Key points of 2014 Autumn Statement: At-a-glance

- Published

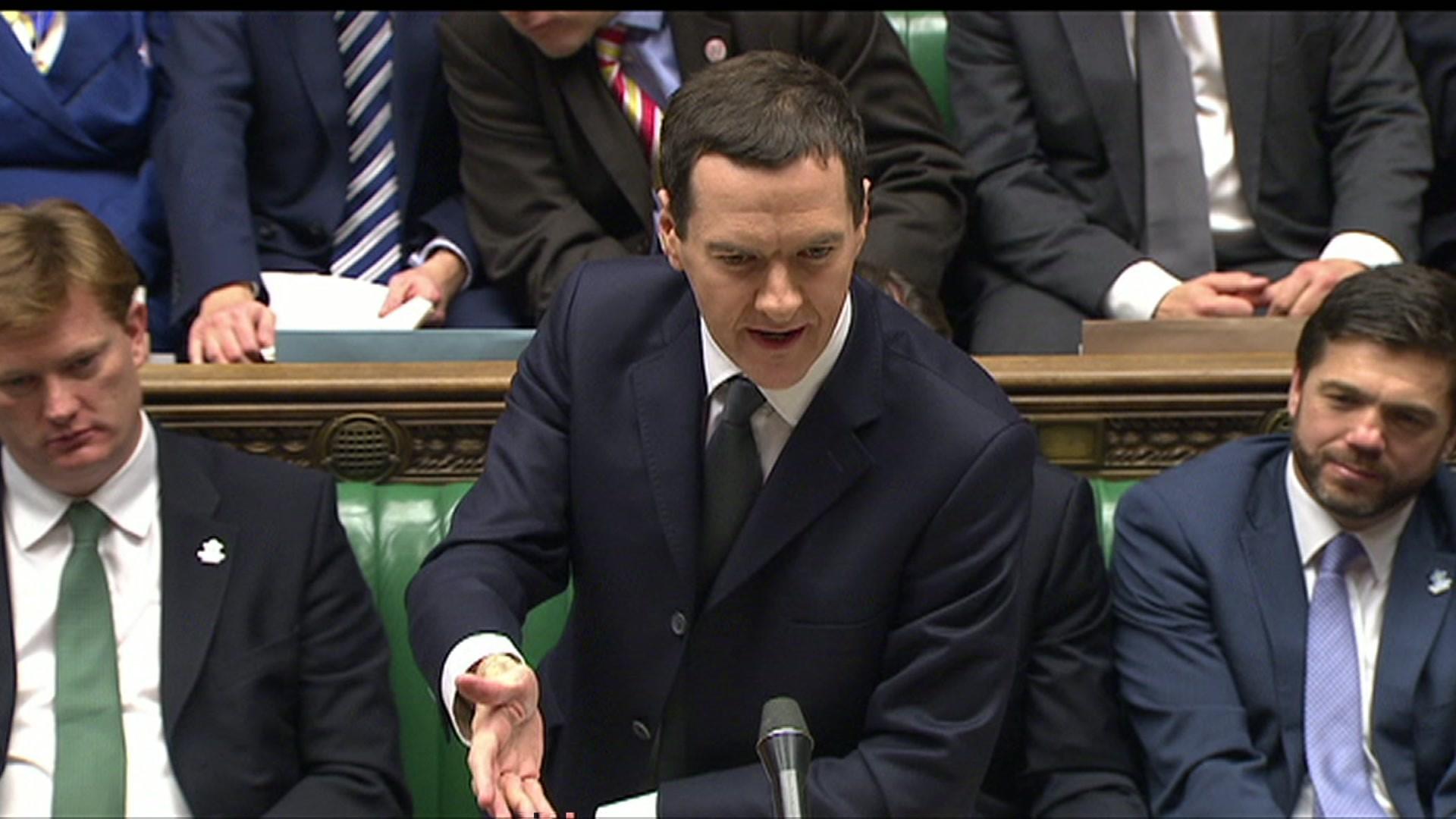

Chancellor George Osborne has updated MPs about the state of the economy in his last Autumn Statement before the general election. Here are the main points in his 50-minute speech:

