AstraZeneca shares soar after Pfizer confirms bid talks

- Published

Shares in pharmaceutical company AstraZeneca rose by more than 14% on Monday, after US giant Pfizer confirmed its interest in a takeover bid.

The firm said it had contacted AstraZeneca over a multi-billion pound bid for the UK-based drug maker.

If successful, the deal would be the biggest ever takeover of a UK firm by a foreign company.

Pfizer said it approached AstraZeneca on Saturday, after an initial offer in January, worth £58.8bn, was rebuffed.

AstraZeneca said the original offer "significantly undervalued" the firm, which employs more than 51,000 staff.

However, AstraZeneca said it was "confident" its strategy would create "significant value" for shareholders on its own.

"The Board remains confident in the ongoing execution of AstraZeneca's strategy as an independent company," it added.

Pfizer said in a statement, external that AstraZeneca's refusal to engage meant it was currently "considering its options".

Global player

AstraZeneca manufactures drugs in 16 countries focusing on treatments for diabetes, cancer and asthma as well as antibiotics.

It reported £25.7bn in sales last year, with £3.3bn in pre-tax profit.

In the UK it has eight sites and about 6,700 employees.

Recently it posted a drop in first quarter profits - and laid off thousands of staff in an effort to reduce its costs to compensate for a fall in sales - due to patent losses on blockbuster medicines.

In April, it posted a drop in first quarter profits after its earnings were by hit by patents expiring on some of its older medicines.

'Compelling opportunity'

Pfizer said its initial offer in January was a combination of cash and shares worth £46.61 per AstraZeneca share, worth £58.8bn in total.

At the time, it represented a 30% premium to AstraZeneca's share price, although AstraZeneca's share price has since increased and on Monday morning it jumped nearly 15% to £46.88p.

Pfizer said the deal was "a highly compelling opportunity" for AstraZeneca's shareholders.

It said if the takeover went through, the combined firm would have management in both the US and the UK, but would list its shares on the New York Stock Exchange.

"We have great respect for AstraZeneca and its proud heritage," said Pfizer chairman and chief executive Ian Read.

Pfizer said it would only make a firm offer if AstraZeneca directors voted unanimously in favour of the deal.

"The strategic, business and financial rationale for a transaction is compelling," it added.

Hostile move?

