Plastic banknotes ready for 2016, says Bank of England

- Published

- comments

The Bank of England's Executive Director for Banking Services, Chris Salmon: "The environmental impact of a polymer bank note is actually less than paper bank notes"

Smaller, wipe-clean plastic banknotes could be introduced by the Bank of England from 2016, matching some currencies across the world.

The new polymer notes stay cleaner, are more secure and should even survive a spell in the washing machine, the Bank says.

It has spent three years studying the impacts of a change from cotton paper.

The switch could start with the new £5 note, featuring Sir Winston Churchill, with the £10 note to follow.

The Bank has organised a roadshow, external to gauge public opinion across the UK over the next two months before coming to a final decision in December.

Recycling

The current Bank of England banknotes are made from cotton fibre and linen rag, with the average fiver only lasting for a year. Unfit notes are shredded and can end up in industrial compost.

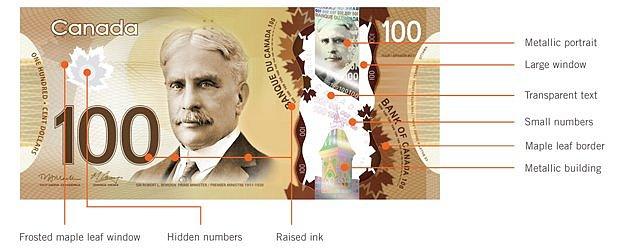

The proposed new polymer banknotes would be made from a thin, transparent and flexible film made of polypropylene.

This is coated with an ink layer that enables it to carry the printed design features of a banknote. This allows the inclusion of windows or clear portions in the design, used to enhance protection against counterfeits.

The Bank believes the new notes would be:

Cleaner, as they resist dirt and moisture. For example, red wine can be wiped off but would stain the current paper notes

More durable, as they last for 2.5 times longer than paper banknotes. However, they would still shrink under extreme heat - such as being put under an iron

Secure, because they could include more sophisticated anti-counterfeiting techniques. New Zealand reported a big fall in reported counterfeits after introducing polymer notes

It added that the longer life-cycle meant that they were more environmentally friendly. In Australia, where polymer notes are used, unfit notes are recycled and used for other plastic items, such as plant pots.

They would be still be thin and flexible enough to fit into purses and wallets, the Bank argues. If they are adopted, then the new notes would be slightly smaller than the existing collection of banknotes and easier to fit in pockets and purses.

Public approval

The prospect of plastic banknotes has been on the agenda for some time.

If it goes ahead it would not be the first time that polymer notes had been seen in the UK.

In 1999 Northern Bank of Northern Ireland issued a polymer £5 commemorative note celebrating the year 2000.

The general public react to the prototype polymer Bank of England £10 note: "It looks fake"

Bank of England researchers have been engaged in a project for three years to look at the options.

Much of this has focussed on the experience of 20 other countries that have adopted the polymer notes. Of these, only seven have all denominations in plastic.

Adopters of the notes include Canada, whose last central bank governor - Mark Carney - is now the governor of the Bank of England.

Earlier this year, the Bank of Canada was forced to deny that the notes had any scent added, after authorities were inundated with queries from consumers about why they detected a "hint of maple" when smelling them.

The plastic notes are also being used in New Zealand, Mexico and Singapore. More recently, the banknotes were issued in Mauritius in August.

Charles Bean, deputy governor of the Bank of England, said that the outcome of 50 public events across the country over the next two months was key to a final decision.

"The Bank of England would print notes on polymer only if we were persuaded that the public would continue to have confidence in, and be comfortable with, our notes," he said.

Following initial increased costs, the extra durability of the notes would mean they would be cheaper to issue than paper notes, he said.

Canada has already adopted the polymer banknote

The Bank of England has been busy redesigning banknotes, following the announcement of Churchill's inclusion on the £5 note from 2016 at the earliest.

This created controversy over the potential lack of women on Bank of England notes, so in July the Bank said it planned to put Jane Austen on the next version of the £10 note.

- Published24 July 2013

- Published26 April 2013

- Published2 February 2013

- Published18 November 2011