Where will public spending 'sledgehammer' cuts fall?

- Published

By 2019-20, central government departmental spending will have dropped to £279.7bn.

Public services in the UK are facing a protracted squeeze, with central and local government under pressure to cut spending as budgets shrink.

Despite encouraging signs in the economy, and years of public sector austerity measures already, only 40% of planned cuts will have been made by the general election in May, according to UK spending watchdog the Office for Budget Responsibility (OBR).

To hit current government plans to reduce the UK deficit, the remaining 60% of cuts would have to be brought in by the next parliament.

By 2019-20, central government departmental spending will have dropped to £279.7bn, from £317.5bn in 2013-14 - a fall of £37.8bn, OBR said.

If the projections are followed, the prospect for many UK public services looks uncertain.

"The implied squeeze on local authority spending is similarly severe," said OBR.

So where will the cuts be made? And should they be made at all?

We asked five experts for their opinion.

First cut is the deepest?

If the government is going to achieve its projected spending goals by 2020, then it's going to have to reform the big-ticket items: welfare, pensions, and the NHS.

It's not realistic to expect that policing and other unprotected areas will be cut by 50%; if the arithmetic is going to add up, the meaty parts of the budget are going to have to be cut too.

Local government cuts should fall precisely where the community and local council feel they can best handle a decrease in spending.

Westminster is not in an effective position to decide the level of services needed in local communities throughout the UK.

The solution is to devolve taxation and spending powers to local communities, where funding for public services and benefits can be better, and more efficiently, allocated.

Kate Andrews, communications manager and research associate, Adam Smith Institute

'Radical reform'

Growing demand on adult social care means that other services, such as road maintenance, libraries, youth centres, parks etc, are likely to be disproportionately cut.

Between 2010 and 2015-16 local government funding will be cut by 40%.

We expect a similar level of cuts in the next parliament.

Local authorities have tried to protect spending on social care services.

Other service areas such as housing services (-34%) and culture and leisure services (-29%) have seen larger reductions.

Local government has seen the biggest cuts of any part of the public sector during this parliament.

Efficiency savings are coming to an end. Further cuts without radical reform will have a detrimental impact on people's quality of life.

Spokesman, Local Government Association

'Bold decisions'

All parties must recognise that serious structural changes are required to prevent public services suffering inevitable decline through a thousand cuts.

Tinkering around the edges of public service reform will not meet the challenges we face.

It will take bold decisions, like integrating health and social care, to help address the pressures that an ageing population places on our public services, especially the NHS.

Managing public spending within acceptable limits will demand re-shaping of public services to better meet people's needs, including increasing the number of services available online.

Katja Hall, CBI deputy director-general

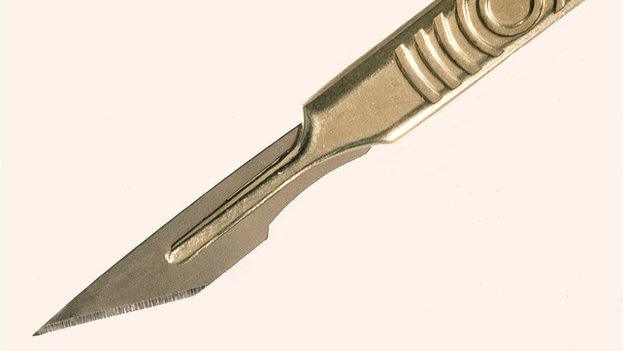

'Sledgehammer'

The Autumn Statement shows that the chancellor is determined to take a sledgehammer to public services and local government.

Adult social care is in crisis and children's services are under increasing attack.

With cuts on this scale it will be impossible to protect local services, including leisure and cultural facilities and school support.

In addition, far less will be available to fix the roads and build new homes.

The government has already slashed spending to local government. The tragedy is that the cuts have been disproportionate - those local authorities with the greatest need have been the worst hit.

Frances O'Grady, TUC general secretary

Alternatives to cuts?

There are enough people in Britain who are uncomfortable with the idea of saddling the next generation with high debts that simply borrowing more with no realistic repayment plan will attract deserved criticism.

Could we tax more? The level of UK taxation has been remarkable constant as a percent of GDP - around 35% - but that does not mean a radical rising could not be undertaken.

That many, particularly those paying tax, are increasingly feeling highly taxed and some rises have already led to dramatic falls in revenues will not be lost on the Treasury.

James Sproule, chief economist, Institute of Directors

- Published4 December 2014

- Published4 December 2014

- Published3 December 2014