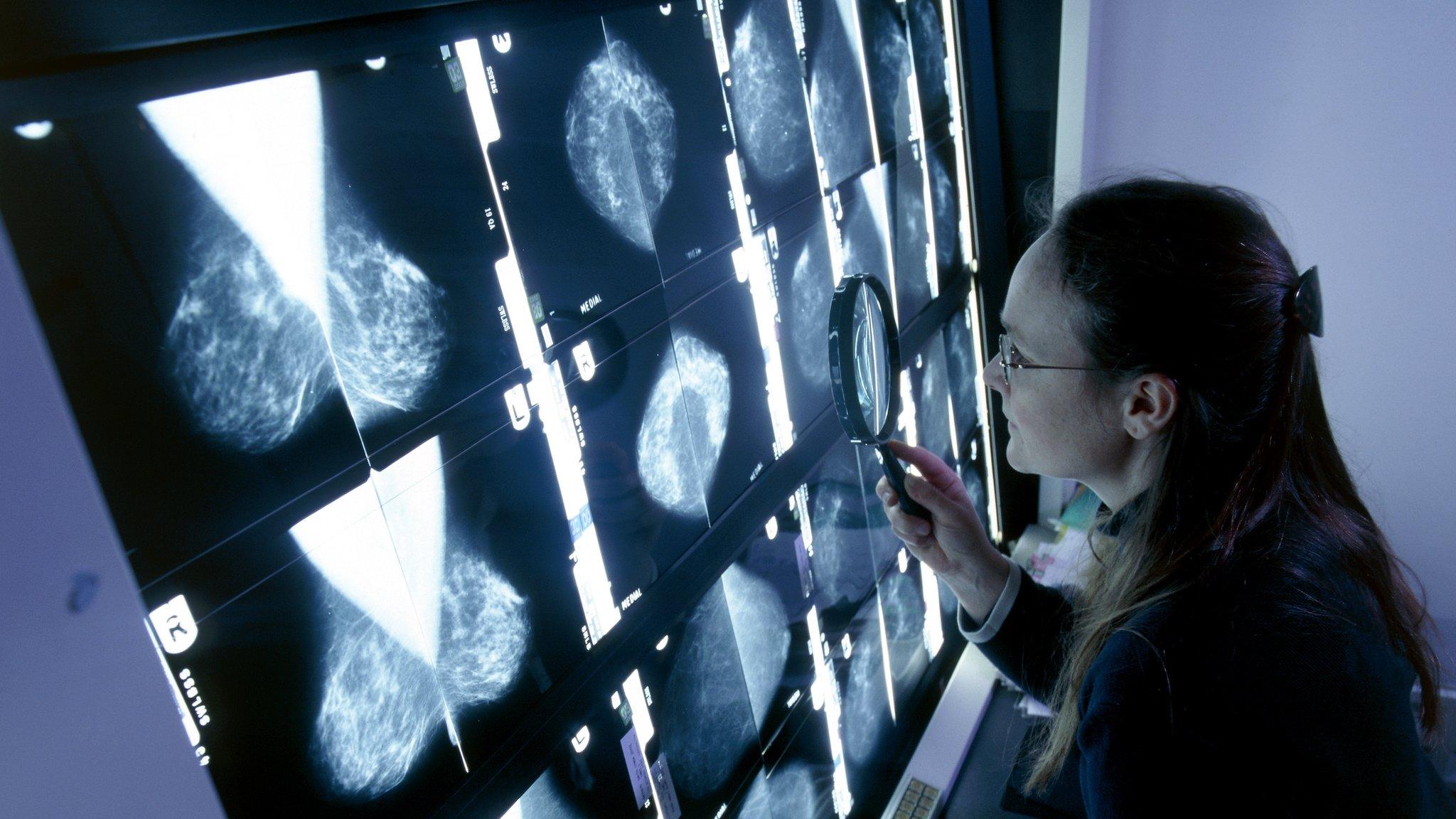

Buying AstraZeneca would give Pfizer, whose drugs include Viagra, access to a number of cancer and diabetes drugs.

However, Justin Urquhart Stewart, head of corporate development at Seven Investment Management, told the BBC the price Pfizer is offering was still too low to secure a deal.

"It's too close to what it is priced at in the market," he said.

"They've tried to talk to the management and gain agreement but that's not happened so they are considering now going directly to the shareholders".

Citi analyst Andrew Baum said he believed there was now a 90% chance that Pfizer would acquire AstraZeneca for at least around £49 a share.

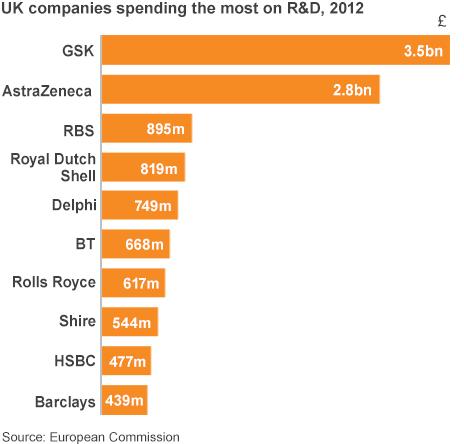

Linda Yueh, the BBC's chief business correspondent, notes that AstraZeneca is a key UK firm in the area of research and development (R&D) and also in exports.

"AstraZeneca's £7bn of drugs sold every year accounts for a whopping 2.3% of British goods exports," she added.

Pfizer has made other major acquisitions, its most recent being the $68bn (£40.4bn) purchase of Wyeth in 2009.

However, this would mark its biggest foreign acquisition.

It would also be the largest foreign takeover of a British firm, beating some of the more recent deals which include:

O2 bought by Spain's Telefonica for £18bn in 2005

Cadbury bought by US-based Kraft for £11.5bn in 2010

Alliance Boots bought by US investment firm KKR for £11.1bn in 2007

BAA bought by Spain's Ferrovial for £10.3bn in 2006

Powergen bought by Germany's E.on for £9.6bn in 2002

However, the BBC's business editor, Kamal Ahmed, warned Pfizer's takeover approach could turn into a lengthy battle.

"If AstraZeneca does not engage, and it hasn't so far, this bid could turn hostile," he said.

Reacting to news of the bid, Business Secretary Vince Cable said: "My priority is to ensure that the objectives of this government's life sciences industrial strategy are fulfilled. This means ensuring there are high-skilled jobs and long term investment in research and development in the UK.

"On the potential merger, the CEO of Pfizer has made contact and informed me of his intentions and I have emphasised the importance of these points."

- Published28 April 2014

- Published28 April 2014

- Published7 August 2014

- Published24 April 2014

- Published22 April 2014