Lehman's collapse: 'These were very dangerous times'

- Published

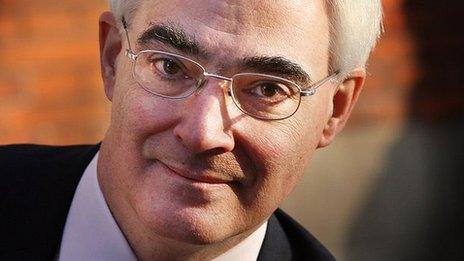

We are still picking up the pieces following Lehman Brothers' failure, says Alistair Darling

The failure of investment bank Lehman Brothers five years ago brought UK and US banks to "within hours" of collapse, says former UK Chancellor Alistair Darling.

Its failure saw the start of a global crisis, with governments across the world scrambling to avert a possible financial meltdown, and five years on the world's economy is still in the grip of a sustained recession.

Mr Darling, who was at the heart of decisions to bail out UK banks like RBS and Lloyds/HBOS says even before Lehman's collapse, "it was just a matter of time before we hit some sort of crunch".

"By the beginning of September it was obvious to me the banks were in dire straits and it was going to end in tears," he told BBC World Service's Business Daily programme.

On Friday, 12 September 2008, the then US Treasury Secretary Hank Paulson asked Mr Darling if the UK would allow Barclays to buy Lehman Brothers.

"I said there was no way the British government could agree to a British bank buying an American bank that was by all accounts bust," he said.

"The losses would fall ultimately on the British taxpayer."

'Panic in the system'

Darling: Our banks were within hours of collapse

Just days later on Monday, 15 September, Lehman Brothers filed for bankruptcy in a move that sent shockwaves through the world's financial markets.

Doubts have since been raised as to whether the US authorities underestimated the problems facing the financial sector.

"I remember saying to my officials at the time, 'I wonder if they know what they are doing?'" said Mr Darling.

"It set in train events that brought our banks and the American banks within hours of collapse just three weeks later."

Lehman's failure "allowed panic to get into the system", he said.

"When Lehman went down, people started circling other banks as well, to look for the next one to go after. The situation got progressively worse."

Yet, while in hindsight the failure to support the bank triggered a wider financial crisis, there was little political support in the US for the authorities to save it.

"It was obvious to me the banks were in dire straits and it was going to end in tears," said Mr Darling.

"The scale of the bailout needed to fix things was simply politically impossible," says Harvard University economist Kenneth Rogoff.

"It was only by allowing Lehman to fail that the Federal Reserve, the Treasury and others could think about trying to campaign for the scale needed for the bailouts."

'That was scary'

The collapse of the bank might have been the starter for the financial crisis, but it did not have a single cause.

Analysts say that interest rates had been held too low for too long, allowing companies, countries and ordinary borrowers to build up too much debt.

Too many highly complex financial instruments had been created, with too little regulation and too little management oversight.

"With hindsight it is easy to criticise some of the decisions made, and investors rather than taxpayers should have borne more of the pain," said Jessica Ground of fund managers Schroders.

"However, I think the positives from keeping the world going outweigh the negatives."

With the ripples of Lehman's collapse spreading far and wide, other governments were forced to quickly react to prop up their own exposed banks.

In the UK, Treasury officials had already been working on a banking contingency plan because "it was just a matter of time before we hit some sort of crunch", said Mr Darling.

"The question was could you hit it in a way that you could manage through it, or in a way that could have been catastrophic?"

The former chancellor recalls that his worst moment came three weeks later, in a phone call from the Royal Bank of Scotland (RBS).

"When I asked them how long they could last, they said 'Well, maybe two or three hours' - and they were the biggest bank in the world at the time. That was scary."

Tony Lomas, lead administrator for Price Waterhouse Coopers, was called in at the eleventh hour to try and save Lehman Brothers from collapse

'Social catastrophe'

Critics have since argued that governments were too eager to throw public money at banks which should have been allowed to stand or fall on their own account.

It is not a scenario Mr Darling accepts.

"We were heading for the brink - these were very dangerous times.

"If these banks had all collapsed, it wouldn't have just been economic catastrophe, it would have been a social catastrophe."

The effects would have spread far beyond the banks themselves, he argues.

"I think it would have led to a lot of unrest all over the Western world - dark times indeed."

Banking collapse

If other banks like Lehman Brothers had been allowed to fail, "the rest of us would have been suffering for decades afterwards," he said.

Governments are unlikely to allow important banks to fail any time soon, he says, because the risks to economies and society at large are simply too great.

In other words, banks are still too important to fail.

"If you lose control of things you could end up with your entire banking system collapsing," warns Mr Darling.

"That is something that I think that no responsible government could ever entertain."

- Published9 September 2013

- Published28 June 2013

- Published25 June 2013

- Published15 March 2013

- Published18 March 2013

- Published18 January 2013