Ukrainian currency hits 10-year low

- Published

The fall in Ukraine's currency has left Ukrainians worried about their savings

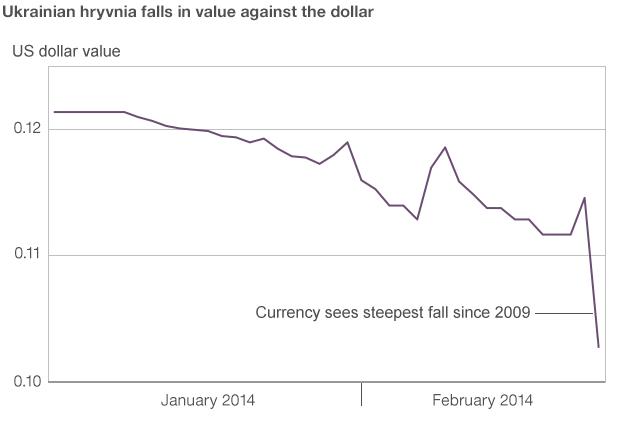

Ukraine's currency, the hryvnia, has fallen to a new low of 10 to the US dollar.

The currency's decline reflects political upheavals and longer-term persistent economic weakness.

But it is also likely to aggravate those underlying problems and adds to Ukraine's need for international financial assistance.

The pressure is on the West and the International Monetary Fund (IMF) to help, as Russia seems unlikely to.

Even before the recent political upheavals, Ukraine's economic performance was dismal. The economy is still smaller than it was in 1992, in the early days of post-Soviet independence.

'Currency slide'

But the political crisis has aggravated the country's long standing problems and the falling value of the currency is one of the consequences.

And it has been a sharp fall, 18% so far this month alone. The central bank has been making some efforts to stem the decline, by using its foreign exchange reserves to buy hryvnia.

At best, it has slowed the loss of value, but at the expense of running those reserves down to dangerously low levels.

One rough and ready rule sometimes used is that a country should have enough reserves to pay for three months of imports.

Capital Economics, a consultancy in London, reckons Ukraine is now down to less than two months' worth, which can only magnify the incentive for investors and savers to get their money out.

So why not just the the currency slide? After all, the IMF has in the past called for Ukraine to adopt a more flexible exchange rate policy, which in practice would mean a depreciation of the hryvnia.

In some circumstances a falling currency can be very helpful, in enhancing local industry's competitiveness, and it means you do not have to burn up your currency reserves.

But if it happens too quickly it can be a very serious problem for anybody - individuals, companies, banks of governments - that have borrowed in foreign currency.

Russia's angst

The interest and repayments become more expensive in local currency terms. It can render borrowers insolvent.

To take one example; that mechanism was one of the reasons why the Asian financial crisis of the late 1990s was so devastating.

Ukraine does have plenty of external debt. Capital Economics estimates there is a total of $66bn that matures this year - in other words it will either have to be repaid or "rolled over", financed with new borrowing.

Most of that is private sector, but even so, the government will need more than $9bn this year, according to the consultancy.

There have also been comments about the financial situation from Russian officials that might be seen as ominous.

The Ambassador to the European Union, Vladimir Chizhov, said that Ukraine owes about $3bn to the Russian gas company Gazprom.

"The gas is still flowing" he said "but the money is not coming back".

The decline in the value of the hryvnia simply reinforces the key financial fact about Ukraine - that it will need help soon.

Ukraine's political upheaval has aggravated longer term problems

- Published25 February 2014

- Published24 February 2014