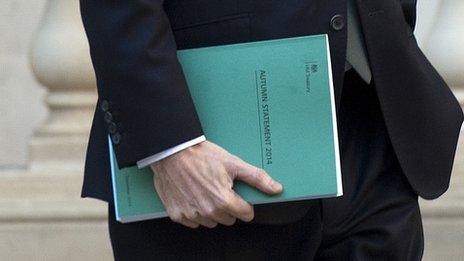

IFS says worst of UK spending cuts yet to come

- Published

Paul Johnson, IFS: "If you look at us internationally our structural borrowing is one of the two biggest in the developed world"

The Institute for Fiscal Studies (IFS) has said that the worst of the UK's spending cuts are still to come.

Its Green Budget, which looks at options and issues ahead of next month's Budget, says the UK's finances still have "a long way to go".

To meet plans announced in last year's Autumn Statement departmental spending cuts of £51.4bn, or 14.1%, are needed in the next parliament, the IFS said.

Cuts in the current parliament are expected to reach £38.3bn, or 9.5%.

The IFS said that over the next four years the UK is planning the largest fiscal consolidation out of 32 advanced economies.

It would mean public spending falling to its lowest share of national income since at least 1948, and fewer people working in the public sector than at any time since at least 1971.

More shopping: Oxford Economics, which contributed to the Green Budget, says growth will be driven by consumer spending and business investment

Long way to go

But the report is optimistic about UK growth, estimating zero inflation and 3% growth this year.

Andrew Goodwin, senior economist at Oxford Economics and co-author of a chapter in the Green Budget, said: "The prognosis for the UK economy is pretty upbeat", and he predicted "a big turnaround in household finances" over the next year.

The Green Budget said that spending cuts so far have been less than planned.

Main points

There has been no real reduction in spending on social security

Capital spending has been cut in real terms only about half as much as planned

Protecting health, schools and overseas aid would double cuts in other departments

On current plans tax receipts will be 1% of GDP lower in 2019/20 than 2007/08

The last five elections have been followed by net tax rises of more than £5bn a year in today's terms

Paul Johnson, director of the IFS, said: "Mr Osborne has perhaps not been quite such an austere Chancellor as either his own rhetoric or that of his critics might suggest.

"And he has cut departmental investment spending by only half as much as he originally planned.

"The public finances have a long way to go before they finally recover from the effects of the financial crisis.

"One result is that he or his successor will still have a lot of fiscal work to do over the course of the next parliament."

Social security spending has seen no real reduction as pensions and the number of pensioners continue to rise

The report said that the high deficit of more than 5% of national income, and total debt of more than 80% of income, is because of poor economic performance at the start of this parliament.

Fiscal targets

But the coalition government has implemented fewer real spending cuts than originally planned, no net additional tax rises have been implemented, and tax revenues have risen slower than expected.

There has been no real reduction in spending on social security as the number of pensioners and the generosity of the state pension has risen.

Analysis: BBC economics editor Robert Peston

The IFS's Green Budget starkly illustrates the central economic choice facing voters in May: bigger cuts with a Tory or Tory-led government; higher public sector debt with a Labour one.

The contest stems from their differing approaches to balancing the books.

The Tories want an overall surplus by 2018 and surpluses thereafter in all "normal" years; Labour wants balance only on the current budget - that's day-to-day spending, excluding investment - by 2020.

The IFS has provided a useful numerical way of understanding Tories' and Labour's conflicting economic visions - which is essentially that the Conservatives believe the imperative is to cut debt and the size of the state, whereas Labour wants potentially bigger budgets for building roads, rail and schools, and for funding the police and prisons.

Both parties promise to protect spending on health, education and overseas aid.

The IFS said 98% of the remaining consolidation is currently planned to come from spending cuts rather than higher taxes.

It says that the three main UK parties could all cut spending by less than is implied by Autumn Statement plans and still hit their fiscal targets.

The Conservatives would need to reduce departmental spending after 2015/16 by 6.7% (£24.9bn).

And Labour and the Liberal Democrats would need to impose departmental spending cuts of 1.4% (£5.2bn) and 2.1% (£7.9bn) respectively to be consistent with their fiscal targets and stated intentions on tax and benefit policy.

But if Labour plans were continued into the 2020s the reduction in total debt would be 9% of GDP, compared with 19% under the Conservatives' proposed overall budget balance.

- Published4 February 2015

- Published11 December 2014

- Published1 December 2014

- Published3 December 2014