Brent crude oil price dips below $50 a barrel

- Published

- comments

The price of Brent crude oil has fallen below $50 a barrel for the first time since May 2009.

It fell more than a dollar to $49.92 a barrel in early trading on Wednesday before edging back above the $50 mark.

Slowing global growth and increased supply of oil and gas have pushed prices sharply lower in recent weeks.

The price of oil traded in the United States, known as West Texas Intermediate crude, has already fallen below $50.

Many observers expect the price of oil to fall further as North American shale producers continue to supply increasing quantities of oil and gas, and the oil-producing group Opec resists calls for cuts in production to support prices.

"With no sign that Opec will do anything about over-production, it seems likely that we could well see further declines towards $40 in the coming weeks," said CMC Markets analyst Michael Hewson.

Saudi Arabia has again insisted that it will not cut production to prop up oil prices in the short term

Analysis by Mark Lobel, business reporter, Dubai:

Oil industry insiders tell me they think it will be a year or two until prices return to around $80 - $90 per barrel.

A senior oil executive thinks Brent crude will drop to $45 per barrel, while an engineer suggested it could drop further.

Despite this, the Saudi King used a speech, delivered by the Crown Prince on Tuesday, to again insist the oil giant will not cut production, despite themselves having to decrease discounts to Asian customers as the low prices bite.

There are other signs Saudi Arabia may be feeling the pinch a little too hard, despite its large foreign reserves and cheap production costs.

The Kingdom's main oil company has suspended a major clean fuels plant and several new rigs.

Gulf economies are now budgeting for an assumed oil price of around $60 a barrel this year but insist that they will continue spending regardless, to build and diversify their economies, incurring a deficit if needs be.

Iraq however is suffering badly. With major security challenges there, they are already budgeting for a huge deficit.

Producers suffer

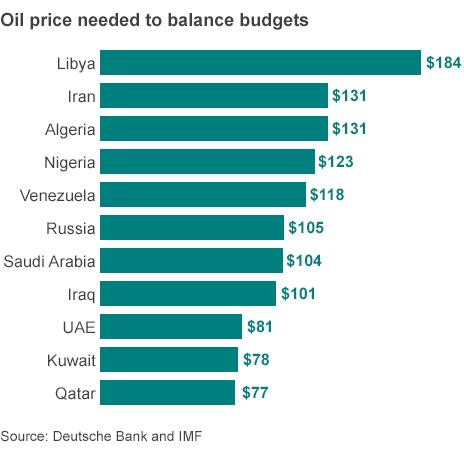

Whilst many consumers and businesses welcome a drop in the cost of fuel, oil producing countries including Russia and Venezuela have been hit as the price of their main export falls.

The oil price has now fallen by more than half since June when the price stood at $110 per barrel.

"All the net exporters of oil are the ones that are suffering at the moment," said Iain Armstrong, oil market analyst at investment management firm Brewin Dolphin.

"Unless you're lucky enough to be tied to the dollar, your currency is going to be in big trouble, i.e. just like Russia."

Pump price

In the UK politicians have called for more of the fall in oil prices to be passed on to consumers.

On Monday, Chancellor George Osborne tweeted that it was "vital this is passed on to families at petrol pumps, through utility bills and air fares".

Speaking BBC Radio 5 Live Sainsbury's chief executive, Mike Coupe said fuel prices could eventually fall below a pound a litre:

"We have certainly seen prices chased down, mainly by the supermarkets," he said.

"You could feasibly see fuel prices fall below the £1 barrier."

All the major supermarkets have reduced fuel prices this week.

However, former US treasury secretary Larry Summers, who says the world is not doing enough to combat climate change, warned there were increased risks associated with lower energy prices.

"The consequences of lower oil prices, lower natural gas prices, lower coal prices, is surely going to be more energy use, more emission of greenhouse gases and higher temperatures down the road," he told BBC World Service radio.

Mr Summers wants to see the widespread adoption of carbon taxes and says that the current system of combating carbon emissions is not working.

He says that putting a more appropriate price on carbon emissions would help tackle climate change.

- Published6 January 2015

- Published7 January 2015

- Published19 January 2015

- Published10 December 2014