Lloyds and Barclays avoid EU bonus cap by paying shares

- Published

Lloyds boss Antonio Horta-Osorio could see total pay rise to £7.8m for 2014

Two UK banks are handing out massive share awards to senior executives amid EU limits on bonuses.

In their annual reports, Barclays and Lloyds Banking Group said they will pay their chief executives nearly £1m each in shares this year on top of their salaries and bonuses.

The move sidesteps EU rules which limit bonuses to 100% of annual salaries, or 200% with shareholder approval.

The rules, opposed by banks and the UK government, came into force in January.

Lloyds boss Antonio Horta-Osorio is set to be paid £900,000 in shares this year, on top of a base salary that was £1.1m last year, plus bonuses and a long-term incentive scheme that could bring his total pay to £7.8m for 2014.

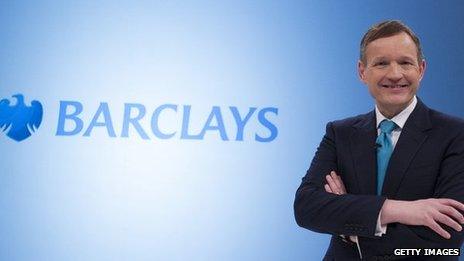

Barclays chief executive Antony Jenkins is set to be paid £950,000 in shares in quarterly instalments over the year.

He may pick up as much as £6.3m over the course of 2014.

Last week HSBC announced similar plans to award its chief executive, Stuart Gulliver, £1.7m in shares in response to the EU rules.

Those rules are being challenged by Chancellor George Osborne in the European courts, amid fears that limiting bankers' pay could threaten London's position as a leading global financial centre.

Barclays chief executive Antony Jenkins has defended the need to pay increased bonuses to staff

The report from Lloyds confirmed that the state-backed bank would ask shareholders - including the UK government- to back plans to allow bonuses of up to 200% of salaries.

It said its remuneration committee "strongly believes in pay for performance, in providing a competitive package that allows us to attract and retain the key talent."

In February the bank reported a pre-tax profit of £415m for the first time since its £20.5bn taxpayer bailout.

Meanwhile Mr Jenkins wrote in Barclays' report, external to defend last year's 10% increase in the bonus pool.

"Whilst this [increase] is up 10% on the final 2012 incentive pool,... it is down 18% on 2012 and remains 32% below the pool level in 2010."

He told the Telegraph newspaper increased bonus payout were essential to prevent a "death spiral" of staff leaving.

The news that UK banks were working around EU rules provoked anger from some European figures.

Philippe Lamberts, the Belgian Green MEP who helped devise the bonus cap, said it was clear the UK government was failing to implement EU law and accused the coalition of having no interest in halting "absurd remuneration packages".

He has urged the European Commission to take the UK to court over the issue.

- Published15 January 2014

- Published13 February 2014

- Published11 February 2014