Scottish vote: Experts debate potential economic impact

- Published

The Scottish referendum will take place on 18 September

As the polls narrow in the Scottish independence debate, banks, investors and economists have been ramping up their warnings about the potential investment and economic impact a break-up of the United Kingdom could have.

But some commentators believe that, while all the uncertainty surrounding the details of separation may have negative economic consequences in the short term, an independent Scotland could be financially viable in the longer term.

Here is a representative selection of recent comments.

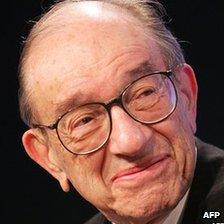

Alan Greenspan, former chairman, US Federal Reserve

The former Fed head has warned that independence would be "surprisingly negative for Scotland, more so than the Nationalist party is in any way communicating", according to the Financial Times.

He said their economic forecasts were "so implausible they really should be dismissed out of hand", making reference to falling North Sea oil production.

He also maintained that the Bank of England would be extremely unlikely to act as "lender of last resort" to a newly independent Scotland.

Professor Mike Danson, Heriot-Watt University, Edinburgh

Heriot-Watt's professor of enterprise policy believes the doom-mongers are wrong.

"The concerns are overdone," he told the BBC. "Supermarkets have said prices could go up, but they could also go down."

An independent Scotland would be freer to make choices about where and how to spend its money, he argues. "We could incentivise companies and universities to invest in research and development, for example.

"We're not going to see an economic revolution overnight, but its about building on Scotland's strengths in life sciences, food and drink, tourism and financial services. We have a long history of good practice and a skilled workforce."

Peter Dixon and Dr Jorg Kramer, Commerzbank

The German bank's economists argue that while the Scottish government's assumptions on energy reserves are credible, "more than half of the figure relies on potential resources or those yet to be found. On current technology only around 40% of projected reserves are likely to be extracted."

The bank also warns about the consequences for the remainder of the UK, arguing that it "would have a diminished presence on the global stage."

But overall, it concludes that "it is likely that an independent Scotland will fare better than the Westminster government expects but considerably worse than the nationalists believe."

Dame Vivienne Westwood, fashion designer

The former high priestess of punk fashion said an independent Scotland could be "the turning point towards a better world. They could lead by example."

She backed Scottish independence as she kicked off her London Fashion Week showcase, sending her models down the catwalk sporting Yes campaign badges.

Dame Vivienne, who was born in Tintwistle, Derbyshire, is just one of hundreds of business people who have given their support to the Yes campaign. For example, in August 200 firms signed Business for Scotland's open letter, external supporting the case for independence.

Robert Zoellick, former president, World Bank

The former World Bank president said "a break-up of the UK would be a diminution of Britain and a tragedy for the west just at a moment when the US needs strong partners. I strongly suspect it would not work out well for the Scots either."

Goldman Sachs

The global investment bank thinks the short-term effects of a "Yes" vote in the Scottish referendum could have "severe consequences" for both countries' economies.

Scottish First Minister Alex Salmond believes Scotland could negotiate EU membership

"In the event of a surprise 'Yes' vote, the near-term consequences for the Scottish economy, and for the UK more broadly, could be severely negative," it wrote in a research note last week, but longer term the bank said it could prosper.

Protracted negotiations over the division of UK national debt, the currency, and Scottish membership of the European Union would lead to "a prolonged period of uncertainty," the bank said. "This, in itself, is likely to have adverse economic consequences for Scotland and the UK."

"Even if the sterling monetary union does not break up in the event of a 'Yes' vote, the threat of a break-up would provide investors with a strong incentive to sell Scottish-based assets, and households with a strong incentive to withdraw deposits from Scottish-based banks," the bank argued.

However longer term, it believes there is "little reason why an independent Scotland could not prosper: there is no evidence to suggest that smaller countries are richer or poorer, on average."

Martin Gilbert, chief executive, Aberdeen Asset Management

Aberdeen Asset Management, Scotland's largest fund management company, is officially neutral in the independence debate. However its boss, Martin Gilbert, has said an "independent Scotland would be a big success", although he declined to say which he had voted in his postal vote.

In Aberdeen's Press and Journal, external, Mr Gilbert said Scotland was among the 20 wealthiest countries in the world, adding: "Most sensible people now accept that Scotland would be prosperous with either outcome in the current constitutional debate."

He also said sterlingisation - in which an independent Scotland kept the pound without a formal deal - would be a "pretty good option".

"Low or no debt would be the position if an independent Scotland were denied access to Bank of England financial assets, and that would leave the newly-independent country in both budget and balance of payments surplus. Not a bad start," he added.

Paul Krugman, economist

An independent Scotland could become like "Spain without the sunshine", says Paul Krugman

Writing in his New York Times column, external, Mr Krugman had a stark message for Scotland: "Be afraid, be very afraid. The risks of going it alone are huge. You may think that Scotland can become another Canada, but it's all too likely that it would end up becoming Spain without the sunshine."

On the prospects of keeping sterling as the country's currency, Mr Krugman said: "The combination of political independence with a shared currency is a recipe for disaster."

He would find it "mind-boggling" if Scotland decided to do this.

Oliver Harvey, Deutsche Bank

Echoing Paul Krugman, Deutsche Bank's foreign exchange strategist Oliver Harvey, wrote: "Scotland: be afraid, be very afraid" in a note to investors on Monday.

"The implications of a yes vote would be huge....", he said.

"On the currency side, it could at worse lead to a destabilising crisis in the whole British banking system and at best leave the the rest of the UK with an unstable currency union in which the Bank of England is forced to continue to provide liquidity to Scottish banks while Westminster thrashes out a fiscal and monetary arrangement with a new Scottish sovereign government holding all the cards.

"A 'yes' vote could easily derail the UK economic recovery. Scotland represents the rest of the UK's second largest trading partner after the EU and many corporate investment plans are likely to be put on hold until clarity over currency, regulatory and tax questions is achieved."

Ben Chu, The Independent

A Scottish state is "perfectly viable", argues the Indy's economics editor, Ben Chu, external. "Some of the wilder prophecies of ruin are unconvincing."

Would Scotland be better off with its own currency?

"Scotland's North Sea oil money will eventually run out but the country still has a well-educated population. Its future productivity growth and prosperity rests on those foundations of human capital."

In the short-term, however, he says that: "Corporate investment, which has been disappointingly weak for a decade, could flatline amidst the uncertainty thrown up by a Yes vote. That wouldn't help either Scotland or the rest of the UK recover from the biggest slump since the 1930s."

A lot depends on whether Scotland retains the pound, he argues, thereby accepting a degree of Westminster oversight that many Scots who voted for independence would find unpalatable.

- Published9 September 2014

- Published9 September 2014

- Published8 September 2014

- Published8 September 2014