemployment rate fell to 7% or below.

But when that seemed likely to happen much sooner than anticipated the Bank altered its stance, saying it would focus on a range of economic variables rather than just the jobless numbers before changing rates.

Mark Carney reacted with apparent amusement after Robert Peston asked if the Chancellor was being "irrational and hysterical"

But Mr Carney did then give clear hints that rates would have to gradually rise towards 2017.

Instead, the opposite has happened, and in the wake of the UK's Brexit vote the Bank actually cut rates to 0.25% this summer.

A very different banker

When Mark Carney became the Bank of England's governor in June 2013, he was the first non-Briton to be appointed in the Bank's 300-year history.

He came after a successful stint as Canada's central banker, where he was credited for shielding the country from some of the worst effects of the 2008 financial crisis.

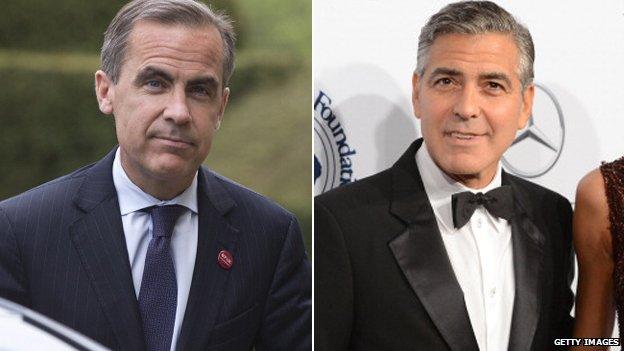

Likened more than once to Hollywood actor George Clooney, Mr Carney has become one the UK's best-known central bank governors

In March 2008, just a month after his appointment, he cut Canadian interest rates. This and other measures helped boost market confidence and enabled Canada to recover from the crisis more quickly than some of its peers.

Likened more than once to the Hollywood actor George Clooney, ahead of his arrival in the UK Mr Carney was touted as a "rock star" banker, a change from the usual Bank of England head.

"He's got star quality, and he knows how to use it," said fellow Canadian and former government colleague Scott Reid.

Mr Carney's appointment was a break with tradition in many ways.

He had a commercial banking, as well as a public sector background - unlike his two most recent predecessors who had spent their careers within the Bank of England and academia.

Mr Carney worked for investment banking giant Goldman Sachs in New York before returning to Canada to work for the country's Finance Department - and then Canada's central bank.

Mark Carney: Career highlights

Born 16 March 1965: Fort Smith, Northwest Territories, Canada

1988: Graduates from Harvard University

1991-95: Gains a doctorate in economics at Oxford University

1995: Marries economist Diana Fox, whom he met at Oxford. The couple now have four children

Works at Goldman Sachs in London, Tokyo, New York and Toronto, rising to position of managing director

2004-07: Senior position at Canada's Department of Finance

2008-13: Governor, Bank of Canada

2013-present: Governor, Bank of England

Another difference was the size of his pay packet, which was well above that of his predecessor, Sir Mervyn King.

His starting annual salary of £480,000 (plus £144,000 pension allowance) was £175,000 more than Sir Mervyn received - and that's not counting his £250,000 annual accommodation allowance.

A 'practical banker'

So what is it about Mr Carney that separates him from other central bankers?

"He's extraordinarily charismatic," says Scott Reid. "You go to his speeches and you'll find them just as dry as anyone's.

"But it's the way he does things, he takes the time to linger on you... and the public and the press find that very intoxicating.

"He such a fetching figure - but let's not be shy about that. He's conscious of it. He's shrewd when it comes to his image."

Following the UK's Brexit vote, many in the markets see Mr Carney as one of the few voices of continuity

Married to an Englishwoman, the 48-year-old's postgraduate education was at Oxford University, where he studied economics.

His former tutor during his Masters degree, economist Peter Oppenheimer, says "he was a typically bright, transatlantic student".

"That sounds terribly old fashioned, but he wasn't the sort of young man who walked around in torn sweaters."

Prof Oppenheimer says Mr Carney was an interesting choice to run the Bank of England. "He wasn't an insider, he wasn't an academic economist, and he was a practical banker of a certain kind.

"The really good governors of the post-Second World War period have been people with practical banking experience, such as Gordon Richardson and Robin Leigh-Pemberton.

"They have been the outstanding governors. More so than Bank insiders, or people with long academic careers."

Market hopes

It's been said Mr Carney wanted to stay to help the UK through the challenges of Brexit, and that leaving early might be seen by some of his critics as admitting defeat.

Mrs May believes Mark Carney is "the right man for the job"

Crucially, he has the backing of the Prime Minister, Theresa May, who believes he is the right person to be Bank of England governor.

There is also the matter of market confidence.

Following the referendum result and all the personnel changes in the Conservative government, many in the markets see Mr Carney as one of the few voices of continuity in the UK.

- Published31 October 2016

- Published31 October 2016

- Published16 September 2016

- Published12 July 2016