Global debt: How worried should we be?

- Published

Will we ever really get over the financial crisis? Six years or more on from the start of it, the world economy is still struggling to generate a convincing recovery.

Among the headwinds is debt, the factor that took us into the crisis in the first place.

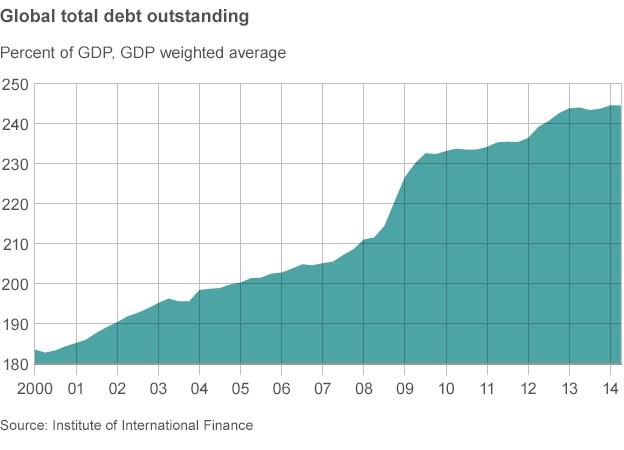

In the meantime, since the crisis began global debt has actually risen. The hoped-for financial healing has happened only in a few scattered parts of the global economy.

The most recent figures, external come from the Institute of International Finance (IIF), a group that represents the financial services industry. As of June this year it estimated that global debt, excluding the financial sector, was equivalent to 245% of total global economic activity or GDP. That's up from 214% in September 2008 when the financial crisis was going into its most intense phase.

The IIF describes the continued build-up of debt as "worrisome".

These figures cover debts owed by governments, households and businesses outside the financial sector. They don't cover all countries, but the vast bulk of global debt is included.

Financial companies, such as banks, have reduced their debts. The IIF says that is desirable, but as they are essentially intermediaries between the ultimate lenders and borrowers, "their debt reduction does not influence the assessment of sustainability of the debt burden to the economy".

What deleveraging?

The persistence of the debt problem was highlighted by another recent study, external by the International Center for Monetary and Banking Studies (ICMBS) and it tells a similar story.

Its language is rather technical, referring to leverage, which in this context is a measure of debt burdens.

Its title gives the key conclusion: "Deleveraging? What Deleveraging?"

To quote the report's assessment slightly more fully: "Contrary to widely held beliefs, the world has not yet begun to de-lever and the global debt-to-GDP [ratio] is still growing, breaking new highs."

If you do include the financial sector for the rich economies, the total figure in the ICMBS report has at least stabilised at 385% of their collective GDP, a level that is nonetheless very close to its all-time high.

Those countries were the source of the bulk of the build-up in global debt levels before the crisis.

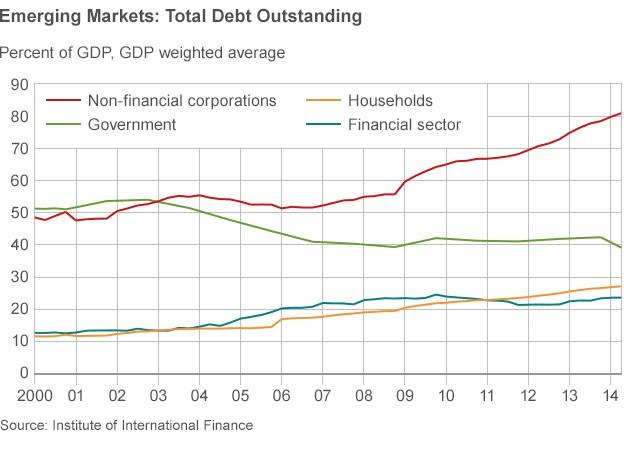

Since then, it is the developing world, especially China that has driven the rise in debt. In the case of China, the report describes the rise in debt as "stellar". Excluding financial companies it has increased by 72 percentage points to a level far higher than any other emerging economy. The report says there have been marked increases in Turkey, Argentina and Thailand as well.

Emerging economies are particularly worrying for the authors of the report: "They could be at the epicentre of the next crisis. Although the level of leverage is higher in developed markets, the speed of the recent leverage process in emerging economies, and especially in Asia, is indeed an increasing concern."

Although the most recent financial crisis was in the rich countries we don't have to go all that far back in history to find debt crises in emerging economies that caused tremors, though not full-scale financial earthquakes, around the world.

There were a succession of crises beginning with Mexico in 1996, continuing in Asia, Russia, Turkey, Brazil and then Argentina early in the following decade.

Signs of improvement

There are also some, though not many, more positive signs in the global debt situation.