State of the economy

UK fastest growing economy in the G7

3% growth forecast in 2014, up from 2.7% predicted in March

2.4% growth forecast in 2015, followed by 2.2%, 2.4%, 2.3% and 2.3% in the following four years

500,000 new jobs created this year. 85% of new jobs full-time

Unemployment set to fall to 5.4% in 2015

Inflation predicted to be 1.5% in 2014, falling to 1.2% in 2015

Stamp duty

Reform of residential property stamp duty so that rates apply only to that part of the property price that falls within each band

0% paid for the first £125,000 then 2% on the portion up to £250,000

5% up to £925,000, then 10% up to £1.5m; 12% on anything above that, saving £4,500 on average priced home

Changes to come into effect at midnight on Thursday, 4 December

Public borrowing/deficit

Deficit 'cut in half' since 2010

Borrowing set to fall from £97.5bn in 2013-14 to £91.3bn in 2014-15.

Deficit projected to fall to £75.9bn in 2015-6, £40.9bn in 2016-7, £14.5bn in 2017-8 before reaching a £4bn surplus in 2018-9

By 2019-20 Britain will have a surplus of £23bn

Debt as a share of GDP to rise from 80.4% this year to 81.1% next year before falling in every year. reaching 72.8% in 2019-20

World War One debt to be repaid

Tax receipts up to 2017-18 to be £23bn lower than forecast

Energy and fuel

Fuel duty to be frozen

Sovereign wealth fund for north of England to keep benefits of shale gas exploration

Immediate reduction in oil industry supplementary charge from 32% to 30%

Savings and pensions

Spouses will be able to inherit their partners' ISAs tax free upon their death

ISA threshold increases from £15,000 to £15,240 next April

Tax free annuities for dependents of people who die under 75

Commitment to complete public service pension reforms, saving £1.3bn a year

Personal and business taxation

Air Passenger Duty to be scrapped for under-12s from 1 May next year and for under-16s the following year

Personal tax allowance to increase to £10,600 next April

Inheritance tax to be cut for families of aid workers who die in course of their work

55% death tax passed on to loved ones abolished

Libor fines to support Gurkhas and other service veterans and their families

Higher rate income tax threshold to rise to £42,385 next year

VAT paid by hospices and search and rescue organisations to be refunded

Introduce 25% tax on profits generated by multi-nationals that are shifted out of the UK, set to raise £1bn over five years

Bank profits which can be offset by losses for tax purposes to be limited to 50%

New £90,000 charge for non-doms resident in the UK for 17 of the past 20 years

Inflation-linked increase in business rates capped at 2%

Welfare

Welfare spending to be £1bn lower than forecast in March

Two year freeze in working-age benefits (first announced in October)

Migrants to lose unemployment benefits if they have "no prospect" of work after six weeks

Health and education

£2bn extra every year until 2020 for the NHS

GP services to get £1.2bn in extra funds from bank foreign exchange manipulation fines

£10,000 loans for postgraduate students studying for masters degrees

Employment Allowance worth £2,000 extended to carers

Business and science

Theatre tax break extended to orchestras and new tax credit for children's TV producers

Research and development tax credit increased for small and medium-sized (SMEs) firms

Support extended to small businesses with £500m of bank lending plus £400m government-backed venture capital funds which invest in SMEs

£45m package of support for exporters

Expand tax relief on business investment in flood defences

Britain awarded the lead role in the international effort to explore Mars

National Insurance on young apprentices abolished

Scotland, Wales and Northern Ireland

Agreement reached on full devolution of business rates to Welsh Government

Corporation tax devolved to Northern Ireland if the Stormont executive can manage the "financial implications"

Income tax to be devolved in full to Scottish Parliament

Housing/infrastructure/transport/culture

£2bn for flood defence schemes in England

Tendering for Northern Rail and Trans-Pennine Express franchises to replace pacer carriages with modern trains

A £78m theatre and arts venue is to be built on the former site of Granada's TV studios in Manchester

£15bn for 84 roads projects in England by 2021

- Published3 December 2014