Samsung faces Chinese and Indian mobile challengers

- Published

The times are changing. And so are the preferences of smartphone users in the world's two biggest markets - India and China.

Theses changes do not bode well for global market leader, South Korea's Samsung Electronics.

Recent industry figures, external have shown that during the second quarter of the year, Xiaomi, a handset maker in China, and Micromax of India have toppled Samsung from the top spot in each of their home markets.

The main reason, is that both Xiaomi and Micromax offer smartphones which are "low-on-price, high-on-specs" models - which are more wallet-friendly than those Samsung has to offer.

Our correspondents in Shanghai and Delhi explain the shift in consumer preferences in these two markets.

Analysis: Why Xiaomi is popular in China

By John Sudworth, BBC News, Shanghai

In the no-holds barred battle of the handset makers, dominance in the Chinese market really matters.

Firstly, it is already the world's biggest market for smartphones. More than 108 million of the things were sold here in China in the second quarter of this year, something close to 40% of what was sold globally.

And secondly, with a total of 700 million Chinese people already owning a smartphone, there is, in a population double that size, still room to grow.

But how much growth there might be is a big question and, in terms of new users, price is probably a key driver. Which is where Xiaomi has been driving home its advantage.

It has come from just 5% market share a year or so ago, to 14% today, pushing Samsung into second place with 12%.

Xiaomi's budget Redmi phone sells for little more than $100 (£59), a fraction of the price of a Samsung Galaxy and yet offers a good quality camera and processor and some attractive styling, albeit, critics have pointed out, uncannily similar to the sleek lines of an Apple device.

Whatever the secret of its success it's not bad for a tech upstart that was founded just four years ago. But there are question marks over how likely the company is to maintain its lead.

Firstly the low-price, low-profit model, at which Xiaomi sells its handsets pretty much at cost, depends on the company being able to generate revenue through content and services.

Then there's the question of whether it can turn domestic success into a global brand - it needs to sell more products abroad to really challenge the likes of Samsung whose presence in so many markets gives it flexibility and economy of scale.

And then there's the unpredictability of the Chinese market itself.

It is highly fragmented, with something like 100 manufacturers vying for share and changing quickly.

Samsung is unlikely to take the loss of pole position lying down and will be looking to capitalize as many consumers prepare to upgrade from 3G to 4G devices.

That said, for now Xiaomi is in the ascendency and as many a giant who has been challenged by a newcomer knows, lost market share is often very difficult to regain.

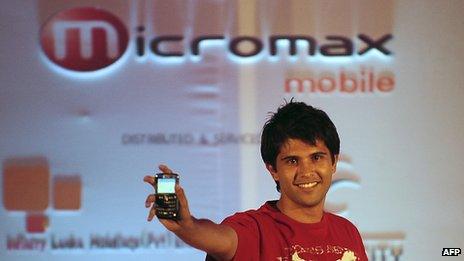

Analysis: Why Micromax is popular in India

By Shilpa Kannan, BBC News, Delhi

India is one of the biggest mobile phone markets in the world with around 20 million units sold every month.

But no Indian company makes phones. Everyone depends on Chinese phone makers for their handsets.

Micromax too has captured the biggest share of the market with cheap phones that are made in China but are customised for Indian needs.

It cracked the code when it came to unique customer demands in this market.

The firm's first phone, the X1i came with a guarantee of a month-long battery backup. For many Indian villages with no access to electricity, the simple act of recharging a phone often costs money and involves travelling to nearby towns.

So a phone with a battery that lasted 30 days and priced at less than $40 was an instant success.

The second idea that worked for Micromax was to make attractive looking phones that could accept two SIM cards. Most people in India use pre-paid connections and switch between operators to make use of the cheapest mobile tariffs.

Critics in India had brushed off Micromax as a low-end phone maker, and didn't expect them to pose a serious threat to the big names.

That's when the company came up with another surprise - they roped in Australian actor Hugh Jackman for a major advertising splash.

He became the brand ambassador for their Canvas series of smartphones.

It is this series of smartphones that has resulted in their sales doubling, and the company replacing Samsung in the top spot.

It now has a handset shipment share of 16.6% compared to Samsung's 14.4%, according to Counterpoint Technology Market Research.

Micromax claims to sell around 2.3 million devices every month.

The firm is unlisted but experts believe that the company has hit $1bn in revenue.

Already it is looking to sell in markets beyond India. After a few Asian countries, Micromax is now targeting the Russian market.

So after winning round one against Samsung on home turf, Micromax looks all set to challenge the Korean giant in the global arena.

About Micromax

India's largest mobile phone company by market share

Launched mobile phone business in 2008

First in India to offer a phone with a 30-day battery life

Crossed $1bn in revenues as of March this year

Available in India, Sri Lanka, Nepal, Bangladesh and Russia

- Published6 August 2014

- Published22 July 2014

- Published31 July 2014