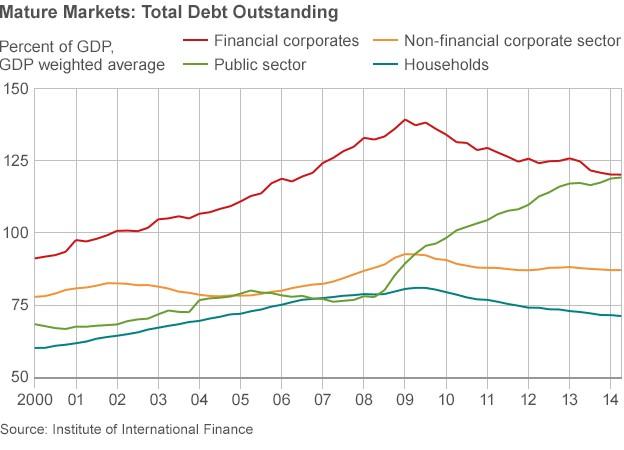

In the rich countries, the financial sector has reduced its debt.

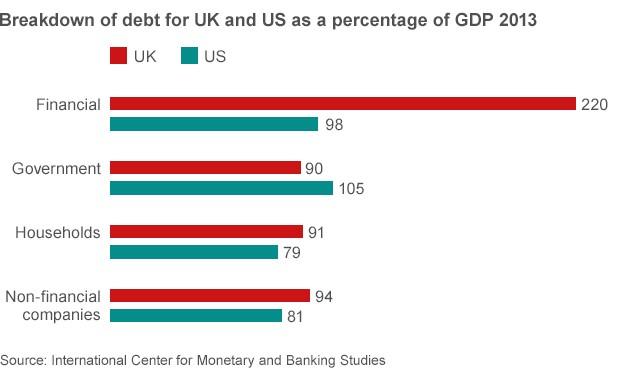

The UK and the United States account for most of that. In the UK, however, while it has fallen it is still at historically very high levels.

The same two countries have seen significant reductions in household debt, measured as a percentage of GDP.

But government debt has risen in both. For the UK, if you add that still high financial sector debt you get a total just shy of 500% of GDP. To spell it out, that is the estimate from the International Center for Monetary and Banking Studies and it covers households, business, including the banks, and the government.

The British figure is a good deal higher than the US or the average for the eurozone but significantly lower than Japan. On government debt alone, the British figure (for 2013) is lower than the US or, by a small margin the eurozone.

Now there is an argument that debts are less troublesome if they are owed by governments rather than by households. The Nobel Prize-winning economist Paul Krugman wrote, external: "Families have to pay back their debt. Governments don't - all they need to do is ensure that debt grows more slowly than their tax base."

But others, such as American professors Carmen Reinhart and Kenneth Rogoff,, external argue that beyond a certain point, government debt tends to hold back economic growth. They say the threshold is about 90% of GDP. A significant number of countries, mainly rich ones are close to or above those levels. Their work has been the subject of controversy, external. While admitting some errors, they have defended it., external

'Poison'

In any event, the authors of the ICMBS report argue that there are features of the current situation that make the large debt burden, public and private, more of a problem. They refer to the "poisonous combination of rising leverage and slowing growth".

The point is that debt payments - interest and repayments of the original loan - are easier to keep up-to-date for borrowers with a rising income.

And that brings us to the "poison" that the ICMBS report refers to. Debt is high and economies are growing more slowly than before the crisis, so they are not generating the incomes to service the debt as rapidly as they were.

There has also been a fall in inflation rates in many countries. Inflation can help limit debt burdens. Household incomes, company revenues and government tax receipts all rise but debt payments are often fixed. Low inflation, especially if it is lower than borrowers expected when they took their loan, weakens that process and leaves debt burdens heavier than they would have been.

But there are some who say the picture painted by the ICMBS report is excessively gloomy. You can find some of them in the report itself, which includes a record of a discussion of its findings.

Mark Carey of the US Federal Reserve said he would have toned down a little the size of the disaster we are facing, and that the situation is not as bad as described. He said there is no obvious downtrend in economic growth and pointed out that a great deal of American debt has a variable interest rate. That would reduce the debt burden as inflation falls.

Angel Ubide of DE Shaw Group and the Peterson Institute of International Economics in Washington described the assessment of China as "a bit apocalyptic" and thought it should have been more balanced. He saw a prospect for credit going increasingly to highly productive private firms - which would presumably be able to meet their debt obligations.

Carlo Monticelli of Italy's Ministry of Economy and Finance recalled that China has $4 trillion in foreign reserves. He also noted the large numbers of people still in the countryside who could support further economic growth by moving to industry or becoming more productive farmers. That implies more economic growth to meet the debt payments.

The conclusion: there is not really any consensus on just how worried we should be about the global debt situation or China's in particular. But you can be sure that economic policy officials - in central banks, finance ministries and international agencies such as the IMF - will be watching it warily. You can also be sure that we won't really be shot of the legacy of the financial crisis for a long time yet.

- Published16 December 2014

- Published23 July 2014

- Published12 February 2014