IMF warns banking reform has not made enough progress

- Published

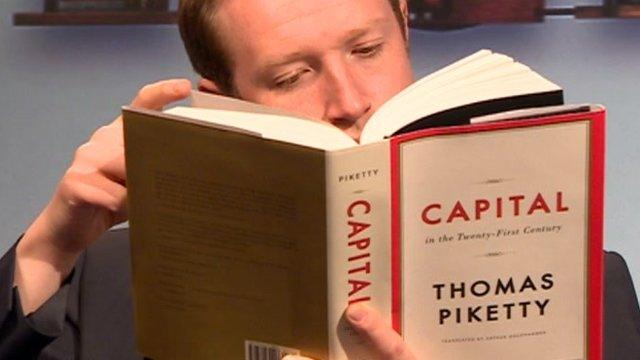

Christine Lagarde: "Inequality is rising"

Banking reforms aimed at preventing another financial crisis have failed to make enough progress, the boss of the International Monetary Fund has warned.

IMF managing director Christine Lagarde blamed a combination of the complexity involved, industry lobbying and "fatigue" for the delay.

"The industry still prizes short-term profit over long-term prudence," Ms Lagarde said, external at a conference on the future of capitalism.

She said inequality was "an issue" too.

Speaking to the BBC, Ms Lagarde noted that inequality was rising.

"To the extent that inequality is not particularly supportive of sustainable growth, it's an issue and one that we have to look at carefully and try to address in order to maintain stability and sustainability of economies," she said.

'Implicit subsidy'

In her speech, Ms Lagarde said some of the biggest problems were with the so-called "too-big-to-fail firms", banks whose collapse would cause such a big knock-on effect on the wider economy that governments were still expected to rescue them.

She said a recent IMF study indicated that such banks were still "major sources of systemic risk" and called for "tougher regulation and tighter supervision" to tackle the issue.

"Their implicit subsidy is still going strongly - amounting to about $70bn (£41.5bn) in the US, and up to $300bn in the euro area," she said.

Ms Lagarde called for regulators worldwide to agree a framework to wind down big banks in trouble, as well as mutual recognition on rules for financial markets.

"This is a gaping hole in the financial architecture right now, and it calls for countries to put the global good of financial stability ahead of their parochial concerns," she said.

For such changes to be effective, however, Ms Lagarde said there also needed to be a change in the culture of financial firms, saying changes so far were "not deep or broad enough".

"Incentives must be aligned with expected behaviour and be made transparent," she said.

Ms Lagarde said the changes required both investors and the leaders of financial firms to "take values as seriously as valuations" and "culture as seriously as capital".

"Ultimately, we need to ingrain a greater social consciousness - one that will seep into the financial world and forever change the way it does business," she said.

- Published27 May 2014

- Published3 April 2014

- Published16 January 2014

- Published12 May 2014

- Published30 April 2014