Tesco shares plunge after profit warning

- Published

Tesco said its group trading profit for the full financial year "will not exceed £1.4bn"

Tesco has warned its full-year profits will be substantially below market expectations.

The supermarket chain said, external its group trading profit for the full financial year "will not exceed £1.4bn", far below the £1.8bn to £2.2bn range expected by markets.

The downgraded guidance follows its admission earlier this year that it had misstated its profits by £263m.

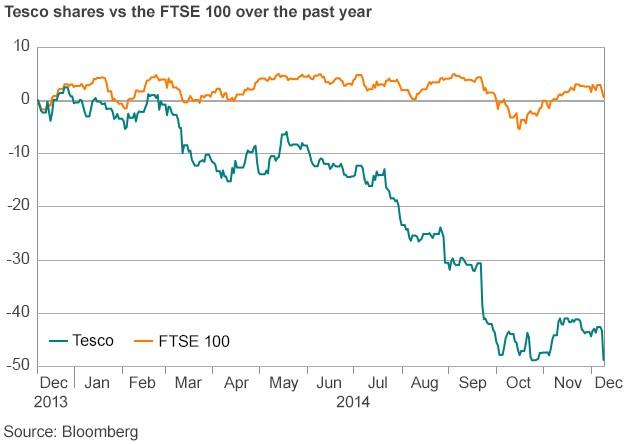

Its shares plunged 16% following the update, before recovering slightly.

Tesco chief executive Dave Lewis, who took the helm on 1 September, said changes to the way it deals with its suppliers and taking on 6,000 new staff were responsible for much of the expected profit shortfall.

"We have taken a very deliberate decision not to take short-term measures that would close the profitability gap in the short term, but would not improve relations with customers and suppliers," he added.

Mr Lewis, a former Unilever executive, admitted Tesco's relationship with suppliers had become "bent a little", but said it had now retrained all 900 people involved in negotiations [with suppliers] at any level and set "a new framework for how we expect the teams to operate".

"It does imply we are trying to make more on the front margin rather than the back margin, on how we sell rather than how we buy. It's a much more efficient model for everybody," he said.

"While the steps we are taking... are impacting short-term profitability, they are essential to restoring the health of our business," added Mr Lewis.

The firm said its new approach would "ensure that revenue recognition is transparent and appropriate".

In August, before the accounting irregularities came to light, Tesco had already cut its profit forecast for the year to £2.4bn from £2.8bn.

Long journey

Analysts warned that Mr Lewis's plans to turn around the supermarket group could take years.

"The CEO needs to simplify the business via UK and international asset sales, then reconnect with suppliers by changing payment terms and lowering his cost of goods and then start on the long road to rebuilding the Tesco brand with shoppers," said Cantor Fitzgerald analyst Mike Dennis.

All this could take several years and suppliers are not going to be disposed to Tesco, given the negative industry volumes and poor performance of Tesco over the last two years."

And Richard Hunter, head of equities at Hargreaves Lansdown Stockbrokers, said investors were losing patience.

"Amidst the accounting mishap, the revolving door in the boardroom and an unforgiving attack from the discount retailers, investors have simply lost interest in waiting for a recovery story which still seems some way off," he added.

Billions wiped off shares

The Serious Fraud Office (SFO) is currently carrying out a criminal investigation into the accounting irregularities at Tesco.

Tesco had been doing deals with suppliers over promotions, which is commonplace for supermarkets, but it appears Tesco had been booking returns from those promotions too early, while pushing back the costs.

The incident, which came to light in September, caused shares in Tesco to plunge, wiping billions off the value of Britain's biggest supermarket chain.

Eight executives were suspended while an investigation into the accounting irregularities was carried out, and it is understood that four of the suspended executives have now left the company.

Tesco said it planned to update the market further on 8 January.

- Published22 October 2014

- Published29 October 2014

- Published25 September 2014

- Published5 October 2014