Warren Buffett's Berkshire Hathaway buys Duracell

- Published

Berkshire will acquire the battery maker by giving back $4.7bn of the Procter & Gamble shares it owns

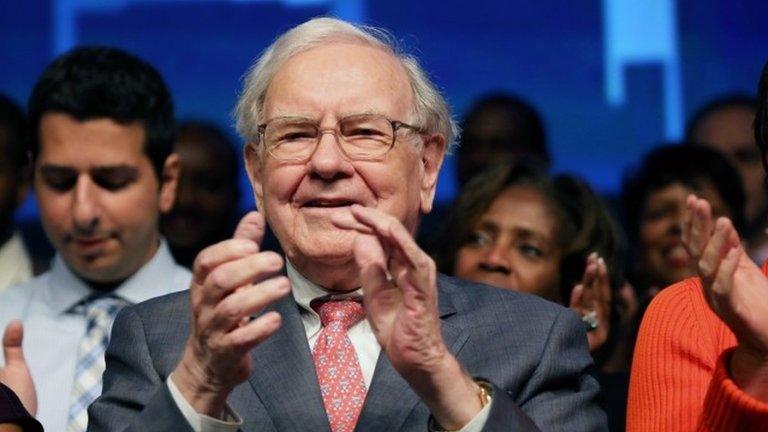

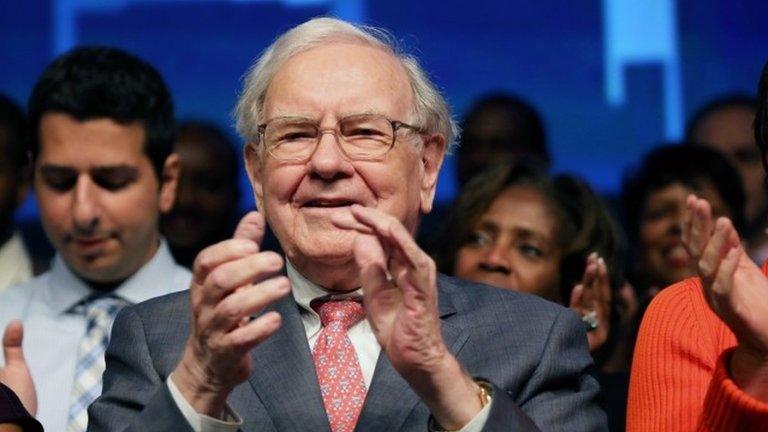

In a surprise move, Warren Buffett's Berkshire Hathaway said it will acquire battery maker Duracell from Procter & Gamble.

Last month, Procter & Gamble had announced plans to spin off the battery business.

Berkshire will acquire Duracell via an unusual move, in which the firm sells the $4.7bn (£3bn) shares it owns in Procter & Gamble back to P&G.

That structure will reduce the overall tax bill Berkshire Hathaway must pay.

Also as part of the deal, Procter & Gamble will first invest $1.7bn in Duracell in order to recapitalise the business.

"I have always been impressed by Duracell, as a consumer and as a long-term investor in [Procter & Gamble] and Gillette," Mr. Buffett said in a statement., external

"Duracell is a leading global brand with top quality products, and it will fit well within Berkshire Hathaway."

Procter & Gamble had acquired Duracell when it bought Gillette in 2005 for over $50bn.

However, as the company has sought to focus more on growth, it has started to shed some underperforming aspects of its business.

Duracell leads the battery market with an estimated $2.2bn in sales, but that figure has not been rising rapidly.

Mr Buffett had said over the summer he was looking for "elephants" - or big, brand name firms - to acquire.

- Published16 October 2014

- Published2 October 2014

- Published26 August 2014