The Chinese company founder aiming to be Warren Buffett

- Published

Footage of Guo Guangchang first broadcast May 2014: The company founder who wants to be Warren Buffett

If you live in the West, you're unlikely to have heard of Guo Guangchang - or Fosun, the company he founded and now chairs.

Fosun has interests spanning insurance, real estate and retail. It controls the French holiday group, Club Med, and its boss is one of China's wealthiest men.

In just two decades, Mr Guo has transformed Fosun into one of China's most powerful companies.

In 2013, it had revenues of 61.7bn yuan (£6.23bn; $9.44bn) with its industrial operations, including health, steel and property, accounting for 53bn yuan of that, according to its annual report, external.

Mr Guo models himself on the US investment legend Warren Buffett, on a mission to transform Fosun into a top asset management company.

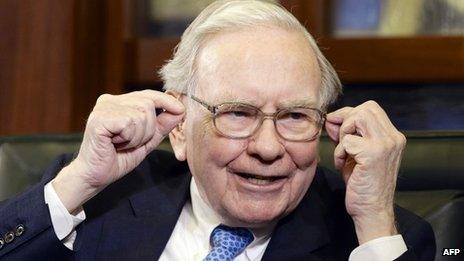

Warren Buffett is Guo Guangchang's role model

"Our goal is very clear. We need to create a Buffett-style investment company, rooted in China but with global capabilities," he told the BBC in an interview he gave in 2014.

Chinese twist

At first glance, Mr Guo - a bespectacled, modest and softly-spoken man who practises Tai Chi daily - seems an unlikely candidate to become the East's answer to the Sage of Omaha.

Yet last year, he managed to trump US private equity firm Apollo Global Management in a €1bn (£814m) deal to take control of Portugal's largest insurer, Caixa Seguros e Saude.

At the time, Mr Guo hailed the deal as "a solid step for Fosun to evolve into Warren Buffett's model", external.

It is Mr Buffett's investment firm Berkshire Hathaway's skill at picking good investments and its success at generating money for long-term investments in larger firms via its insurance investments that Mr Guo wants to emulate, but with a Chinese twist.

Fosun has a stake in the Greek fashion brand Folli Follie

Fosun's strategy is to invest in foreign firms that want to establish a presence in China, using its position as a "China expert" to help drive their expansion.

It also invests in Chinese firms that stand to benefit from the country's growing middle class and consequent increase in consumer spending.

It owns several local insurance firms, and bought JP Morgan's former headquarters One Chase Manhattan Plaza in Lower Manhattan for $725m - at the time, the largest acquisition of an overseas real estate asset by a Chinese investor. Another notable building it owns is Lloyds Chambers in London, which it bought for £64.5m.

Humble roots

Yet the firm's roots are a far cry from these lofty goals. Mr Guo started the company alongside three founders in 1992 with just $4,000. It began as a small pharmaceutical company, although it rapidly expanded into real estate.

In those early days, Mr Guo, who himself had grown up in a rural area in Zhejiang and whose parents had scrimped and saved to put him through college, just wanted to make some money to help provide a better standard of living for his parents.

"There was nothing so high and noble at the beginning," he says.

Mr Guo is on the Forbes rich list but still has some way to go to catch up with Warren Buffett

The firm's initial expansion was rapid - it bought lots of different businesses to establish itself as a conglomerate - before deciding to refocus the firm as an investment manager.

Mr Guo says the fact that it was no longer able to operate the businesses it was buying itself drove the shift. "As we started to run two to three businesses, it became clear to us that we could no longer operate the businesses ourselves. So we redefined Fosun as an investment company."

Global perspective

Even when Fosun owns a company entirely, Mr Guo says its strategy is to look at the business as if it were a shareholder. "My team or myself cannot run the businesses on a daily basis. Our task was to design strategy, and let better teams manage the business."

This shift also drove it to look beyond China to give it a "global perspective and capability".

Its track record of investments abroad helped it to persuade foreign firms that it was "the best partner for global companies to develop business in China", says Mr Guo.

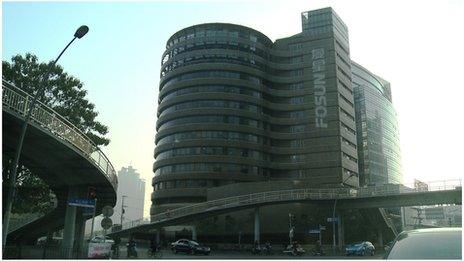

Fosun is one of China's biggest companies

The 2015 Forbes list of world billionaires, external ranks him 259th with an estimated net worth of $5.7bn.

He has a while to go before he matches Mr Buffett, however, who is ranked third on the Forbes list, external with a net worth of $72.7bn.

This feature is based on interviews by leadership expert Steve Tappin for the BBC's CEO Guru series, produced by Neil Koenig and Evy Barry.

- Published13 May 2014

- Published6 May 2014

- Published29 April 2014