IMF calls for bond market reform

- Published

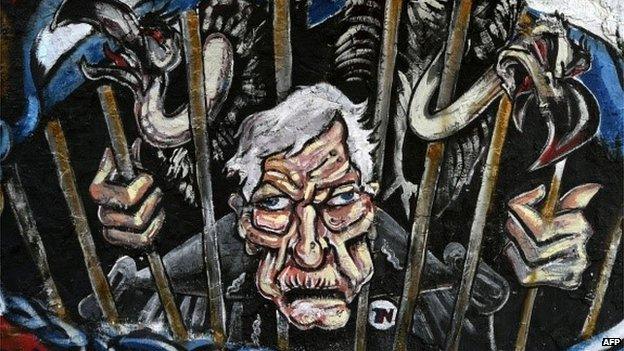

The Argentine case, presided over by Judge Griesa, prompted much anger, and graffiti, in the country

The International Monetary Fund has called for reforms to government bond markets.

One of the key aims is to prevent repeats of the legal problems that have affected Argentina in US courts.

The proposed reforms could help governments struggling with their debts to negotiate more sustainable arrangements with their creditors.

A leading debt campaign group welcomed the proposals but says that more is needed.

Governments can get into difficulty with their debts and have done for many centuries.

When it happens, one option is to negotiate with creditors and search for a new agreement. Sometimes it may just reschedule the payments, but often there is a real loss for the creditors.

'Hold-outs'

There certainly was in the case of Argentina following a default in early 2002. Eventually, the great majority of creditors agreed to accept new bonds.

But some "hold outs", as they are called, did not, and were able to use the US courts to disrupt Argentina's payments to those who did accept the alternative they were offered.

A key element was what's called a "pari passu" clause, which means, roughly, in equal step.

The Argentine case went to an American court - because the bonds are issued under New York law - where a judge, Thomas Griesa, ruled that it meant that if one group of creditors were paid in full the others, the holdouts, must be too.

The IMF's concern is that this could make future efforts to resolve debt crises even harder; it increases the incentive for creditors not to settle. A paper written by IMF staff, external says "creditors who would otherwise be inclined to accept the terms of a restructuring may now be less likely to do so".

So it is calling for pari passu clauses to make it clear that they don't have the meaning inferred by the US courts.

The IMF also has concerns about "collective action clauses" in government bonds. They enable creditors who accept a debt restructuring to force it on others, provided the majority is large enough. It can, in short, prevent the "holdout" strategy working.

'No impact'

The weak link is that different bonds issued at different times may have collective action clauses that are independent.

In other words, if creditors of one batch of bonds agree to a restructuring it might still be possible for holdout creditors to take advantage of a different batch. It happened to Greece. Most of its bond holders did accept heavy losses, but a few managed to get full payment.

So the IMF is proposing more use of what are called "aggregation clauses" so that all groups of bonds can, in effect, be covered by a single vote.

The debt campaigners Jubilee USA Network welcomed the proposals, so far as they go. But the IMF's remedies would only apply to new bonds and even if they were adopted tomorrow there would be a large amount of debt without the provisions for a long time.

Jubilee's Executive Director Eric LeCompte said "they won't have an impact for decades". Jubilee also wants to see a more wide ranging international bankruptcy procedure.

But Mr LeCompte welcomed another feature of the IMF report - a call for change in US law if the court ruling in the Argentina case turns out to disrupt future debt restructuring.

What the IMF proposals do show is a view that sometimes governments can't pay their debts and that it's a situation made even more difficult by some features of the bond market.

- Published30 September 2014

.jpg)

- Published30 September 2014