UK QE has failed, says quantitative easing inventor

- Published

When the UK embarked on quantitative easing (QE) in March 2009, in the aftermath of the Lehman Brothers collapse, the Bank of England was expected to administer a monetary stimulus equal to £50bn, writes Liam Halligan.

Over the past four years, such "extraordinary measures" have extended somewhat more, with the Bank's bond-buying programme now amounting to £375bn - almost eight times the original estimate.

Since the financial crisis began, the Bank of England's balance sheet has expanded four-fold. But where did the phrase "quantitative easing" come from?

Arguably among the most controversial economic policies of recent years, QE is surely the most unpronounceable. Not many Western analysts are aware that this tongue-challenging name originated in Japan, the modern-day spiritual home of money-printing.

Even fewer know that the man who coined the phrase comes from Germany - which, of all the big Western economies, has probably the most deep-seated aversion to printing money.

In the mid-1990s, Prof Richard Werner, a German academic fluent in Japanese, was working as an economist in Tokyo. Japan's real estate bubble had burst and property and share prices were tumbling. The country was locked in a debate about the use of unconventional monetary policy to support asset prices and boost broader commercial activity.

Prof Werner submitted an article to Nikkei, a leading business newspaper, advocating a new type of radical monetary measure.

Rather than attempting to shift interest rates, he argued that the country's central bank, the Bank of Japan should instead intervene directly to influence the size of the money supply by taking steps to encourage commercial banks to extend more credit.

Prof Werner argued against lowering interest rates or expanding central bank reserves

"I was promoting a policy that involved more credit creation, rather than changing the price of money," says Prof Werner.

"So when I wrote my article, and after the newspaper's editors insisted on a phrase readers would understand, I added the Japanese adjective for quantity to the standard expression for monetary stimulation. 'Quantitative easing' was the literal translation back into English of these two Japanese words."

Prof Werner's article was widely noticed. Several years later, in fact, the Bank of Japan decided to implement extreme monetary measures and adopted the Japanese name the German economist had coined.

"In 2001, the Japanese central bank said, 'Now we're actually doing this'," he recalls.

"To communicate this to global markets, they had to give the policy a name in English. I suppose the translators had a bad day, or were under time pressure. Normally, you'd try to come up with something slightly more fluent than 'quantitative easing', but they did only a literal translation."

While the Bank of Japan adopted the precise name of Prof Werner's policy, it was somewhat less accurate when interpreting his actual proposal.

Richard Werner: "The bank of Japan started using it in its reports"

Incredibly, the Japanese version of QE that was eventually implemented was a policy Prof Werner had specifically ruled-out.

Prof Werner's argument was that, because more than 95% of the money supply in a modern economy is derived not from cash or reserves, but from private bank lending, it is essential to get banks to lend.

So he urged the Japanese government to enter into private long-term agreements to borrow from commercial banks, instead of issuing government debt.

The Bank of Japan's version of QE, in contrast, involved creating money out of nothing at the central bank.

"That's absolutely not what my policy was about," says Prof Werner. "In my original article, I specifically argued against either lowering interest rates or expanding central bank reserves. That was my whole point - traditional solutions weren't going to work. Actually, it was a bit upsetting."

Then, in an additional twist, the Bank of England also later adopted Prof Werner's QE label - but, again, to describe a policy with which he didn't agree.

"It was one thing when the Bank of Japan did it, because that was over in Japan and was some time ago," he says. "But once the Bank of England also started using the phrase, I thought 'Hang on - I've got to speak up and make clear that the original definition is quite different.'"

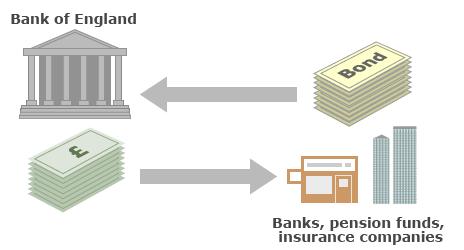

Quantitative Easing: Step by step

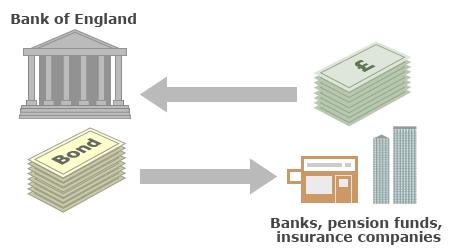

First, with the permission of the Treasury, the Bank of England creates lots of money. It does this by just crediting its own bank account.

The Bank of England wants to use that cash to increase spending and boost the economy so it spends it, mainly on buying government bonds from financial firms such as banks, insurance companies and pension funds.

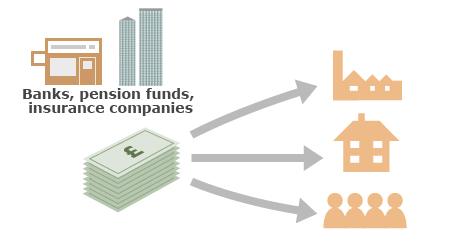

The Bank buying bonds makes them more expensive, so they are a less attractive investment. That means companies that have sold bonds may use the proceeds to invest in other companies or lend to individuals.

If banks, pension funds and insurance companies are more enthusiastic about lending to companies and individuals, the interest rates they charge should fall, so more money is spent and the economy is boosted.

Theoretically, when the economy has recovered, the Bank of England sells the bonds it has bought and destroys the cash it receives. That means in the long term there has been no extra cash created.

The Bank of England's interpretation of QE also involves the creation of central bank credits, as in Japan. But in the UK these have been used to buy government bonds from commercial banks rather than from the government directly.

Prof Werner says this is "a little better" than Japanese QE, as it "at least in theory increases commercial banks' reserves". He maintains, though, that the "best way to boost the economy is to increase bank credit", and that can only be guaranteed by governments borrowing from banks directly.

"That creates new credit," says Prof Werner. "The money supply then expands, transactions increase, there's more demand, more employment, more tax revenues and suddenly you have a virtuous circle."

'Household name'

In both Japan and the UK, QE isn't working, he says, because it doesn't focus on "the most important part of the money supply", which is bank lending. "UK QE has singularly failed, as bank credit is still shrinking."

When faced with the claim used by some British banks that the demand for credit is low, Prof Werner is dismissive. "I'm quite used to this argument, because banks in Japan used it for 20 years," he says. "The banks, of course, have become very risk-averse, as they have many non-performing assets."

Prof Werner is also critical of the UK's concentrated banking structure - which he argues has made the economy more vulnerable. "British banking is dominated by a small number of big banks - with just five banks controlling 90% of deposits," he says.

"Big banks want to lend to big firms and do big deals that give big bonuses. Small firms are too much hassle, and the banks are absolutely not interested - even though small firms need the credit and account for 70% of UK employment. So these small firms are credit-rationed and that's a problem."

"In Germany, 70% of deposits are held by 2,000 banks," says Prof Werner. "These local German banks lend a lot more to small- and medium-sized firms, and when the credit crunch happened most of them were fine."

When it comes to QE, although his policy recommendations have been misinterpreted in Japan, the UK and elsewhere, Prof Werner maintains his natural sense of humour about giving the world a phrase that's so challenging to say.

"It's become a household name anyway and I should get some kind of fee, some royalties, for that," he says with a smile.

- Published20 October 2013

- Published1 November 2022